Many investors would like to follow in the steps of America’s most successful stock picker and fund manager, Warren Buffett (Trades, Portfolio). He and his partner at Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial), Charlie Munger (Trades, Portfolio), have emphasized simplicity and a sense of contrariness in their buying process. Buffett has summarized that philosophy in just a few words: “It's far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

GuruFocus has created the Buffett-Munger screener to look for companies with those characteristics. Only 47 stocks make the screener as of this writing, and among them is the logistics company ArcBest Corporation (ARCB, Financial).

About ArcBest

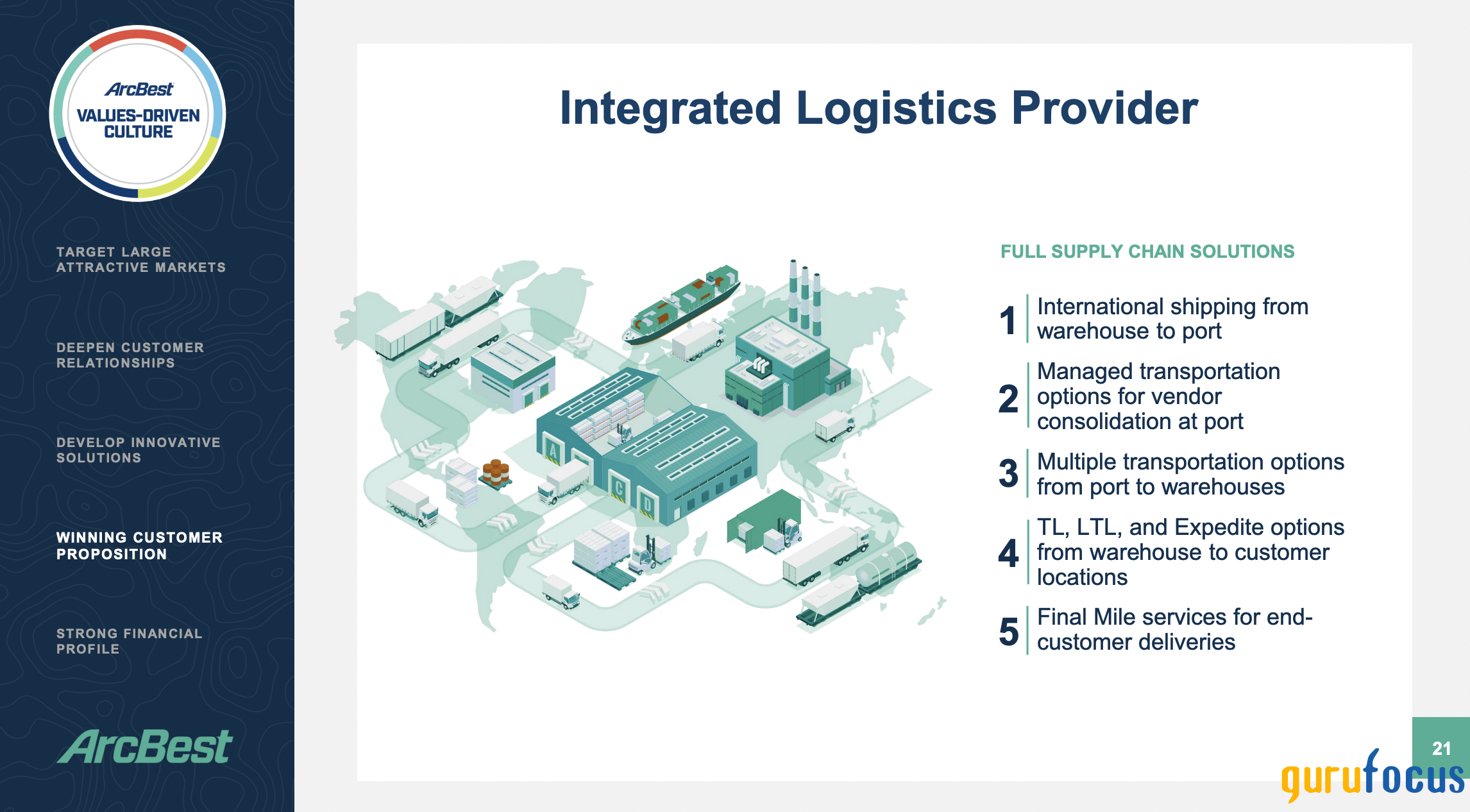

In its 10-K for 2021, the company calls itself an “integrated logistics firm” that offers ground, air and ocean transportation. It does that through multiple providers, including its own operations. Below is an overview of operations:

- The ABF Freight network provides less-than-truckload freight hauling, truckload transportation and brokerage services.

- Panther Premium Logistics handles specialized transportation, logistics and supply management services.

- I-Pack provides household goods moving services.

- FleetNet offers commercial vehicle maintenance and repairs.

- ArcBest Technologies develops technological solutions and “utilizes patented handling equipment, software, and a patented process to load and unload trailers more rapidly and safely.”

- MoLo Solutions is a truckload brokerage company.

This slide from its third-quarter 2022 investor presentation shows how it integrates these businesses:

Based in Fort Smith, Arkansas, ArcBest has a market cap of $1.90 billion (just below the threshold for mid-cap status at $2 billion). It has trailing 12-month revenues of $5.265 billion.

Competition

Given the ease of entrance to the trucking industry, ArcBest faces significant competition in each of its segments.

For its asset-based segment (where it owns its own trucks and equipment), competitors include Yellow Corporation (YELL, Financial), FedEx Freight Corporation (FDX, Financial), Old Dominion Freight Line Inc. (ODFL, Financial) and Saia Inc. (SAIA).

The ArcBest segment, which is asset-light, is mainly a brokerage/logistics operation and competes with Landstar System Inc. (LSTR, Financial), Echo Global Logistics Inc. (ECHO), Hub Group Inc. (HUBG, Financial) and others.

Financial strength

The GuruFocus financial strength ranking of 8 out of 10 reflects ArcBest’s debt in relation to other important measures, as shown in the chart below:

With an interest coverage ratio of 54.25, the company is generating more than enough operating income to cover its interest expenses.

Debt-to-revenue is a similar measure, putting debt into the context of a company’s revenue-generating power. ArcBest has short-term debt of $64 million and long-term debt of $190 million (on a trailing 12-month basis) for a total of $254 million. That’s not much more than a blip when trailing 12-month revenue is $5.265 billion. Again, the company’s debt is insignificant.

The Altman Z-Score is a more complex formula, measuring how likely it is that a company will get into financial distress. Here, we have a score of 4.33, which is well into the safe zone.

These metrics tell us the company is financially stable and strong.

Profitability

The company gets a high GuruFocus profitability ranking of 8 out of 10 based on the below criteria:

The below table tells us ArcBest’s current operating margin of 7.91% is middling for the transportation industry, which has a median of 7.08. Except for a couples of dips, its trend has gone in the right direction:

Its profitability, as measured by earnings per share without non-recurring items, has taken a similar path:

The Piotroski F-Score is above average at 7 out of 9, and it has a business predictability ranking of 4.5 out of 5 stars.

As we can see, the company deserves its high marks for its profitability.

Growth

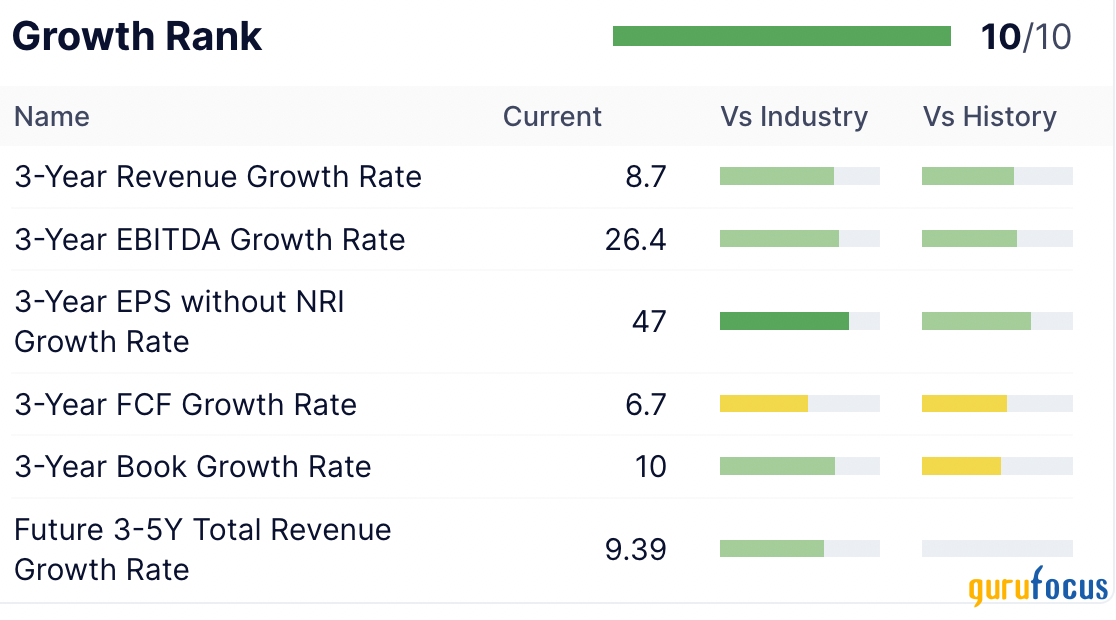

GuruFocus gives the stock a growth ranking of 10 out of 10. This ranking is based on a company’s ability to consistently grow its revenue over three and five years and its Ebitda over five years, among other factors:

Over the past five years, the revenue growth averaged 12.65% per year. Over three years, the growth rate jumps to 29.28%. That pick-up over the past three years reflects the recovery from the pandemic.

Should we be concerned about the revenue dip in the third quarter of 2022? Is it perhaps the end of the recovery trend? According to the company’s third-quarter 2022 earnings report, that’s not the case:

“ArcBest’s Asset-Based business continued its recent pattern of revenue growth as customer demand softened some but remained at a good level. Higher third quarter shipments and tonnage, combined with an increase in average weight per shipment, resulted in a revenue increase versus the same period last year. Following the robust year-over-year increase in third quarter 2021, current pricing levels remain solid and were enhanced by higher fuel surcharges.”

Dividends and share repurchases

After leaving its dividend alone for six years, ArcBest increased it by 50% in the second quarter of 2022, from $0.08 to $0.12. At the closing price of $77.66 on Jan. 12, 2023, that worked out to a dividend yield of 0.56%.

The dividend payout ratio of just 0.03 tells us the company has plenty of cash but just doesn't like paying dividends. In recent quarters it has reduced its share count, bringing it back to around the level it was at 10 years ago:

Valuation

As a Buffett-Munger stock, ArcBest is undervalued based on the PEG ratio of 0.31. This ratio is calculated by dividing the price-earnings ratio of 6.14, by the average five-year Ebitda growth rate of 19.5% per year.

The GF Value chart considers the company to be modestly undervalued. It estimates the intrinsic value at $92.60 per share.

In addition, both types of discounted cash flow analysis see clear undervaluation:

GF Score

ArcBest receives a very high GF Score of 94 out of 100:

Gurus

Three gurus, Jim Simons (Trades, Portfolio) of Renaissance Technologies, Chuck Royce (Trades, Portfolio) of Royce Investment Partners and Joel Greenblatt (Trades, Portfolio) of Gotham Asset Management, had stakes in ArcBest at the end of the third quarter based on their 13F filings.

Institutional investors have 98.05% of the shares outstanding, while insiders hold another 6.61%. Because those two figures exceed 100%, there may be short-selling, administrative issues, or some anomaly in the shares reporting.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Conclusion

The numbers make it clear in my opinion: ArcBest is a quality company at an undervalued price and thus worthy of its inclusion on the Buffett-Munger list. Looking ahead, we have to ask, though, can the current rate of growth continue?