Iconic fashion designer and retailer Lululemon Athletica inc. (LULU) has set another ambitious goal: to double both its revenue and earnings in the five years from 2021 to 2026.

That follows on its previous Power of Three plan, which it achieved in 2021, two years ahead of schedule. One of its growth goals, from 2018, was to deliver $6 million in net revenue.

The new strategy, Power of Three ×2, aims to double men’s and digital revenue and to quadruple its international revenue.

About Lululemon

In its 10-K for 2021, the company described itself as “principally a designer, distributor, and retailer of healthy lifestyle inspired athletic apparel and accessories. We have a vision to be the experiential brand that ignites a community of people through sweat, grow and connect, which we call 'living the sweatlife.'”

It operates through two segments: company-operated stores and direct-to-consumer. They made up 90% of net revenue in 2021, while the remaining 10% was comprised of warehouse outlets, temporary locations and wholesale.

With a market cap of $40.59 billion, it is now one of the giants of the apparel industry. It had 600 stores at the end of its second quarter operating in 17 countries.

Competition

Both established companies and new entrants fight for positions in this highly competitive market. According to Lululemon, it competes directly with wholesalers and direct sellers, including Nike Inc. (NKE, Financial), Adidas AG (ADDYY, Financial), Under Armour Inc. (UA, Financial), Columbia Sportswear Co.(COLM, Financial), The Gap Inc. (GPS, Financial) and Urban Outfitters Inc. (URBN, Financial).

The company believes it has several competitive advantages, including its premium brand image, technical product innovation, its vertical retail distribution strategy and community-based marketing.

It provides a chart in its annual report showing how it has outperformed its peer group and the S&P 500 Index over the past five years:

Financial resources

Innovation and growth demand capital expenditures, and usually lots of it. That would appear to be the case as Lululemon attempts to double its revenue and earnings in five years.

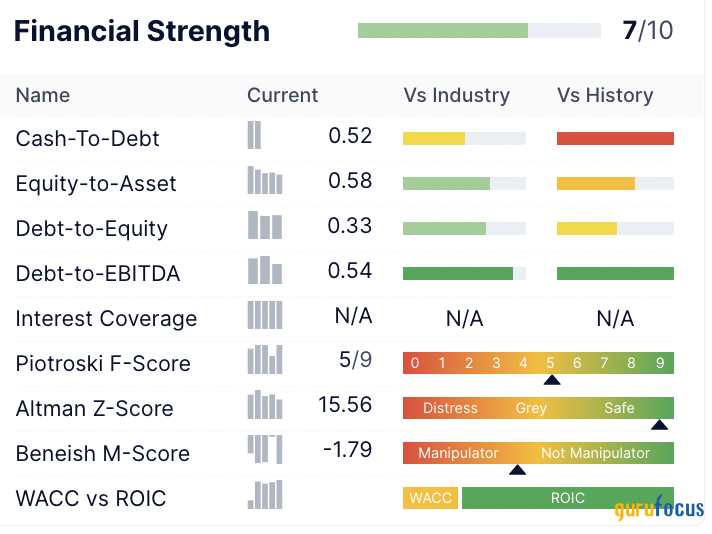

But I would argue the company is well prepared. It had neither short nor long-term debt when its most recent fiscal year ended on Jan. 30. You may see references to debt on the Summary page, but that refers to capital lease obligations, presumably in connection with its retail and distribution facilities:

At the same time, it held cash and cash equivalents worth $1.26 billion. That’s a lot of funding, especially since the company does not pay a dividend and does not repurchase shares aggressively.

The cash should keep coming. It has a return on invested capital of 34.67%, far greater than its weighted average cost of capital at 9.57%.

Profitability and growth

In addition, Lululemon has an industry-leading net margin of 15.6% and it has been profitable every year for the past 10 years.

To double its revenue over the next five years, from $6.257 billion to $12.5 billion, it will need a compound annual growth rate of 14.84% per year. Looking at its revenue history on the balance sheet, I see it increased its revenue from $2.65 billion in 2018 to $6.257 billion in fiscal 2021, an increase of $3.61 billion in three years. That’s a CAGR of 18.75%, well above the 14.84% it will need over the next five years.

And its earnings per share without non-recurring items has grown rapidly since the previous strategy was adopted in 2018:

Returning to the funding issue, it has a history of increasing its free cash flow, from $237 million in fiscal 2018 to $995 million in fiscal 2021.

Although there are still challenges such as supply chains and inflation, I believe all the key measures point in one direction: The company will have ample financial resources to double its revenue and earnings.

New platforms

Two innovations will help Lululemon capture new business and help solidify existing customer loyalty. It launched “Lululemon Studio” on Oct. 6, a service that will connect members to what it calls “more than 10,000 on demand and live-streamed classes” and “adds a breadth of content from some of the most notable fitness and wellness partners across North America.”

The retailer also introduced a new Lululemon Membership program. It will provide early access to products, returns on sale items, select Lululemon Studio Content, virtual community events, receipt-free and fast-track returns and free hemming.

The latter is free to join, while a Studio membership costs $795 per year. I see both programs increasing customer engagement and generating revenue from an adjacent space.

Management strength

Let’s start with the Piotroski F-Score, which provides an indication of how well the company is managing its finances. Originally designed as a tool for finding value candidates, it helps sort the good from the bad with nine specific ratings from the financial statements.

Lululemon receives a 5 out of 9 rating, which GuruFocus says means the financial situation is typical for a stable company. The score is in line with its major, publicly traded competitors: Nike with a 5, Adidas with a 4, Under Armour with a 5 and Columbia Sportswear with a 6.

We can also assess the quality of management by looking at return on equity and ROIC. The former displays how shareholders are faring, while the latter includes borrowed capital as well as shareholder equity.

And shareholders have done very well on both, as shown on the profitability table:

On ROE, Lululemon outperforms 91.77% of peers and competitors in the retail cyclical industry. It does even better on ROIC, with higher returns than 96.34% of publicly traded companies in the industry.

All that green on the table tells us management is highly competent and an effective steward of shareholders’ capital.

Gurus

Seven gurus have holdings, but only one is significant. Spiros Segalas (Trades, Portfolio) of the Harbor Capital Appreciation Fund owned 1,022,955 shares on July 31, representing 0.80% of Lululemon’s shares outstanding and 1.30% of his fund's assets under management.

Institutional investors own 88.02%, indicating professional investors have confidence in management. Insiders hold another 0.53%, led by Glenn K. Murphy, a director and a former chairman and CEO of The Gap.

Conclusion

By repeating a winning strategy from 2018, Lululemon Athletica should be able to double its revenue and earnings again by 2026. It has the financial resources, profitability and management expertise to do it again.

In other words, it is a quality company with a hot hand ready to pursue more growth beyond the women's channel and its North American base.