Joel Greenblatt (Trades, Portfolio) is a legendary investor who is the founder and managing partner of Gotham Asset Management, an investment firm with $3.34 billion in its latest 13F portfolio. Greenblatt developed the iconic “magic formula,” which is a method of picking stocks in a systematic way based on several factors, mainly the earnings yield and the return on capital.

Using this method to help inform his investing decisions, Greenblatt has beaten the market for multiple years running, though his portfolio investment strategy also uses individual stock research. The goal is to identify undervalued stocks with strong growth potential. Thus, in this article, we will be taking a look at two stocks Greenblatt was buying in the third quarter of 2022 that I believe are undervalued growth stocks.

1. Snowflake

Snowflake (SNOW, Financial) is a leading Cloud-native data warehouse platform that is poised to benefit from the growth in “big data." In the third quarter of 2022, Greenblatt purchased 423,947 shares of the stock, which traded at an average price of $165 per share during the quarter. At the time of writing, the stock trades at ~$147 per share.

About Snowflake

Snowflake is a software company that provides Cloud-native data warehousing based on a Software-as-a-Service (SaaS) model. The company is number one rated data warehouse provider according to G2, surpassing even Amazon's (AMZN, Financial) AWS.

A data lake stores unstructured data, while a data warehouse stores structured data. Historically in larger organizations, data is stored in siloed departments, making it difficult to access and derive insights. However, a Cloud data warehouse enables the data sources to be brought together, then machine learning can be run with it to derive insights.

Snowflake is making waves as its platform is ideal for the hybrid Cloud environment. This means large organizations are not locked into a single cloud infrastructure provider such as AWS or Microsoft's (MSFT, Financial) Azure.

The company also has strong management. Its CEO is former ServiceNow (NOW, Financial) CEO Frank Slootman. I recently read his book “Amp It Up,” and in it he discussed his growth strategy which includes setting a high bar and amping up the execution. I was also very impressed with how humble he is, as he admits past mistakes such as not recognizing ServiceNow’s platform could be used for other applications.

Growing financials

Snowflake generated strong financial results in its third quarter of fiscal 2023. Its revenue was $557 million, which increased by a outstanding 67% year-over-year, while its remaining performance obligations (RPO) increased to $3 billion in contracted revenue.

Its customer number grew by 34% year-over-year to 7,292. In addition, its larger “enterprise” customers with over $1 million in contributed product revenue increased by a substantial 94% since the prior year to 287. This is part of management's strategy to “grow upmarket” and target larger organizations with greater upsell potential.

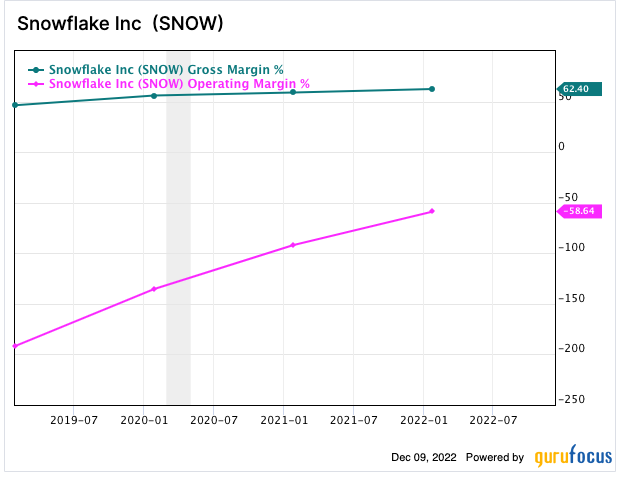

Snowflake also improved its profitability with earnings per share of $0.11, which surpassed analyst estimates by a staggering 139%. Snowflake has managed to drive revenue growth while also reducing its operating expenses, which is incredible. This was driven by G&A expenses being sliced in half as a portion of revenue and overall economies of scale.

Snowflake has a robust balance sheet with $4.9 billion in cash, cash equivalents and marketable securities compared to debt of approximately $241 million.

Valuation

Snowflake has been infamous for overvaluation since its IPO in 2020. However, since that point its price-sales ratio has compressed from over 120 to just 24 based on share price decline combined with growing revenue.

2. Qualys

Joel Greenblatt (Trades, Portfolio) purchased 70,034 shares of Qualys (QLYS, Financial) in the third quarter of 2022, during which shares traded at an average price of $140 per share. At the time of writing the stock is trading at ~$117 per share.

About Qualys

Many organizations are going through a “digital transformation” as they aim to move their on-premesis IT to the Cloud. However, a risk with doing this is the increased security concerns. Qualys helps companies solve this problem with its cybersecurity compliance platform that helps customers secure their workloads in the Cloud.

The company’s platform aims to replace a legacy security stack of many single point solutions with a single vendor muilti-product platform. Its platform helps companies to manage vulernabilities while also automating threat response to hackers.

Qualys has grown its customer base substantially and already works with 66% of the Forbes Global 50 and one quarter of Global 2000 companies. Its most notable customers include, Apple (AAPL, Financial) Amazon, Microsoft, Visa (V, Financial) and many more. This gives the company significant credibility and a competitive advantage.

Growing financials

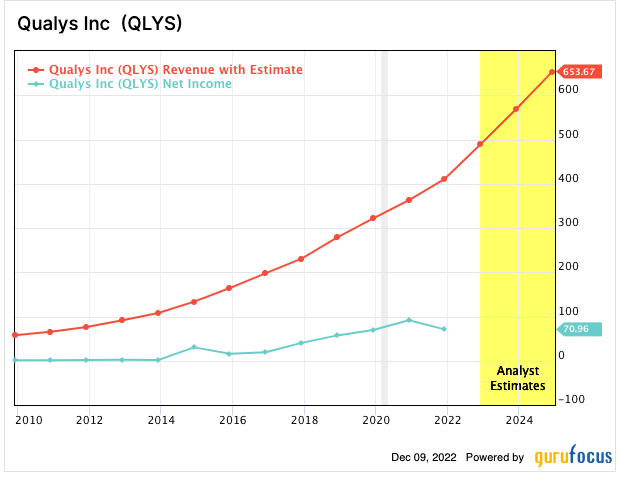

Qualys reported strong financial results in the third quarter of 2022. Revenue was $125.6 million, up a rapid 20% year-over-year.

Operating income was $33.3 million, which was up slightly from $32.0 million for the same quarter in 2021. However the company did report strong earnings per share of $0.71, which beat analyst expectations by $0.14.

The company has a strong balance sheet with $385 million in cash and short-term investments vs. just $39.9 million in total debt.

Valuation

Qualys trades at a non-GAAP price-earnings ratio of 33, which is more expensive than the average price-earnings ratio for the software industry of 19. However, it is 24% cheaper than its five-year average. The GAAP price-earning ratio is 46, though personally I believe the non-GAAP metric is a more accurate reflection for this company.

The stock trades at a price-sales ratio of 9, which is 14% cheaper than its five-year average.

The GF Value chart indicates a fair value of $147 per share for the stock, making it “modestly undervalued.”

Final thoughts

Both Snowflake and Qualys are tremendous growth stocks which have an elite customer base of enterprise clients. These two high quality companies have historically been overvalued, but due to the macroeconomic environment, they now look undervalued in my opinion, and its seems that Greenblatt agrees based on his firm's third-quarter buys for these stocks.