The latest inflation numbers were recently announced for the month of October 2022. The report indicates 7.7% year-over-year growth on the Consumer Price Index (CPI). This was down slightly from the 8.2% year-over-year gain in the prior month but still substantially higher than the Fed's 2% target. Thus, in a recent speech on Dec. 1 the Brookings Institution, Federal Reserve Chariman Jerome Powell was still hawkish on inflation and said he plans to “stay the course until the job is done."

Powell acknowledged that the economy has slowed down substantially and it is getting tough for many businesses. However, he did highlight that inflation is coming down substantially in areas such as the cost of cars, furniture and appliances. Nevertheless, labor market conditions are still tight with wages rising faster than expected. Health care and food inflation also remains high, as does energy.

Rental and housing costs remain elevated, and these expenses make up one-third of the CPI index. Although Powell expects this metric to come down next year as rental contracts are renewed, it likely won't be by much unless we have a wave of foreclosures like in 2008, which is unlikely due to the manufactured housing shortage.

Given these factors, Powell is taking a hard stance and believes that to restore price stability, interest rates will need to remain elevated with hikes expected to continue. Powell references the 1970’s, in which prematurely loosening interest rates, resulted in a swift return of inflation.

For investors, this means it's important to diversify with inflation hedge. My favorite inflation hedge stock is one that Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial) has been loading up on this year: Occidental Petroleum (OXY, Financial). Here's why I believe this unconventional inflation hedge could be ideal in the current stock market environment.

The case for oil as an inflation hedge

Energy makes up a substantial part of the consumer price index (CPI), and oil prices increased by 17.6% in September. This was driven by a 17.5% spike in gas prices per barrel, driven by a variety of macroeconomic factors including the economic reopening and the Russia-Ukraine war.

The WTI (West Texas Intermediate) oil price went negative in 2020 as travel declined to almost nothing, but then spiked to $120 per barrel by June 2022. Since then, prices have started to fall, but they are still higher than the pre-pandemic levels of $59 per barrel.

I don't think oil prices are likely to tank much in the near-term, as their are many factors that continue to support higher prices, such as the Russia-Ukraine war and OPEC mulling further production cuts.

I see Occidental Petroleum as an ideal inflation hedge for two main reasons: one, this is a highly diversified oil and gas company, and two, gurus have been interested in the stock recently, as shown in the below chart. Most of the buys falling outside the quarterly numbers were from Buffett, and when added to the quarterly additions from other gurus, the sentiment on the stock seems to be bullish overall.

About Occidental

Occidental Petroleum runs a globally diversified operation across Texa,s Colorado, New Mexico, the Middle East and North Africa. The business is also has a mix of “long cycle” and “short cycle” oil production operations, which offers a diversified mix of “quick hit” supplies and longer-term steady state volume derived from the Permian Basin. Occidental also has exposure to the natural gas liquids (NGL) market, which has now become the go-to alternative to Russian oil in Europe.

Occidental also has a thriving chemical business called “OxyChem” which converts the unwanted excess from fuel production into valuable chemicals.

Many people don't want to invest in oil stocks because, like cigarette stocks, they're destined for eventual long-term decline. Occidental is far from a leader in the transition to green energy, outclassed by many peers on this front, but it does own a subsidiary called “Oxy Low Carbon Ventures,” which uses advanced technology to reduce emissions.

Growing financials

Occidental continues to benefit from high oil prices. The company reported solid financial results for the third quarter of 2022. Revenue was $9.38 billion, which beat analyst estimates by $452 million and increased by a rapid 38% year-over-year.

The company also produced solid earnings per share of $2.52, which beat analyst expectations by $0.11. Occidental is a cash cow at the moment, having generated $2.8 billion in the third quarter. This was down slightly from the record $3.9 billion reported in the second quarter, but still up over the prior year.

By segment, for the third quarter, the oil and gas segment reported solid pre-tax income of $3.3 billion. This was slightly less than the pre-tax income of $4.1 billion in the prior quarter but still up substantially year-over-year.

Occidental’s Chemical segment and its Midstream and Marketing segment both surpassed management guidance with pre-tax earnings of $580 million and $104 million.

The company has a precarious balance sheet with $1.2 billion in cash and short term investments compared to debt of $21.4 billion, but it has managed its debt structure well as just $184 million of this is current debt due within the next two years.

Occidental’s management also paid off $1.3 billion worth of debt in the third quarter, which compounds on top of the humongous $9.6 billion worth of debt paid off in the trailing 12 months. This is incredibly prudent and smart giving the rising interest rate environment.

Management also ordered the repurchase of 28.4 million shares for a staggering $1.8 billion. This compounds on top of the 41.8 million shares bought back in the trailing 12 months, so the company is not neglecting shareholders even as it focuses on paying down debt.

Occidental does pay a 0.59% dividend yield, which is consistent, which is not great but better than nothing.

Advanced valuation

In order to value Occidental Petroleum, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. Valuing Occidental is fairly challenging as its future cash flows are dependent upon oil prices and interest rates. Therefore, to be conservative, I have forecasted oil prices (and thus revenue) to decline by 10% next year. This is my worst case scenario considering the 38% revenue growth rate reported recently. In years two through five, I am forecasting a stabilization in growth with 10% revene growth per year.

I have also capitalized the company’s operating leases to increase margins. In addition, I have forecasted the business’s operating margin to decline from 37% to 30% over nine years. Again, this is driven by conservative estimates of future oil prices.

Given these factors. I get a fair value estimate of $179 per share. Since the stock trades at $68 per share at the time of writing, it is ~62% undervalued.

Occidental trades at a price-earnings ratio of 5.69, which is 80% cheaper than its five-year average.

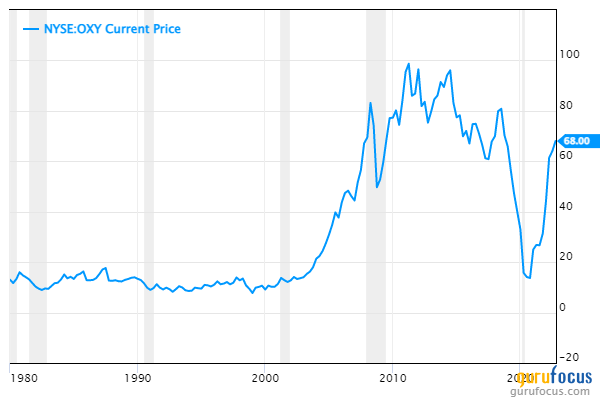

However, the GF Value calculator does indicate a fair value of $53 per share and estimates the stock is significantly overvalued. I believe this may be unfairly skewed due to the extremely high volatility of the stock, as part of the GF Value calculation comes from historical growth and price multiples. Occidental's business was in shambles a few years ago, causing the stock price to drop like a stone before it was buoyed by the current positive environment.

Occidental trades at an enterprise-value-to-Ebitda ratio of 4 , which is at the middle of the range relative to other companies in the oil sector. For example, Exxon Mobil (XOM, Financial) trades slightly more expensive at anenterprise-value-to-Ebitda ratio of 5.82, whereas Shell (SHEL, Financial) trades cheaper with an enterprise-value-to-Ebitda ratio of 3.97 and BP (BP, Financial) trades at an enterprise-value-to-Ebitda ratio of 4.5.

Final thoughts

Occidental Petroleum is a tremendous energy company that is diversified across products and geographies. Many people thought oil was dead in 2020, but as energy security and thus fossil fuels are still vital, profits are flowing. Management is prudently paying down debt and returning cash to shareholders, which is a positive sign. Buffett’s substantial purchases of the stock are also a huge point in its favor, in my opinion.