The high inflation and rising interest rate environment has caused a cyclical shift from growth stocks to value stocks. This is partially because valuation multiples have been compressed due to higher discount rates. Therefore, it is not a surprise to see many growth stocks trading close to 52-week lows.

Now if you are a traditional value investor, you may say the stock price doesn’t matter and it's all about the value of the underlying business and whether or not you can get in at a price that is below intrinsic value estimates. I tend to agree with that strategy, but I also think combining fundamental valuations with technical analysis of stock price charts can also be useful.

One of the most basic methods of technical analysis is looking at stocks trading near 52-week lows, as this price level may act as a support line where investors begin to see value again. Investing guru Robert Rodriguez of First Pacific Advisors (Trades, Portfolio) has used this tactic to generate compounded annual returns of 15% over the past 20 years.

Thus, in this article, we're going to dive into two tech giants which are trading close to 52-week lows to see if they offer potential value opportunities: Meta Platforms (META, Financial) and Nvidia Corp. (NVDA, Financial)

1. Meta Platforms

Meta Platforms (META, Financial), formerly known as Facebook, is a leading social media and technology company. The company was founded by Mark Zuckerberg in 2004. Since then, Meta has grown into a powerhouse by executing what I like to call the “fast follow” strategy, which was pioneered by the likes the Microsoft (MSFT, Financial) during the late 90s. This basically involves either getting “inspiration” from new competitors or just acquiring them entirely.

For example, in 2012, Facebook acquired Instagram for $1 billion after the platform gained significant traction and popularity among users. Today Instagram is a core part of Meta’s business and widely consists of a millennial audience which have lower activity levels on the Facebook platform. Meta also replicated similar features to Snapchat with its “stories,” which again boosted engagement. However, it has been unable to come up with anything that can match TikTok, which has gained major traction using its algorithm. This extra competition, combined with data privacy concerns and rising scams, have come together to impact Meta’s monthly active users.

In the forth quarter of 2021, user growth declined for the first time in the company’s history as it decreased by 0.05% quarter over quarter. This sparked a huge sell-off by investors. CEO Mark Zuckerberg then announced a series of major changes. By the second quarter of 2022, Meta’s daily active people (DAP) increased by 4% year over year to a substantial 2.88 billion. Facebook monthly active users (MAUs) also increased by 1% year over year to 2.94 billion. These are positive signs for Meta and could be an indication of a potential recovery.

The Metaverse update

At the Meta Connect keynote on Oct. 12, Zuckerberg announced further details on Meta’s push to build the Metaverse. The company showcased an eerie-looking photorealistic avatar of Zuckerberg, which included real-life facial expressions and even had legs. In addition, Meta announced a workrooms platform that would connect to Zoom (ZM, Financial). Avatars with video chat may seem unnecessary, but it actually makes a lot of sense for remote work environments. Meta’s Quest 2 platform is now the most popular virtual reality headset and has sold over 15 million units.

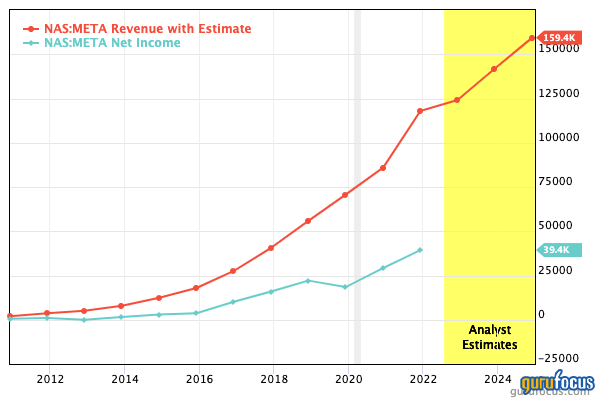

Mixed financials

Meta generated mixed financial results in the second quarter of 2022. Revenue was $28.82 billion, which declined by 1% year over year due to the aforementioned user growth issues and monetization issues with reels.

Meta’s operating income plummeted by over one third to $8.4 billion in the second quarter of 2022. This was driven by a 22% increase in operating expenses, which reached $20.5 billion. Zuckerberg announced a series of cost-cutting measures.

The good news is Meta still generated solid free cash flow of $8.5 billion, which increased by 8.9% compared to the equivalent quarter of 2021. Meta also repurchased a staggering $5 billion worth of stock and authorized a further $24.32 billion for share buybacks.

Valuation

Meta is trading at close to its 52-week low of $122 per share. In addition, the stock trades at a forward price-earnings ratio of 14.95, which is 45% cheaper than its five-year average. The price-to-free-cash-flow ratio is 7.1, which is 60% cheaper than the five-year average.

2. Nvidia Corp

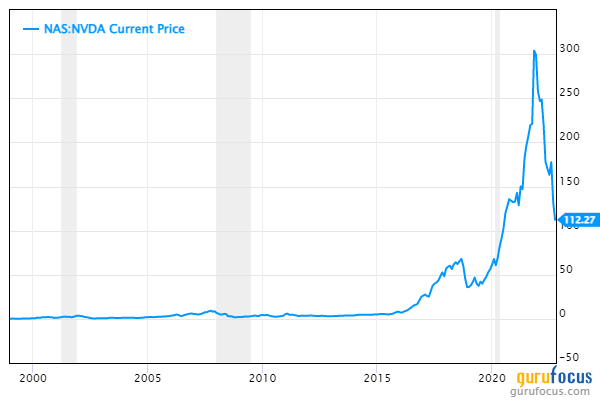

Nvidia Corp. (NVDA, Financial) is the global leader in high performance graphics cards for PCs and data centers. Its stock price has plummeted by 61% from its all-time highs since November 2021, driven by macroeconomic headwinds as well as an expected slowdown in the semiconductor sector driven by the resolution of supply chain issues and the potential for a supply glut. At the time of writing, the stock trades close to its 52-week low of $108 per share.

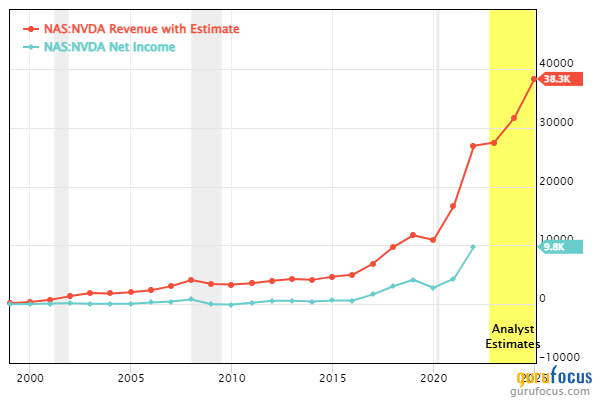

Mixed financials

Nvidia generated revenue of $6.7 billion in the second quarter of 2022, which declined by an eye-watering 19% year over year. This may seem terrible at first glance, but I think it helps to understand the reasons why. This decline was mainly driven by a 33% decline in the company’s gaming segment revenue, which was $2.04 billion in the second quarter of 2022. The gaming industry had a huge boost during the Covid lockdowns as people were stuck at home. Now it looks as though we are seeing a correction in demand.

In addition, many customers purchased Nvidia's graphics cards for Bitcoin mining, and with the price of Bitcoin down 64% from its all-time highs, this use case is less enticing. Nobody knows whether Bitcoin will become popular again.

However, the gaming industry is forecasted to rebound by growing at a 9% compounded annual growth rate between 2021 and 2026, reaching a value of over $321 billion.

Nvidia's data center segment also continues to perform strongly and generated revenue of $3.81 billion in the second quarter, up a rapid 61% year over year.

Nvidia is still profitable and generated earningsper share of $0.26 in the second quarter, which beat analyst expectations by $0.06. The company also has a solid balance sheet with $17 billion in cash and short-term investments versus total debt of $11.7 billion.

Valuation

Nvidia is trading at a forward price-earnings ratio of 33, which is not exactly cheap relative to the S&P 500 average of 26. However, it is still 19% cheaper than the company's own five-year average. The price-sales ratio of 10 is 29% cheaper than its five-year average.

Final thoughts

Both Meta and Nvidia are two high-quality technology companies that are facing a series of macroeconomic headwinds. I believe both companies have issues that are partly permanent and partly transient. For example, with Nvidia, I believe its Bitcoin-derived revenue may not bounce back, but gaming will. With Meta, I believe the younger generations may not even create Facebook or Instagram accounts anymore as they are seen as "old" in the social media world, but its core user base is strong. All things considered, both stocks are trading cheaply and still have market-leading positions.

Also check out: