According to current portfolio statistics, a Premium feature of GuruFocus, five stocks in Tiger Global Management’s third-quarter 13F equity portfolio that have high business predictability and are undervalued based on discounted cash flow value include Meta Platforms Inc. (META, Financial), Taiwan Semiconductor Manufacturing Co. Ltd. (TSM, Financial), Alphabet Inc. (GOOGL, Financial), Visa Inc. (V, Financial) and Microsoft Corp. (MSFT, Financial).

Chase Coleman (Trades, Portfolio), a former protégé of Julian Robertson (Trades, Portfolio)’s Tiger Management, founded the New York-based firm in 2001. Tiger Global seeks high-quality companies by applying a fundamental, long-term investment approach that emphasizes secular growth trends and management strength.

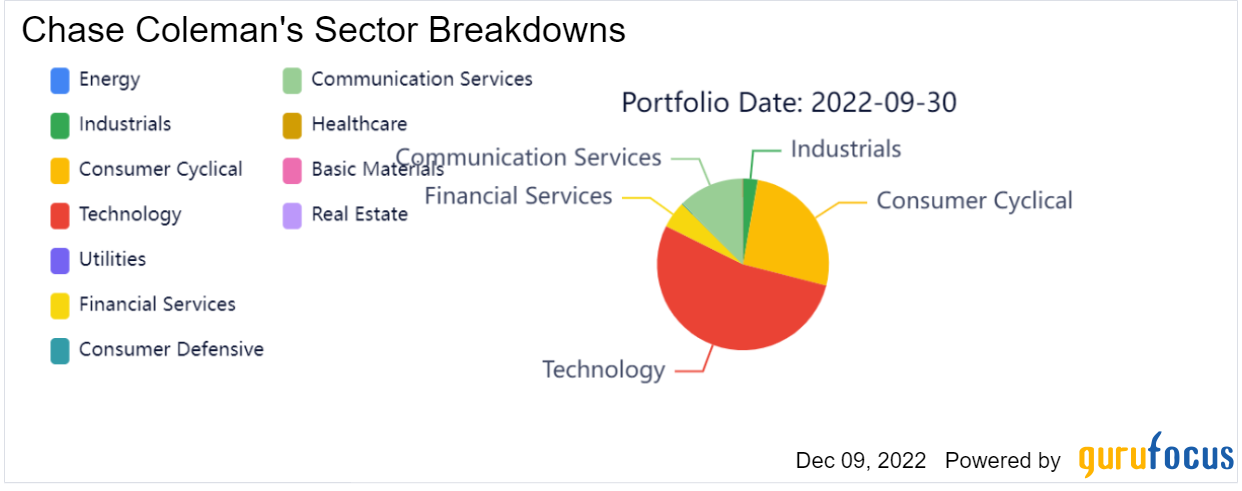

The firm’s $10.89 billion third-quarter 13F equity portfolio contains 64 stocks with a quarterly turnover ratio of 25%. The top three sectors in terms of weight are technology, consumer cyclical and communication services, representing 53.37%, 26.23% and 12.35% of the equity portfolio.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but the reports can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Meta Platforms

Tiger Global owns 4,488,648 shares of Meta Platforms (META, Financial), giving the position 5.59% equity portfolio weight.

Shares of Meta traded around $115.57, showing the stock is significantly undervalued based on its price-to-GF Value ratio of 0.30 as of Friday.

Based on earnings of $10.49 per share and a 10-year growth rate of 20%, Meta is valued at $360.96 assuming the default DCF Calculator parameters for the discount rate, terminal-stage growth rate and years of terminal growth. With a margin of safety of 67.98%, the stock is significantly undervalued based on the DCF earnings model.

The Menlo Park, California-based social media giant has a GF Score of 83 out of 100: Even though the company’s momentum and GF Value rank just 2 out of 10, Meta has a financial strength rank of 7 out of 10 and a rank of 10 out of 10 for profitability and growth.

Other gurus with holdings in Meta include Ken Fisher (Trades, Portfolio)’s Fisher Investments and Dodge & Cox.

Taiwan Semiconductor Manufacturing

Tiger Global owns 1,315,005 shares of Taiwan Semiconductor Manufacturing (TSM, Financial), giving the stake 0.83% equity portfolio weight. Shares traded around $81.96, showing the stock is significantly undervalued based on its price-to-GF Value ratio of 0.66.

Based on earnings of $5.80 per share and a 10-year growth rate of 14.5%, Taiwan Semiconductor Manufacturing is valued at $137.36 assuming the default DCF Calculator parameters. With a margin of safety of 40.32%, the stock is significantly undervalued based on the DCF earnings model.

The Taiwanese semiconductor giant has a GF Score of 91 out of 100: Even though the company’s momentum ranks just 2 out of 10, Taiwan Semiconductor Manufacturing has a rank of 10 out of 10 for growth and profitability and a rank of 8 out of 10 for financial strength and GF Value.

Other gurus with holdings in Taiwan Semiconductor Manufacturing include Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) and Fisher’s Fisher Investments.

Alphabet

Tiger Global owns 5,473,688 Class A shares of Alphabet (GOOGL, Financial), giving the holding 4.81% equity portfolio weight.

Shares of Alphabet traded around $93.61, showing the stock is significantly undervalued based on its price-to-GF Value ratio of 0.67.

Based on earnings of $5.03 per share and a 10-year growth rate of 15.3%, Alphabet is valued at $125.83 assuming the default DCF Calculator parameters. With a margin of safety of 25.61%, the stock is modestly undervalued based on the DCF earnings model.

The Mountain View, California-based online media giant has a GF Score of 95 out of 100: Even though the company’s momentum ranks just 5 out of 10, Alphabet has a rank of 10 out of 10 for growth and GF Value and a rank of 9 out of 10 for financial strength and profitability.

Other gurus with holdings in Alphabet include Fisher Investments and PRIMECAP Management (Trades, Portfolio).

Visa

Tiger Global owns 163,00 shares of Visa (V, Financial), giving the position 0.27% equity portfolio weight.

Shares of Visa traded around $210.21, showing the stock is modestly undervalued based on its price-to-GF Value ratio of 0.77 as of Friday.

Based on earnings of $6.99 and a 10-year growth rate of 19.7%, Visa is valued at $235.66 assuming the default DCF Calculator parameters. With a margin of safety of 10.80%, Visa is slightly undervalued based on the DCF earnings model.

The San Francisco-based payment processing company has a GF Score of 99 out of 100 based on a financial strength rank of 7 out of 10, a rank of 10 out of 10 for profitability and growth and a rank of 9 out of 10 for momentum and GF Value.

Microsoft

Tiger Global owns 6,004,108 shares of Microsoft (MSFT, Financial), giving the position 12.84% equity portfolio weight.

Shares of Microsoft traded around $245.82, showing the stock is modestly undervalued based on its price-to-GF Value ratio of 0.79 as of Friday.

Based on earnings of $9.28 and a 10-year growth rate of 16.8%, Microsoft is valued at $256.80 assuming the default DCF Calculator parameters. With a margin of safety of 4.09%, Microsoft is fairly valued based on the DCF earnings model.

The Redmond, Washington-based software giant has a GF Score of 97 out of 100 based on a rank of 10 out of 10 for profitability and growth, a GF Value rank of 9 out of 10, a financial strength rank of 8 out of 10 and a momentum rank of 5 out of 10.