Lay-Z-Boy Inc. (LZB, Financial) is a leading manufacturer and retailer of furniture. In addition to the iconic La-Z-Boy brand, the company is focusing on the fast-growing Joybird brand and other trade brands, including England, Kincaid, American Drew and Hammary.

In total, Lay-Z-Boy generates approximately $2.5 billion in sales across the wholesale, retail and Joybird segments, with about 95% of those sales coming from North America. Wholesale makes up about 55% of the company's total sales.

Unfortunately, the stock has performed poorly this year, falling more than the overall market. However, the current low price of the stock combined with the company's strong financial performance may indicate potential for growth in the future for investors. The company primarily does business in the U.S., but also has a presence in Canada and other countries. Its main business areas are the Wholesale segment, which manufactures and imports upholstered furniture, and the Retail segment, which sells furniture directly to consumers. Most of the company's revenue comes from the Wholesale segment.

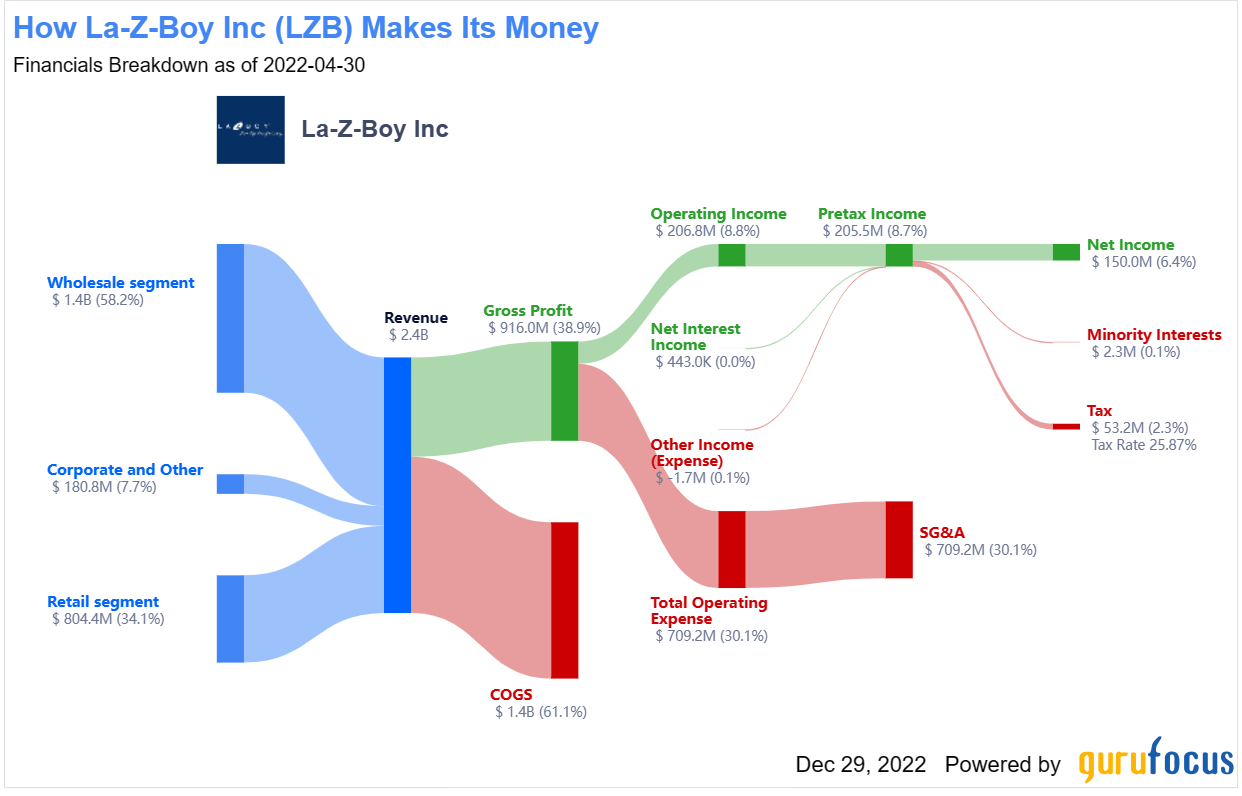

The following diagram shows La-Z-Boy's latest income statement.

The company is a stellar long-term performer. Over the past 15 years, La-Z-Boy's revenue and net income appear to have remained consistent. The company showed a loss in only one year (2009) in the depth of the Great Recession, but otherwise it has been profitable with solid net margins. In 2021, the company had record revenue and income and was a huge beneficiary of consumers spending more time at home due to the Covid-19 pandemic.

The market has recently sold down shares of the company, potentially anticipating a slowdown in sales. Looking at quartery results, I do not see too much to worry about. While the company's sales are understandably slowing down from the unprecedented jump during the pandemic, it still continues to grow.

In the latest quarter, the company reported a 6.15% increase in sales and 15.91% increase in income as compared to a year ago.

| 2022-10 | 2022-07 | 2022-04 | 2022-01 | 2021-10 | 2021-07 | |

| Revenue $ M | 611.33 | 604.09 | 684.57 | 571.57 | 575.89 | 524.78 |

| LZB Revenue % Growth RevQ y/y | 6.15% | 15.11% | 31.78% | 21.56% | 25.43% | 83.84% |

| Net Income (Continuing Operations) | 46.78 | 38.94 | 57.62 | 29.08 | 40.36 | 25.27 |

| % gr net income y/y | 15.91% | 54.10% | 51.79% | -1.72% | 14.33% | 439.96% |

| Net Margin % | 7.54 | 6.37 | 8.39 | 4.98 | 6.86 | 4.68 |

This is hardly a disaster, which the stock price decline is signalling. The stock is now trading at pandemic lows, which, in my opinion, is excessive pessimism.

The GuruFocus valuation box is showing a strong value to price gap in almost all metrics.

The GF Value Line is also indicating significant undervaluation based on historical price multiples, past returns and analysts' estimates of future business performance.

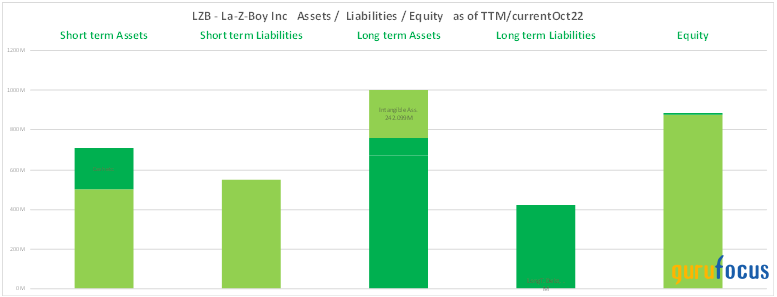

The company has a robust balance sheet with lots of cash and low debt. It should be easily sail through any run-of-the-mill recession.

Additionally, La-Z-Boy has a strong shareholder return focus. It currently pays a dividend yield of nearly 3%, which as grown by about 4% a year over the last five years. This is on top of consistent stock buybacks, which have averaged about 2.8% a year. So we are getting paid a good return while we wait for the share price to return to normal in a few years.

The company does have strong demographic tailwinds behind it. Many millennials are now entering their late 20s and early 30s, which is a common age for people to start thinking about setting up a home and buying furniture. Concurrently, the boomer generation is increasingly retiring. This means that many are downsizing, which is an opportunity to replace some of their older furniture. While it may sound like a cliche, it is nice to put up one's feet and sit back on a La-Z-Boy after a lifetime of work and that game of golf.

Conclusion

La-Z-Boy had strong sales and increased prices in the first half of the fiscal year, resulting in wider margins and higher earnings than expected. While the company is expected to see a slowdown in the next few quarters due to rising costs, softening consumer sentiment and weaker housing demade, the longer-term outlook is positive. The company is expected to continue to adjust its operations and maintain price increases, which should help increase profits once macroeconomic conditions stabilize. In addition, strong employment and higher wages should lead to sales and earnings growth in the future. Overall, the company has strong potential for appreciation and offers a dividend for income seekers. La-Z-Boy is also part of Gurufocus Buffett-Munger Model Portfolio.

The best time to buy cyclical stocks is when market participants are running scared, which seems to be the case now. Consumer cyclical stocks are now the "bad neighborhood" in the stock market. A good strategy is to “buy the best house in a bad neighborhood." When the neighbourhood gentrifies (as in an economic recovery), the house of La-Z-Boy should do very well. However, investors should be aware that this is not a buy-and-hold stock. One has to keep an eye on it and to sell during economic booms.

I think the fair value of La-Z-Boy stock, based on my observtion of the GuruFocus valuation panel and the price chart, is between $35 and $45. I think it can reach that level again in two to five years. As such, investors may want to consider entering a position and opportunitically add if the stock falls further due to recessionary jitters. They could be well rewarded in the future.