Shoots of change

In July 2022, GSK PLC (GSK, Financial) (LSE:GSK, Financial), a London-based global biopharma company, made a historic decision and demerged its consumer health care business by forming Haleon (HLN, Financial) as an independent company. The third-quarter 2022 press release stated that after the demerger, GSK's total ownership (including ESOP trusts and SLPs) is 13.5% in Haleon. Pfizer (PFE, Financial) holds a 32% stake in Haleon.

As a result of the successful demerger of its consumer health care segment, the company now focuses on biopharmaceuticals, prioritizing investment in the development of novel vaccines and specialty medicines. The business operations of the company are based on therapeutic areas such as infectious diseases, HIV, oncology, immunology and respiratory diseases.

Strengthening its core

Solidifying its forte in cancer, GSK acquired 100% of California-based Sierra Oncology Inc., a late-stage biopharmaceutical company focused on targeted therapies for the treatment of rare forms of cancer, for $1.9 billion (1.6 billion pounds) as per the press release. On Aug. 16, GSK also acquired Affinivax Inc. Based in Cambridge, Boston, Massachusetts, it is a clinical-stage biopharmaceutical company.

According to the third-quarter press release, the company’s sales increased to 7.8 billion pounds as a result of strong commercial execution across specialty medicines, vaccines and general medicines. With impressive data readouts and strategic business development, the company has consistently strengthened its R&D pipeline.

Biopharma focused with progressive pipeline

After the Haleon demerger in July 2022, GSK now focuses on being a biopharma company, according to the company strategy. It is prioritizing innovation in vaccines and specialty medicines. This would increase the opportunities to prevent diseases and treat them.

In the third-quarter results, CEO Emma Walmsley said, “We are again raising our full-year guidance and expect good momentum in 2023, further strengthening our confidence in our performance outlooks, driven by Shingrix global expansion and expected new launches including our new RSV vaccine.”

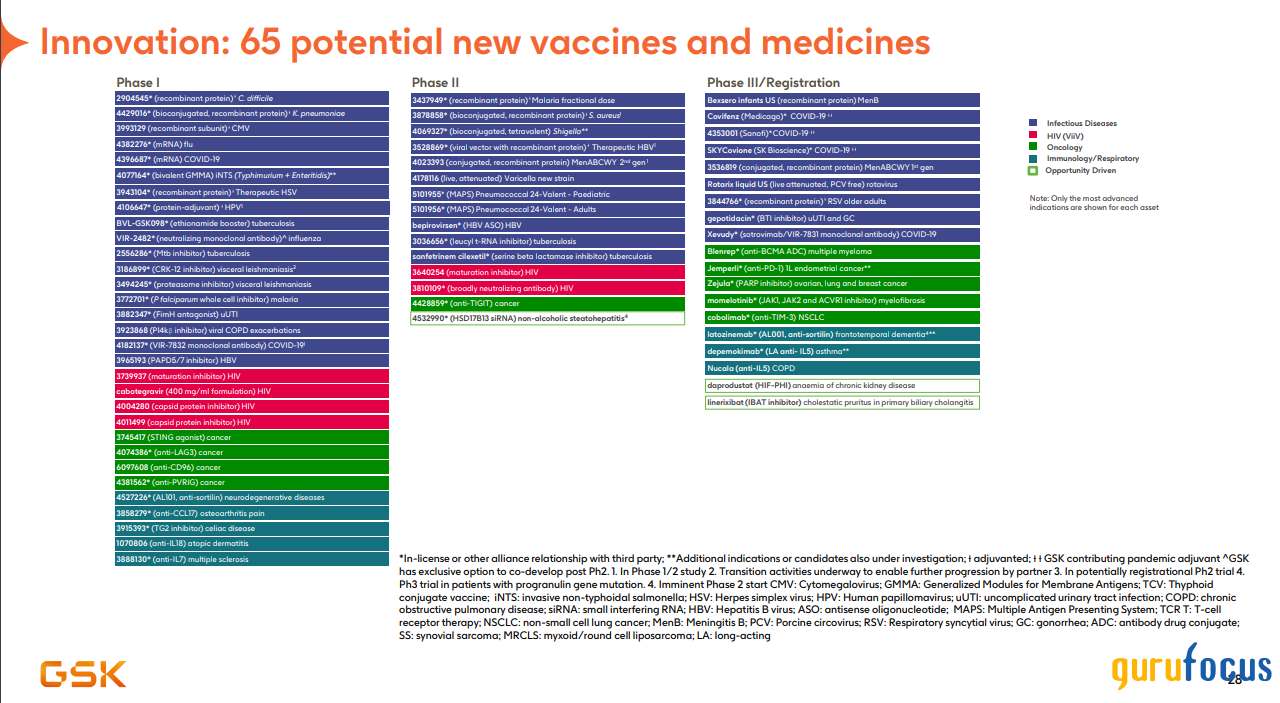

GSK has 19 medicines and vaccines in phase III development (including major lifecycle innovation or under regulatory review). Further, total 65 vaccines and medicines are in clinical development phase, which are included in the presentation. This brings about 85 vaccines and medicines (inclusive of all phases and indications), which are all mentioned in the earnings report.

Apart from this, at Citi's 17th Annual BioPharma Conference, Roger Connor, the company president, said the company is also planning to expand from 24 markets to 35 markets by 2024.

Global competitors

Having a global footprint, GSK faces strong competitors worldwide.

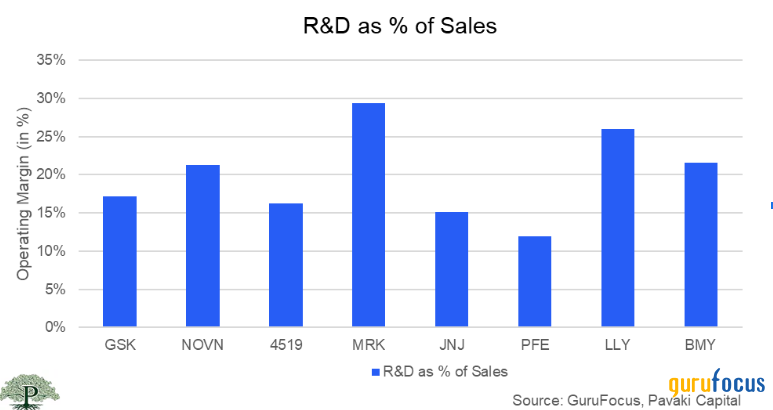

Research and development in the health care sector plays a vital roe. It helps generate revenue for the company as well as saves and improves lives.

Merck & Co. Inc (MRK, Financial), which is strongly rooted in the respiratory diseases drugs market, has invested the most in the last quarter with 29.4%. Eli Lilly and Co. (LLY, Financial) also spent around 26%, while Bristol-Myers Squibb Co. (BMY, Financial) and Novartis AG (XSWX:NOVN, Financial) invested in the low 20s. GSK, with its current 85 vaccines and medicines, spent 17.2% of its revenue on research and development.

Similarly, Chugai Pharmaceutical Co. (TSE:4519, Financial), which primarily deals in oncology, spent 16.3%. Johnson & Johnson's (JNJ, Financial) spending was in the mid-teens.

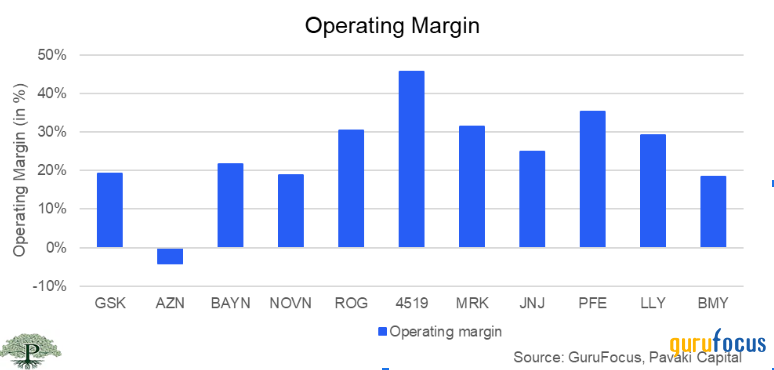

Operating margin for GSK and its peers

The above chart indicates that Chugai Pharmaceutical has the highest operating margin at 45.7%. With the average being 24.6%, more than half of the companies have margins that exceed the industry. GSK has an operating margin of 19.2%.

The numbers say it all!

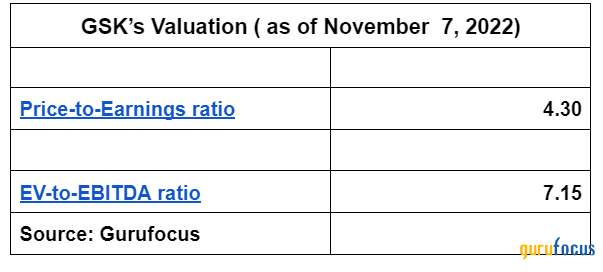

As per data provided by GuruFocus, GSK's price-earnings ratio is 4.30, which is undervalued post the third-quarter results compared to its peers' average of 13.5 and the European Pharmaceutical industry average of 17.2. GSK's enterprise value-to-Ebitda ratio stands at 7.15, which is better than the industry median of 12.74, and its enterprise value-to-revenue ratio of 1.80 is better than the industry median of 2.41.

GSK’s dividend payments have increased over the past 10 years; its current dividend yield is at 5.97%, which is higher than the top 25% of dividend payers in the U.K. market.

So it has reasonable valuations and growing dividends that provide a good yield to investors.

Overall

The company formerly known as GlaxoSmithKline is shaping up to grow stronger. Its consistent M&A activities help it focus on its core strength as well as spread its wings in complementary areas.

GSK’s financials provide it with the strength it needs. The company has consistently seen positive free cash flows in the past 10 years. Also, since 2017, the FCF has been high enough to cover the dividend payments. So the company is producing enough cash flows not only to invest in future growth in the form of capital expenditures, but also to reward shareholders in the form of dividends.

In the third quarter, GSK had 19.3 billion pounds of long-term debt. In comparison, it had about 7.1 billion pounds of cash and equivalents (equity and liquid investments). But the silver lining is that the company has been focused on maintaining financial discipline.

In the earnings call transcript, Walmsley said, “I’d also point us to the improving operating performance generation of cash flow as well as continually competitive distributions, but also some of the pay down of debt (and of course we are helped by currencies).”

Overall, with strong cash flows, a focus on financial discipline and bright growth prospects, GSK looks like a great investment opportunity. Its reasonable valuations and high dividend yield convey that possibly it's the right time to choose this stock for your portfolio.

Disclaimer/Disclosure

We do have a long position in the shares of GSK, either through stock ownership, options, or other derivatives. We wrote this article to express our opinions. We are not receiving compensation from any individual or entity for it.

You should not treat any opinion expressed in this article as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of our opinion. This is not investment advice. Before you invest in anything you might possibly read in our articles or those of the other people offering investment advice online, do your own research to verify the soundness of what you might have read. Please consult your investment advisor before making any decisions.