Ron Baron (Trades, Portfolio) and Daniel Loeb (Trades, Portfolio) are two gurus that follow very different investing styles. While both focus on the long term, Baron’s Baron Funds aims to invest in value opportunities led by quality management teams, while Loeb’s Third Point LLC is focused on activist and special situations investing.

Despite their differing market approaches, both gurus’ investment firms have done well over the years, appearing near the top of GuruFocus’ Guru Scoreboard for their average annual performances since inception. The Baron Partners Fund has averaged a gain of 16.80% since 1992, while Third Point’s Master Fund has averaged a gain of 16.90% since 1995.

There are surprisingly some stocks that these gurus agree on despite the difference in their asset management strategies. Even though one focuses on buying quality management, while the other is known for pushing for changes in what he sees as bad management teams, both gurus held shares of Take-Two Interactive Software Inc. (TTWO, Financial), UnitedHealth Group Inc. (UNH, Financial) and Danaher Corp. (DHR, Financial) as of their firms’ latest 13F reports.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Take-Two Interactive Software

Take-Two Interactive Software (TTWO, Financial) is a holding company that owns three main publishing labels: Rockstar Games, 2K and Zynga. Its popular franchises include Grand Theft Auto, Red Dead Redemption, the NBA games and Farmville.

Loeb’s firm just initiated a new holding of 500,000 shares in the stock during the third quarter of 2022 after previously selling out of Take-Two in the second quarter of 2020. Baron’s firm trimmed its investment in the stock by 0.02% to end the third quarter with 90,042 shares; it first initiated the position in the second quarter of 2017.

The company is still digesting its acquisition of mobile games developer Zynga, which it bought at an unfavorable time when the market was in the midst of a bubble. Now that mobile gaming is suffering declines in engagement and advertising due to the economic slowdown, investors fear Take-Two overpaid for Zynga.

Take-Two has posted net losses for the past two quarters, but analysts from Morningstar (MORN) are expecting the bottom line to turn positive again next year. The company has a three-year revenue per share growth rate of 9% and a three-year Ebitda per share growth rate of 14.5%.

The GF Value chart rates the stock as a possible value trap due to the combination of share price declines and a negative bottom line, but as long as it can recover its profitability, it should move into undervalued territory.

UnitedHealth Group

UnitedHealth Group (UNH, Financial) is the largest managed care company in the U.S. by revenue. It offers a variety of health care products and insurance services through its many subsidiaries. The company has a powerful tailwind due to the ageing population in the U.S.

Loeb’s Third Point owns 670,000 shares of UnitedHealth as of the third quarter’s end after adding 17.54% to its holding. Baron Funds holds 39,534. Both gurus have owned the stock for years, with Loeb buying in the fourth quarter of 2020 and Baron in the first quarter of 2018.

UnitedHealth’s stock has suffered because the U.S. Supreme Court essentially ruled the government is allowed to recoup Medicare Advantage overpayments that resulted from health insurers artificially inflating prices based on falsified records (Medicare Advantage is the private version of Medicare). According to a 2017 Government Accountability Office report, the government made more than $16 billion in improper payments under Medicare Advantage just in fiscal 2016. It is unclear the exact effect this will have on UnitedHealth, but as of last year, the company comprised a quarter of the Medicare Advantage market.

It is important to note that even if UnitedHealth were to lose a few billion dollars per year due to decreased ability to scam the government, it would not have that much impact on the mammoth $313 billion in revenue that the company earned for the trailing 12-month period.

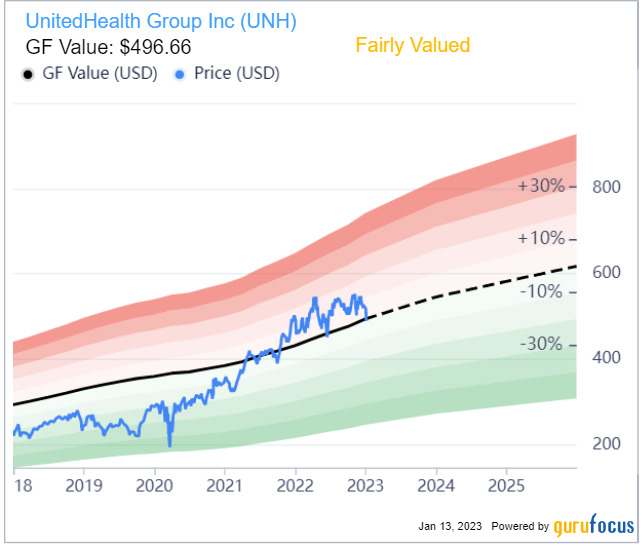

The GF Value chart rates the stock as fairly valued. While shares have come down recently, they were trading slightly above historical valuation levels before. On the positive side, the company’s growth has been incredibly steady over the years, both in terms of profits and capital gains.

Danaher

Danaher (DHR, Financial) is a Washington, D.C.-based science and technology conglomerate that owns a variety of professional, medical, industrial and commercial companies. Its main areas of focus are life sciences, diagnostics and environmental solutions.

As of the end of the third quarter, Loeb owned 2,700,000 shares of Danaher after adding 17.39% to the position. The guru has owned the stock since the third quarter of 2015. Meanwhile, Baron owns 13,628 shares after increasing his firm’s stake by 116.63% in the third quarter. Baron Funds used to have a much larger stake in Danaher, but it sold out in the third quarter of 2011 before initiating a much smaller holding in the first quarter of 2018.

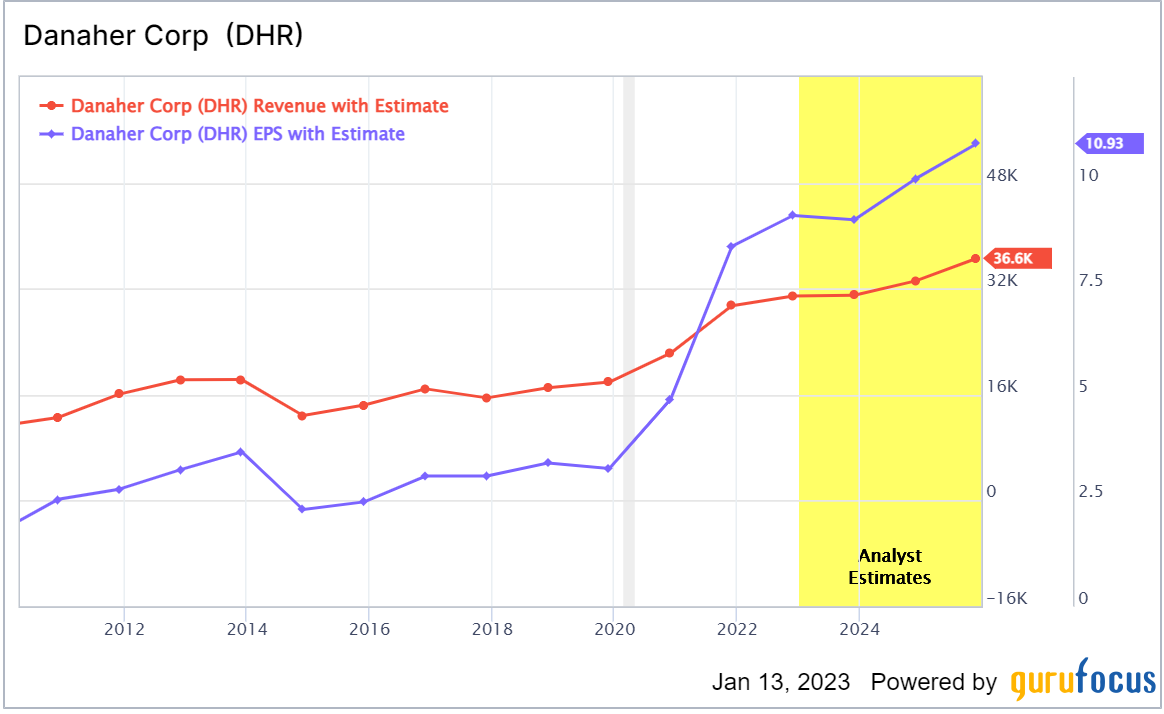

Like many other companies that have operations in life sciences, Danaher’s guidance has become complicated by the volatility of Covid-related revenue. The company’s trailing 12-month revenue is $31.25 billion, though Covid-related revenues only came in at $2 billion in 2021. The company previously expected Covid revenues to drop to $1 billion in 2022 and $500 million in 2023, though it revised guidance in the third-quarter earnings call to $800 million for 2022. One long-term benefit Danaher will likely see from the pandemic is that it has scaled up its diagnostic systems, which should allow it to sell more of other tests.

While Danaher’s revenue and earnings growth have received a boost from Covid-related revenues, Covid alone does not account for the company’s three-year revenue per share growth rate of 18.5%. On the bottom line, the three-year earnings per share growth rate is 35.9%. With that being said, growth rates could still decline as the pandemic boost wanes, depending on whether or not the company is able to make long-term use of its new diagnostic systems.

The GF Value chart rates Danaher as modestly undervalued. However, the price-earnings ratio is a little on the high side at 30.23 compared to the company’s historical median price-earnings ratio of 26.32.