After a rough year in 2022, many investors are looking for some stability within their portfolios.

One strategy they can use to hedge their investments against inflation and other headwinds as they head into a new year is to look for stocks that pay dividends while prices are down. While there is always a risk of the dividend being cut, historically, dividend-paying companies have been found to be less erratic in choppy market conditions and continue to provide a better overall return compared to stocks that do not distribute dividends to investors.

According to GuruFocus’ Historical High Dividend Yield Screener, a Premium feature, there are a number of companies that have long and consistent histories of paying dividends. In addition, they currently have a dividend yield of over 4% and a dividend payout ratio below 0.5.

As of Jan. 13, companies that qualified for the screener and 13F filings show were held by at least five gurus at the end of the third quarter of 2022 were Intel Corp. (INTC, Financial), The Western Union Co. (WU, Financial), Coterra Energy Inc. (CTRA, Financial), Lazard Ltd. (LAZ, Financial), Horizon Bancorp (HBNC, Financial) and HNI Corp. (HNI, Financial).

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Intel

Offering a 4.88% dividend yield and a payout ratio of 0.45, Intel (INTC, Financial) is held by 21 gurus. The company has not reduced its dividend in 31 years.

The Santa Clara, California-based semiconductor chip manufacturer has a $123.45 billion market cap; its shares were trading around $29.91 on Friday with a price-earnings ratio of 9.20, a price-book ratio of 1.24 and a price-sales ratio of 1.76.

The GF Value Line suggests the stock is significantly undervalued currently based on its historical ratios, past financial performance and analysts’ future earnings estimates.

The GF Score of 84 out of 100 implies the company is expected to have good outperformance potential, driven by high ratings for profitability, growth and GF Value, middling marks for financial strength and a low momentum rank.

Of the gurus invested in Intel, PRIMECAP Management (Trades, Portfolio) has the largest stake with 1.26% of its outstanding shares. Chris Davis (Trades, Portfolio), Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Jeremy Grantham (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and Tweedy Browne (Trades, Portfolio) also have significant holdings.

Western Union

Yielding 6.60% and with a 0.44 payout ratio, Western Union (WU, Financial) is held by 10 gurus. For the past 17 years, the company has not cut its dividend.

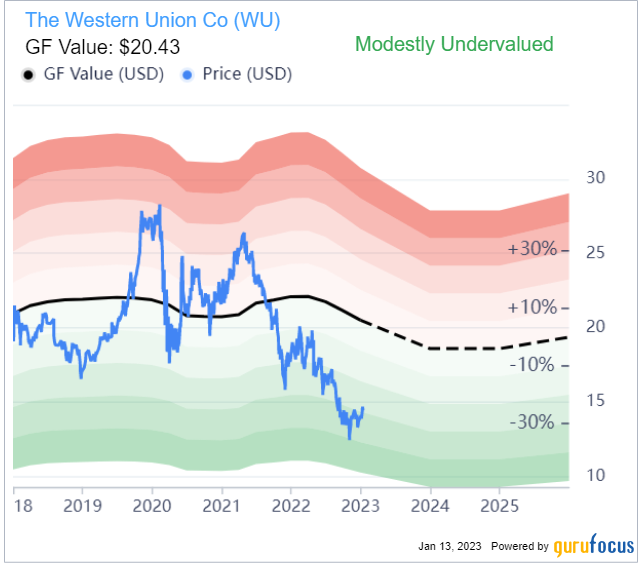

The financial services company headquartered in Denver, which provides money transfer services both domestically and internationally, has a market cap of $5.58 billion; its shares were trading around $14.44 on Friday with a price-earnings ratio of 6.84, a price-book ratio of 10.54 and a price-sales ratio of 1.22.

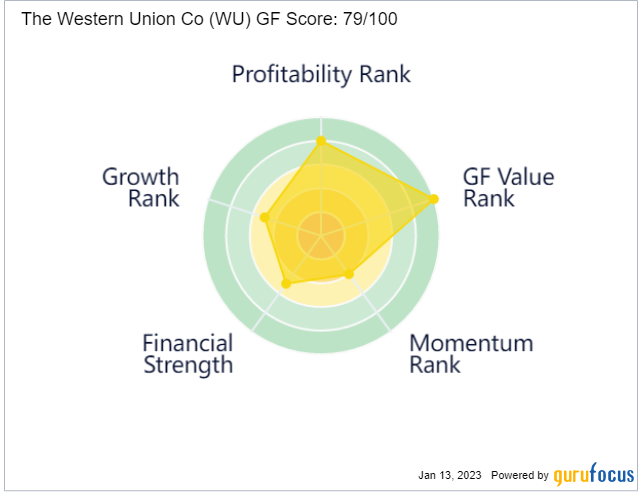

According to the GF Value Line, the stock is modestly undervalued currently.

The GF Score of 79, however, indicates it has average performance potential. While it received high marks for profitability and GF Value, the remaining categories had more moderate ratings.

With a 0.46% stake, Grantham is the company’s largest guru shareholder. Other guru investors of Western Union include Paul Tudor Jones (Trades, Portfolio), Mark Hillman (Trades, Portfolio), John Rogers (Trades, Portfolio), Simons’ firm and Ray Dalio (Trades, Portfolio)’s Bridgewater Associates.

Coterra Energy

Sporting a 6.55% dividend yield and a payout ratio of 0.20, Coterra Energy (CTRA, Financial) is held by eight gurus. The company has not cut its distribution in 26 years.

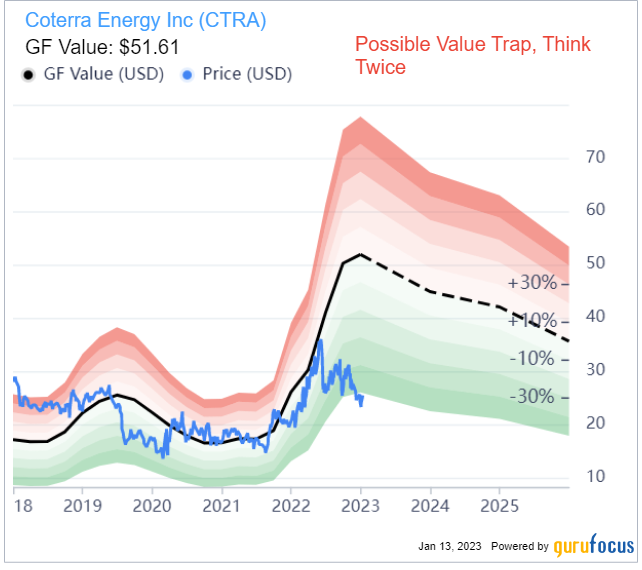

The Houston-based oil and gas producer, which has operations in the Permian Basin, Marcellus Shale and Anadarko Basin, has a $19.74 billion market cap; its shares were trading around $25.04 on Friday with a price-earnings ratio of 5.09, a price-book ratio of 1.56 and a price-sales ratio of 2.25.

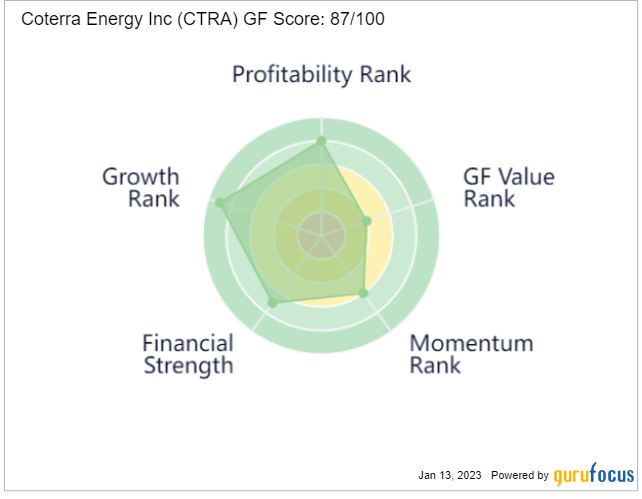

Based on the GF Value Line, the stock, while undervalued, appears to be a possible value trap currently. As such, potential investors should do thorough research before making a decision.

However, the GF Score of 87 indicates the company has good outperformance potential on the back of high ratings for profitability, growth and financial strength and middling marks for GF Value and momentum.

Diamond Hill Capital (Trades, Portfolio) is Coterra’s largest guru shareholder with a 0.57% stake. PRIMECAP, Ken Heebner (Trades, Portfolio) and Stanley Druckenmiller (Trades, Portfolio) also have notable positions in the stock.

Lazard

With a dividend yield of 5.07% and a payout ratio of 0.39, six gurus have positions in Lazard (LAZ, Financial). The company has not reduced its payment in 18 years.

The financial advisory and asset management company, which is headquartered in Bermuda for tax purposes, has a market cap of $3.31 billion; its shares were trading around $38.48 on Friday with a price-earnings ratio of 7.87, a price-book ratio of 6.06 and a price-sales ratio of 1.30.

The GF Value Line suggests the stock is modestly undervalued currently.

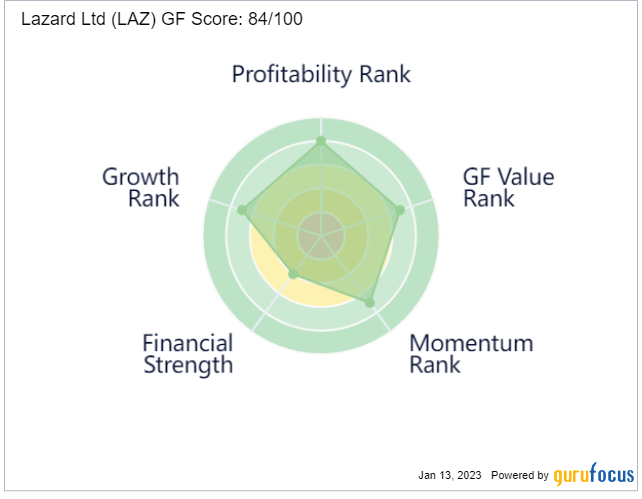

The company has good outperformance potential based on its GF Score of 84. It raked in high ratings for four of the criteria, but the financial strength rank was more moderate.

Of the gurus invested in Lazard, John Rogers (Trades, Portfolio) has the largest stake with 9.18% of its outstanding shares. Mason Hawkins (Trades, Portfolio) and Fisher also have large holdings.

Horizon Bancorp

Generating a 4.04% dividend yield and a payout ratio of 0.29, five gurus own Horizon Bancorp (HBNC, Financial). The company has not slashed its dividend in 28 years.

The Michigan City, Indiana-based bank has a $686.70 million market cap; its shares were trading around $15.63 on Friday with a price-earnings ratio of 7.27, a price-book ratio of 1.06 and a price-sales ratio of 2.80.

According to the GF Value Line, the stock is modestly undervalued currently.

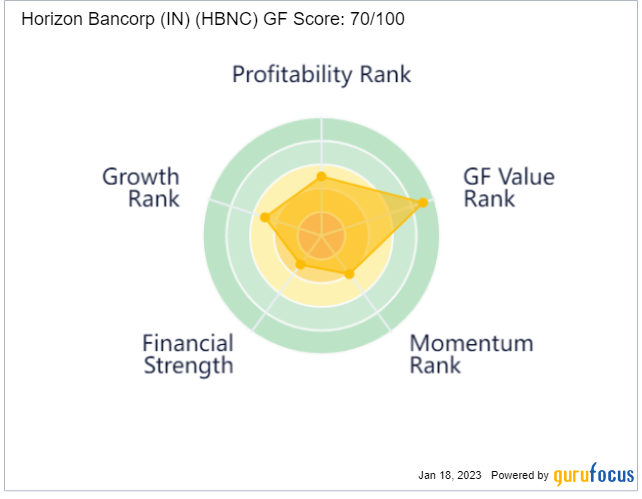

With a GF Score of 68, the company has poor future performance potential. Although it received a high GF Value rank, profitability, growth and momentum were more moderate and the financial strength was low.

Holding 0.65% of its outstanding shares, Simons’ firm has the largest position in Horizon Bancorp. The other guru shareholders are Hotchkis & Wiley, Grantham, Jones and Mario Gabelli (Trades, Portfolio).

HNI

HNI (HNI, Financial), which is being held by five gurus, has a 4.17% dividend yield and a payout ratio of 0.46. The company has not curbed its payment in 38 years.

Headquartered in Muscatine, Iowa, the company, which manufactures office furniture and hearth products, has a market cap of $1.27 billion; its shares were trading around $30.62 on Friday with a price-earnings ratio of 11.13, a price-book ratio of 2.09 and a price-sales ratio of 0.54.

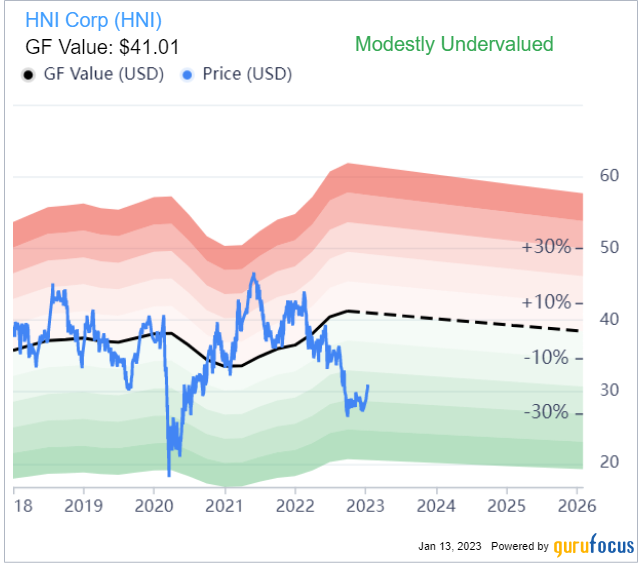

Based on the GF Value Line, the stock appears to be modestly undervalued currently.

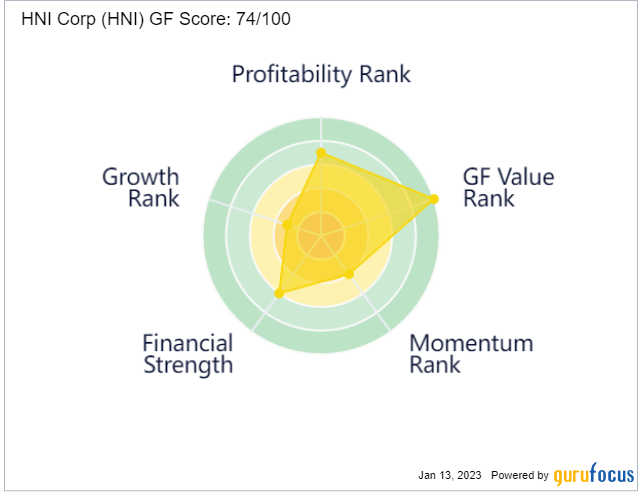

The GF Score of 74 indicates the company is likely to have average performance going forward. HNI raked in high ratings for profitability and GF Value, middling marks for financial strength and momentum and a low grade for growth.

Jones is the largest guru shareholder of HNI with 0.12% of its outstanding shares. Grantham, Simons’ firm, Chuck Royce (Trades, Portfolio) and Barrow, Hanley, Mewhinney & Strauss also own the stock.