These days, investors are talking a lot about Apple (AAPL), and many of us don't know whether we should buy Apple for our portfolios or not. Its share price is passing $700, making it the largest publicly traded company on the planet, with more than $656 billion in market capitalization. Can Apple become a trillion dollar company anytime soon? Is Apple's stock price currently cheap or expensive? In order to figure whether it's cheap or expensive, we have to look at its fundamentals.

Operating figures and historical growth

Apple is a very rare case in that it is the biggest publicly traded company in the world, and it is a growth company. It has been growing tremendously since Steve Jobs came back and brought the company forward. Here are some key operating figures:

Since 2004, Apple has experienced fantastic growth in its operating fundamentals. The annualized growth for the last eight years of revenue, operating income and net income are 37.9%, 78.6% and 76.4% respectively. In addition, Apple is a cash cow machine as well, its eight-year annualized growth in operating cash flow and free cash flow are 58.7% and 58.4% respectively. Currently, trailing 12-month figures are extremely encouraging as well: TTM operating income and net income are nearly double compared to 2011, citing much more growth for Apple since September 2011.

Balance Sheet Strength

Apple is not only a growth and cash cow company, but it is also a debt-free company with lots of cash and investments on hand. As of June 2012, it had $27.6 billion in cash, $89.5 billion long-term marketable equity investments, $111.7 billion in shareholders' equity and no debt. In $89.5 billion of equity investments, $37.3 billion was in corporate securities, $16.7 billion was in U.S. agency securities and $15.3 billion was in U.S. Treasury securities. Average maturities for those investments range from one to five years. In its recent quarterly SEC filing, Apple mentioned its long-term marketable securities investments: "The Company typically invests in highly-rated securities, and its investment policy generally limits the amount of credit exposure to any one issuer. The policy requires investments generally to be investment grade, with the primary objective of minimizing the potential risk of principal loss."

Business

Apple offers terrific brands around its products such as iPod, iPhone, iPad, Mac, etc. And it has great integration among those products. David Einhorn once said that Apple was one of the most misunderstood stocks out there, despite being widely held. He didn't consider Apple a hardware company; rather it was a software company, which lodged its operating system and products in a high-margin device. That is true; in order to use Apple's iOS, iTunes, App store, and the rest, one has to buy Apple products. It represents the "stickiness" of Apple's software, with no privacy problems. Even if the Chinese want to use Apple's products, they have to buy real Apple, not a fake.

Apple's cost factors

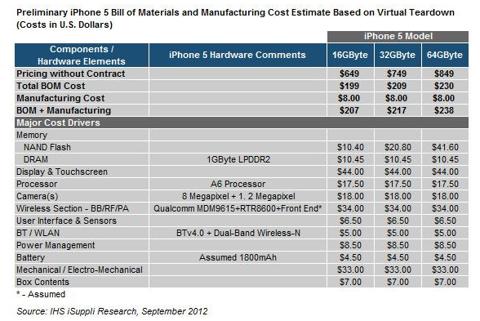

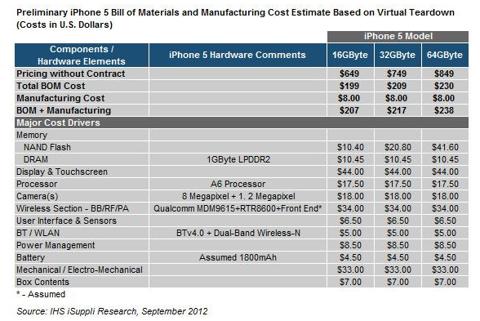

As David Einhorn pointed out, there was quite a high margin in Apple's products. Let's take iPhone 5, the recent hit in the mobile phone market place, for example.

As we can see from the table above, Apple has to pay out $207, $217 and $238 for its iPhone 5 16GB, 32GB and 64GB respectively, whereas it charges $649, $749 and $849 as retail price without contracts. The gross margin is incredibly high, in the range of 68-72%. The more GB version customers choose, the higher gross margin Apple receives.

Comparing with other big PC and mobile manufacturers in the market place, Apple is the most outstanding:

Valuation

With the strong balance sheet and fantastic growth, however, Apple is trading at a quite reasonable valuation. Its share price is $700 per share; the total market capitalization is $656.27 billion. Apple is valued by the market at 16.4x P/E, 5.9x P/B and 12.7x P/CF.

If we do discounted free cash flow analysis for Apple, and we conservatively estimate that its growth would be only 20% in the next five years (although it has experienced 10-year annualized growth of more than 58%), then the perpetual growth would be 2% after that, and the discount rate is 10%.

Following our discounted free cash flow analysis method with the above assumptions, the estimated intrinsic value of Apple would be around $1 trillion.

So is the current market price too high for Apple's estimated real value? I don't think so. Apple still remains a good value buy in investors' diversified portfolios.

Operating figures and historical growth

Apple is a very rare case in that it is the biggest publicly traded company in the world, and it is a growth company. It has been growing tremendously since Steve Jobs came back and brought the company forward. Here are some key operating figures:

| USD million | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | TTM |

| Revenue | 8,279 | 13,931 | 19,315 | 24,006 | 32,479 | 42,905 | 65,225 | 108,249 | 148,812 |

| Op. income | 326 | 1,650 | 2,453 | 4,409 | 6,275 | 11,740 | 18,385 | 33,790 | 53,007 |

| Net Income | 276 | 1,335 | 1,989 | 3,496 | 4,834 | 8,235 | 14,013 | 25,922 | 40,133 |

| CFO | 934 | 2,535 | 2,220 | 5,470 | 9,596 | 10,159 | 18,595 | 37,529 | 52,149 |

| FCF | 758 | 2,275 | 1,563 | 4,484 | 8,397 | 8,946 | 16,474 | 30,077 | 41,677 |

Since 2004, Apple has experienced fantastic growth in its operating fundamentals. The annualized growth for the last eight years of revenue, operating income and net income are 37.9%, 78.6% and 76.4% respectively. In addition, Apple is a cash cow machine as well, its eight-year annualized growth in operating cash flow and free cash flow are 58.7% and 58.4% respectively. Currently, trailing 12-month figures are extremely encouraging as well: TTM operating income and net income are nearly double compared to 2011, citing much more growth for Apple since September 2011.

Balance Sheet Strength

Apple is not only a growth and cash cow company, but it is also a debt-free company with lots of cash and investments on hand. As of June 2012, it had $27.6 billion in cash, $89.5 billion long-term marketable equity investments, $111.7 billion in shareholders' equity and no debt. In $89.5 billion of equity investments, $37.3 billion was in corporate securities, $16.7 billion was in U.S. agency securities and $15.3 billion was in U.S. Treasury securities. Average maturities for those investments range from one to five years. In its recent quarterly SEC filing, Apple mentioned its long-term marketable securities investments: "The Company typically invests in highly-rated securities, and its investment policy generally limits the amount of credit exposure to any one issuer. The policy requires investments generally to be investment grade, with the primary objective of minimizing the potential risk of principal loss."

Business

Apple offers terrific brands around its products such as iPod, iPhone, iPad, Mac, etc. And it has great integration among those products. David Einhorn once said that Apple was one of the most misunderstood stocks out there, despite being widely held. He didn't consider Apple a hardware company; rather it was a software company, which lodged its operating system and products in a high-margin device. That is true; in order to use Apple's iOS, iTunes, App store, and the rest, one has to buy Apple products. It represents the "stickiness" of Apple's software, with no privacy problems. Even if the Chinese want to use Apple's products, they have to buy real Apple, not a fake.

Apple's cost factors

As David Einhorn pointed out, there was quite a high margin in Apple's products. Let's take iPhone 5, the recent hit in the mobile phone market place, for example.

As we can see from the table above, Apple has to pay out $207, $217 and $238 for its iPhone 5 16GB, 32GB and 64GB respectively, whereas it charges $649, $749 and $849 as retail price without contracts. The gross margin is incredibly high, in the range of 68-72%. The more GB version customers choose, the higher gross margin Apple receives.

Comparing with other big PC and mobile manufacturers in the market place, Apple is the most outstanding:

| % | Gross margin (TTM) | Net margin |

| Apple | 44.10% | 27% |

| Nokia (NOK) | 27% | -10.70% |

| Research in Motion (RIMM) | 31.90% | -0.30% |

| Hewlett Packard (HPQ) | 1.50% | -4.54% |

| Dell (DELL) | 21.70% | 5.01% |

Valuation

With the strong balance sheet and fantastic growth, however, Apple is trading at a quite reasonable valuation. Its share price is $700 per share; the total market capitalization is $656.27 billion. Apple is valued by the market at 16.4x P/E, 5.9x P/B and 12.7x P/CF.

If we do discounted free cash flow analysis for Apple, and we conservatively estimate that its growth would be only 20% in the next five years (although it has experienced 10-year annualized growth of more than 58%), then the perpetual growth would be 2% after that, and the discount rate is 10%.

| USD million | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Terminal value |

| FCF | 41,677 | 50,012 | 60,015 | 72,018 | 86,421 | 103,706 | 1,322,248 |

| PV | 45,466 | 49,599 | 54,108 | 59,027 | 64,393 | 746,374 | |

| Est. Value | 1,018,967 | ||||||

| 5 year growth | Terminal growth | Discount rate | |||||

| 20% | 2% | 10% |

Following our discounted free cash flow analysis method with the above assumptions, the estimated intrinsic value of Apple would be around $1 trillion.

So is the current market price too high for Apple's estimated real value? I don't think so. Apple still remains a good value buy in investors' diversified portfolios.