The gaming industry boomed due to Covid as people stayed at home more often and many “real world” social activities were shut down. Many people sought gaming to entertain themselves and even socialize with others online.

However, due to the economic reopening in 2021 and the recession that began 2022, the gaming industry has been on a secular decline. A positive is the gaming market was valued at $195.65 billion in 2021 and is forecast to grow at a 12.99% compounded annual growth rate up until 2030 according to Grand View Research.

Since the gaming industry should eventually rebound due to its cyclical nature, in this article, we will go over my top two favorite gaming stocks that I believe are poised for a rebound; let’s dive in.

1. Corsair Gaming

Corsair Gaming (CRSR, Financial) is a leading provider of PC components, equipment and gear for gamers and content creators. Gaming is not just about buying a console or gaming PC; there is a whole ecosystem of products and accessories to support these devices. In the trailing 12 months, Corsair shipped over 190 million products. These included curved monitors, keyboards, headsets, webcams, gaming chairs and much more.

I personally find many of the products the company ships are those you don’t know you need until you see it or watch a technology review. A key example would be the ultra-comfy gaming chairs which are also fantastic for home offices. Then of course we have the new curved ultra-wide monitors which create an immersive gaming experience. In addition, Corsair’s products are extremely popular with content creators who want a best-in-class webcam or live streaming equipment. A 2022 study by Adobe (ADBE, Financial) indicates that the content creator economy has grown by over 165 million globally over the past two years, up a staggering 119%.

Another growing trend is “Esports,” or gaming sports competitions. You may think this is not a serious industry, but the global Esports market was valued at $1.1 billion in 2020 according to Newzoo. Esports are especially popular in China, where many “digital athletes” win great prizes.

In the third quarter of 2022, Corsair launched its first gaming laptop as it aims to attack the $30 billion market opportunity. Corsair has the number one market share in the gaming case market and a 40% market share in gaming power supplies sold to U.S. consumers, in addition to a 72% market share of the gaming memory market.

Financials

Corsair reported mixed financial results for the third quarter of 2022. Revenue was $311.8 million, which declined by 20.3% year over year due to the cyclical decline in the industry. However, its revenue increased by 9.8% quarter over quarter. This improvement was a result of channel inventory becoming reduced as the company managed to offload old products.

In terms of profitability, Corsair reported gross profit of $71.6 million, which declined by 29.4% year over year. However, this metric has shown a massive improvement quarter over quarter, up 96.3%.

The loss per share was $0.09, which was down substantially from earnings per share of $0.02 in the prior-year period. However, this metric was in line with analyst expectations. Adjusted earnings per share was $0.08, which beat analyst expectations by $0.06.

Corsair has a strong balance sheet with $57.3 million in cash and short term investments compared to $296 million in total debt, $239.1 million of which is long-term debt.

Valuation

Corsair trades at a price-sales ratio of 1, which is 58% cheaper than its five-year average.

Guru investor Jim Simons (Trades, Portfolio)' Renaissance Technologies previously purchased the stock in the third quarter of 2022, based on his firm's latest 13F filing. During the quarter, the average share price was $14.36. It should be noted that Renaissance is an algorithmic trading company and thus it tends to buy stocks based upon momentum indicators.

On the other hand, investors such as Catherine Wood (Trades, Portfolio) of Ark Invest and Paul Tudor Jones (Trades, Portfolio) sold shares of the stock in the third quarter of 2022.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

2. Take-Two Interactive

Take-Two Interactive (TTWO, Financial) is one of the greatest video game holding companies in the world. The company owns the iconic game developer Rockstar Games, which produced the Grand Theft Auto franchise as well games such as Red Dead Redemption, both of which have immensely popular online versions. Grand Theft Auto recently launched a “remastered” GTA trilogy. Other classic games under Take-Two's umbrella include the Max Payne series, Midnight Club Racing, Manhunt, The Warriors and many more.

Take-Two Interactive also owns Zynga, which it acquired for $12.7 billion in May 2022. Zynga is one of the world's biggest mobile game publishers and is known primariy for Farmville.

Take-Two also owns 2K games, which has a large number of sporting franchise games such as NBA 2K, WWE and PGA in addition to iconic games such as Mafia.

Financials

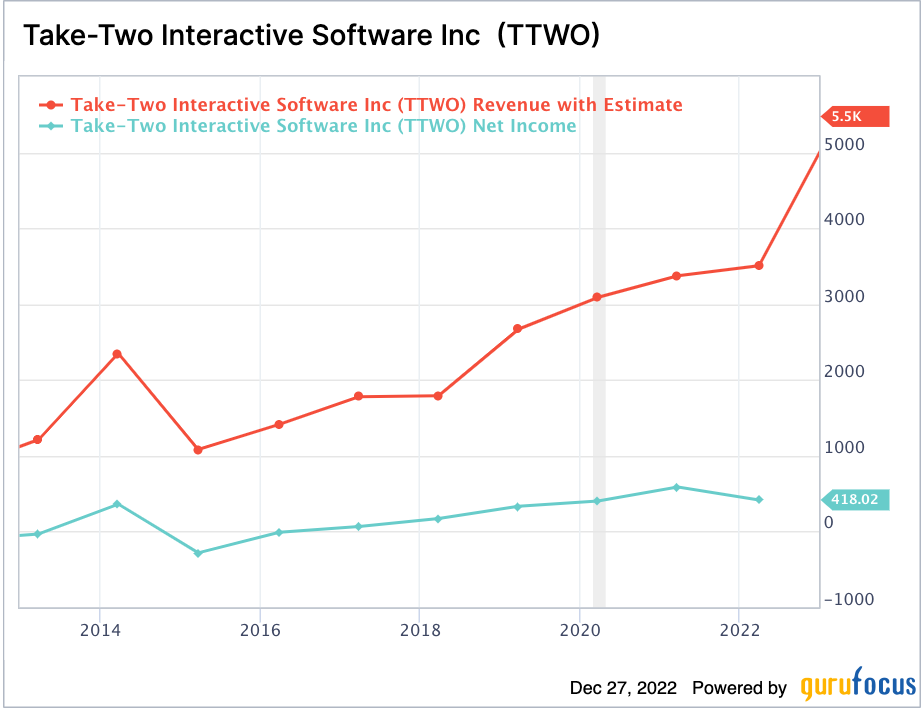

Take-Two Interactive reported mixed financial results for its second quarter of fiscal 2023. Revenue was $1.5 billion, which increased by 62% year over year and was aligned with management guidance, though investors should note this was largely due to the Zynga acquisition. I believe the cyclical decline in the gaming market impacted the business slightly as revenue was below analyst estimates. However, Take-Two is still making strong progress. For example, Grand Theft Auto V drove strong results and has sold over 170 million units globally. Its NBA franchise has also continued to produce strong sales.

Take-Two has finally integrated Zynga mobile gaming and it is expected to drive over $160 million in gross bookings over the next four years.

The loss per share was $1.34, which missed analyst expectations by $0.72. On a non-GAAP basis, EPS was positive at $1.32 but still missed analyst expectations by $0.07.

A positive on the earnings front is 73% of its console game sales were delivered digitally, which up from 65% last year. This is a positive trend and should result in greater margins in the longer term. Games purchased on a physical disk require packaging, production and then shelf space at a retailer, which eat into margins. They can also be shared between families and friends.

Valuation

Take-Two Interactive trades at a price-sales ratio of 3, which is 43% cheaper than its five-year average.

The GF Value chart indicates a fair value of $175 per share for the stock, making it look undervalued at the $99 per share price at the time of writing. The GF calculator does warn of a possible “value trap” due to declining profitability. However, I don’t believe this is a long-term issue, as the gaming market is going through a cyclical decline and the Zynga acquisition is pressuring margins in the near-term.

Caxton Associates (Trades, Portfolio) and activist investor Daniel Loeb (Trades, Portfolio) purchased Take-Two shares in the third quarter of 2022, based on their 13F reports. During the quarter, the stock traded at an average price of $124 per share.

Gurus selling the stock in the quarter included Ray Dalio (Trades, Portfolio)'s Bridgewater and Ron Baron (Trades, Portfolio)'s Baron Funds.

Final thoughts

Corsair and Take-Two are very different companies, but as both operate in the cyclical gaming industry, they are due for a downturn in the near-term as the market suffers. I believe this has opened up value opportunities for these gaming leaders. I personally think Take-Two has a better value proposition overall as it has more of a competitive advantage due to its strong gaming franchises. Producing iconic games has a much larger barrier to entry than producing gaming PCs and accessories, which can be undercut by cheaper alternatives. Either way, when the gaming market eventually recovers, both stocks should benefit.