The third quarter of 2022 was another discouraging period for investors. Inflation kept going strong, the Federal Reserve continued raising interest rates and even the housing market began showing signs of weakness as consumers were slammed by the combination of rising costs and increasing mortgage rates.

As investors digested lackluster earnings reports and began hoping the Fed could ease up on interest rate hikes soon, the S&P 500 was down 6% over the course of the three months through the end of September, while the Nasdaq lost 5% and the Dow Jones Industrial Average dropped 7%.

Falling share prices do not mean a stock is doomed, especially in a bear market. However, if investors believe a company’s prospects have fundamentally changed, or that it does not have what it takes to survive an economic downturn, then it might be best to get out before the stock crashes further. According to GuruFocus’ Hot Picks, a Premium feature which allows investors to screen for the stocks that had the highest number of guru buys or sells based on the most recent regulatory filings, here are the five stocks that gurus were most bearish on in the second quarter, as determined by net buys.

Investors should be aware the data in this article is based on 13F filings for investing firms and portfolio updates for mutual funds, which do not provide a complete picture of a guru’s holdings. The 13Fs include only U.S. common stocks, while the mutual fund updates typically include both U.S. and foreign common stocks. Neither include other assets or investments such as bonds, credit, etc. All numbers are as of the quarter’s end only; it is possible the gurus may have already made changes to the positions after the quarter ended. However, even this limited data can provide valuable information.

Home Depot

The Home Depot Inc. (HD, Financial) was sold by 18 gurus in the third quarter while only three gurus bought the stock, resulting in 15 net sells. As of the quarter’s end, the stock appeared in the portfolios of 22 gurus. This marks a reversal from the first two quarters of this year, in which gurus were mostly bullish on the stock.

Home Depot is the largest home improvement retailer in the U.S., supplying a wide variety of tools, construction materials, pre-constructed home fixtures and related services. Based in Atlanta, the company has over 2,200 stores throughout the U.S., Canada and Mexico.

The company basically holds a duopoly with Lowe’s (LOW, Financial) over the U.S. home improvement market, as the combination of cheaper prices and a wider variety of products at these two big-box retailers has continuously driven smaller competitors out of business. This has led to a highly profitable business model and consistent growth over the past few decades.

The only major dip in Home Depot’s historical growth occurred during the Great Recession, when the company’s bottom line was more than halved from 2007 through 2009 as the housing crisis unfolded, unhousing about 10 million Americans as mass unemployment led to foreclosures. The economic downturn also negatively impacted people’s ability to afford expensive home improvements. With rising interest rates making it more difficult to obtain or even afford a mortgage, investors are worried about a repeat of the Great Recession hurting Home Depot’s profits.

CVS Health

CVS Health Corp. (CVS, Financial) had 17 sells and three buys from gurus in the third quarter for a total of 14 net sells. There were 23 gurus holding the stock as of the quarter’s end. This is the fourth quarter in a row where gurus have been selling off the stock.

CVS Health is a health care company that owns the CVS Pharmacy retail pharmacy chain, as well as Aetna (a health insurance provider), CVS Caremark (a pharmacy benefits manager) and several smaller operations. It is headquartered in Woonsocket, Rhode Island.

The company is planning to leverage its closeness to the consumer market to expand into the primary care space. It has already rolled out a virtual primary care service and aims to get into the in-person primary care market through acquisitions. CVS hopes its entry into primary care will increase American’ access to high-quality care while simultaneously lowering costs, thus luring customers away from competitors.

Unfortunately, due to the incentive structure of this business model, things seem unlikely to turn out according to plan. Since CVS would include a health care provider, a pharmacy and a health insurance provider under the same umbrella, it would be heavily incentivized to limit the quality of recommended care by gatekeeping procedures that would be costly for the insurer while pushing treatments that would be more profitable for the pharmacy side of the business. All in all, cheaper does not usually go hand in hand with better, so CVS may find its ability to gain customers is not as strong as it hopes.

Wells Fargo

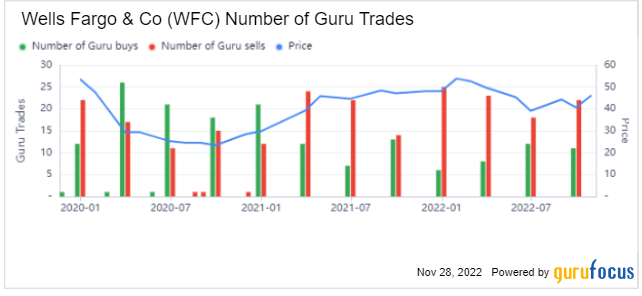

Wells Fargo & Co. (WFC, Financial) had 21 sells and 10 buys from gurus in the third quarter, resulting in 11 net sells. The stock appeared in the portfolios of 35 gurus as of the quarter’s end. Gurus have been mostly bearish on the stock for nearly two years now.

Wells Fargo is a U.S. bank major headquartered in San Francisco. It is the fourth-largest bank in the U.S. by assets. Like its peers, the bank earns most of its revenue from loans and credit cards, though it is subject to an asset cap following its fake accounts scandal back in 2016.

Some value investors have been clinging to Wells Fargo for years following the issues with the fake accounts scandal back in 2016, hoping that someday, the cap on its assets would be lifted, causing shares to skyrocket. However, until the asset cap is removed, Wells Fargo’s upside potential will remain limited.

Even more concerning in the current market environment is Wells Fargo’s high exposure to the home mortgage market. Demand for mortgages is expected to remain low due to rising interest rates and the fact prices are still significantly higher than they were before the pandemic, squeezing many buyers out of qualifying for a mortgage.

Elevance Health

There were 16 gurus selling Elevance Health Inc. (ELV, Financial) stock in the third quarter while five were buying shares, translating to 11 net sells. There were 22 gurus holding the stock as of the quarter’s end. Overall, gurus were mostly neutral on the stock until a wave of sells came in 2022.

Elevance is primarily in the business of health insurance. It offers medical, pharmaceutical, dental, behavioral health, long-term care and disability insurance plans. It is based in Indianapolis.

The company is aiming to transform itself from a traditional health benefits organization to what it calls a “lifetime trusted health partner.” This approach means integrating not just physical health, but also behavioral health, social health and long-term care for ageing and disabled patients.

It is possible that given Elevance’s enthusiastic rebranding, gurus could be fleeing the stock due to a problem that has unfortunately become quite pervasive in the health care industry: the problem of companies buying up doctor’s offices and other health care facilities, cutting costs and hurting the quality of care for short-term profits (which comes at the expense of long-term growth).

Amgen

Amgen Inc. (AMGN, Financial) had 13 gurus selling shares of its stock and only two buying in the third quarter for a total of 11 net sells. The stock appeared in the portfolios of 14 gurus as of the quarter’s end. This huge spike in selling marks a stark change from mostly bullish or neutral sentiment in the past couple of years.

Based in California, Amgen is one of the world’s largest independent biopharmaceutical companies. It has a wide variety of drugs already in circulation as well as a robust pipeline, with the main areas of research focusing on hematology/oncology, inflammation, bone and cardiometabolic.

On Oct. 20, Amgen completed its acquisition of ChemoCentryx, a biopharmaceutical company focused on treatments for autoimmune diseases, inflammatory disorders and cancer, for $52 per share in cash, worth a total consideration of approximately $3.7 billion. Amgen had its eye on Chemocentryx’s Tavneos, a Food and Drug Administration-approved oral treatment for severe active ANCA-associated vasculitis that analysts expect could have as much as $1 billion in annual sales by 2027.

Despite the potential of Tavneos to become a blockbuster, that has not happened yet, and investors are more concerned with the declining sales of the company’s arthritis drug Embrel as well as its entry into the lower margin biosimilars business.