Shares of Air Products & Chemicals Inc. (APD, Financial) are up almost 6% in 2022.

Considering the S&P 500 Index has declined 17.5% and the industrial sector is lower by more than 15% year to date, this mid-single-digit gain is very impressive.

Even with the overall market showing weakness, Air Products & Chemicals recently established a new all-time high of $320.62 and sits just below this level at the moment. Yet, the stock is still trading below its GF Value.

Despite outperforming the broader market and its own sector for the year, I believe Air Products & Chemicals has several tailwinds that should enable the stock to continue to climb higher. This discussion will examine why I believe the stock offers value even as it sits just off of a new all-time high.

Takeaways from recent earnings results

One of the primary reasons that Air Products & Chemicals still has upside potential is due to the strength of its earnings results. The company reported fourth-quarter 2022 results on Nov. 3. Revenue surged almost 26% to $3.57 billion, which was still $339 million more than had been anticipated by analysts covering the name.

Adjusted earnings per share of $2.89 increased 38 cents, or 15.1%, from the prior year and were 13 cents better than expected.

Strong results were not just a one-quarter occurrence either. Fiscal year revenue grew 23% to $12.7 billion, while adjusted earnings per share of $10.41 was an increase of $1.38, or 15.3%.

Both quarterly and full fiscal year results came off of very good growth rates in the comparable periods. Revenue growth for the fourth quarter and fiscal year 2021 was 22% and 17%, respectively, while adjusted earnings per share improved 8% for fiscal year 2022 and 15% for the comparable quarter.

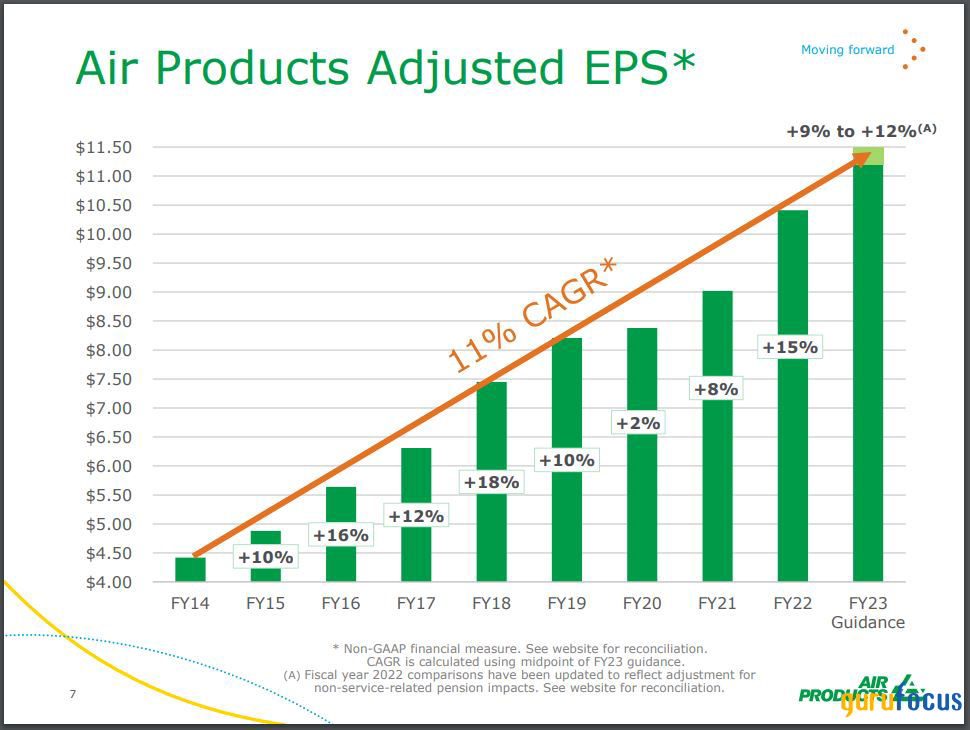

Air Products & Chemicals has long enjoyed high growth rates.

Source: Investor Presentation

The company has had such stellar results for a long period of time because of the importance of industrial gases in industrial functions. Industrial gases are usually a small portion of costs for the company’s customers, but they are needed so that production does not become disrupted. Industrial gases are essential to industrial production. This provides Air Products & Chemicals, one of the largest companies in its industry, to sit in a very advantageous position.

As such, customers are typically willing to sign long-term agreements and are accepting of price increases. Long-term agreements provide the company with a reasonable expectation for future revenue sources. Price increases can help offset higher costs.

This is what helped drive growth in the most recent quarter. Of the growth seen in the period, 15% was related to higher energy cost pass-through. Higher realized prices added 8%, but this did not impact demand very much as volume improved 9%. Despite higher costs to customers, demand was still elevated, once again showing Air Products & Chemicals’ key positioning in its industry. These gains were offset by a 6% headwind from currency exchange rates.

Looking closer at individual segments, revenue for the Americas business improved 38%, with volume growth adding 12% and price increases contributing 8%. Asia grew 14%, mostly due to a 16% increase in volume. Pricing added 3%. Europe was up 34%. Price hikes were felt the most here, as they increased 19%. Even with the magnitude of pricing hikes, volume was essentially flat for the region.

All three of the company’s areas of operation saw high levels of growth. Again, these came on the heels of impressive growth rates in the prior year. For the same period of fiscal 2021, revenue for the Americas, Asia and Europe grew 22%, 6% and 33%, respectively. The ability to raise prices and see volume growth in the two largest regions and remain stable in the third region speaks to the need for the industrial gases that Air Products & Chemicals supplies to its customers.

Not all the news was good for the period, however. Net income did fall 4% year over year, primarily due to the divestiture of Air Products & Chemicals’ Russian operations and the negative impact of a stronger U.S. dollar. The net income margin fell 520 basis points to 16.6%, with about half of the decrease attributed to higher energy cost pass-through.

Still, the majority of the news was positive for the company and management expects its business will continue to perform at a high rate in the new fiscal year. Adjusted earnings per share is projected to be in a range of $11.20 to $11.50, representing growth of 9% at the midpoint.

Air Products & Chemicals has invested heavily over the years to ensure its leading market position. To that end, the company spent $11 billion over the past five fiscal years on projects. The company has a backlog of nearly $16 billion that it intends to invest over the next half-decade.

The following is a list of major projects that the company has signed agreements for.

Source: Investor Presentation

Air Products & Chemicals is also working toward increasing its exposure to green energy. Some recent updates to the project list include an additional $500 million investment in a sustainable aviation fuel project in California, bringing the total investment to $2.5 billion.

The company also has a $5 billion joint venture in Saudi Arabia that will produce green ammonia for export and will be powered by renewable energy. In addition, Air Products & Chemicals has multiple carbon-free of net-zero hydrogen plants in development, which will only improve its positioning within the green energy movement.

This aggressive investment in its business should also help the company to keep its dividend growth streak of 40 years going as well.

Air Products & Chemicals has a GF Score of 89 out of 100, implying the potential for moderate outperformance going forward. This score is driven by solid marks in the areas of profitability, growth, momentum and financial strength and a middling score on value.

Valuation analysis

Using expected the midpoint of company guidance for the new fiscal year, Air Products & Chemicals has a forward price-earnings ratio of 27.5.

This is a premium multiple to be sure, but the company has demonstrated its ability to grow over the long term, has a leadership position in what has become a very commodity-like industry and is heavily invested in growing its business. The forward multiple is not too far off the five-year average price-earnings ratio of 25.5, according to Value Line.

The GF Value Line shows the stock might actually be undervalued based on its historical ratios, past financial performance and analysts' future earnings estimates.

Air Products & Chemicals has a price-to-GF Value ratio of 0.89, which implies a potential return of 12.2% from current levels. Add in the 2.1% dividend yield and total returns could begin to approach the mid-teens. GuruFocus rates the stock as modestly undervalued.

Final thoughts

Air Products & Chemicals has bucked the downward trend this year for both the market and its sector due to the strength of its business model and results. The company raised prices in all of its markets and did not see a decline in demand. In fact, volume improved by at least a low double-digit percentage in its two largest markets. Further investment in its business should help double-digit earnings growth continue, much as it has over the last decade.

Even with these benefits, shares trade just slightly above their medium-term average valuation. On an intrinsic value basis, the stock could provide returns in the low double-digit range, suggesting it is not ready to cool off even as it has recently established a new high. For investors looking for a name that has proven to work even when markets decline, Air Products & Chemicals could make a good candidate.