AT&T (T, Financial) fell out of favor with the investing world in the past decade due to decisions that negatively affected its long-term shareholders. The business decisions made by the company to purchase DirecTV in 2015 and Time Warner in 2019 were extremely costly and ultimately unsuccessful. But now, the spinoffs of these bad acquisitions have been completed, and the company is doing well on the rebound. It is investing heavily in 5G, and its budding leadership in this area is promising so far. Additionally, AT&T offers a lucrative dividend.

The engine is humming

Since completing the spinoff of its media assets, AT&T is giving investors plenty of reasons to be optimistic. From a financial standpoint, its core business is doing well. From the dividend standpoint, AT&T has a dividend yield of 5.62% and is generating enough cash to cover its dividend and then some.

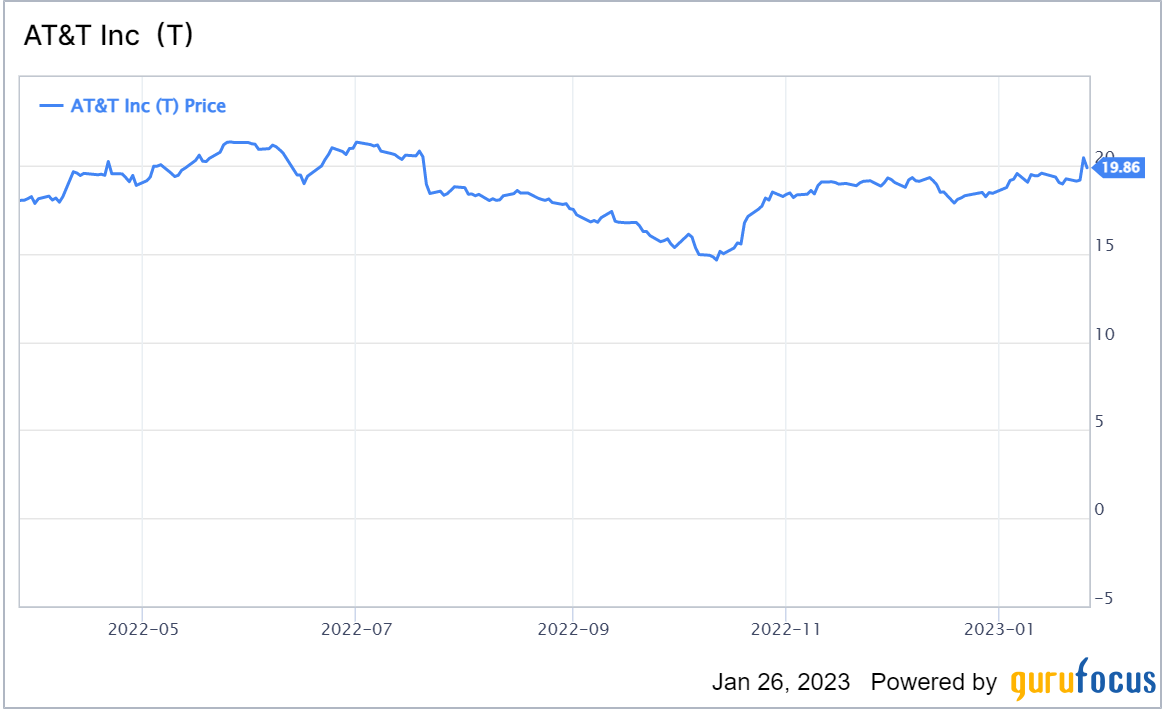

This was further demonstrated by the company's recent earnings release, which boosted AT&T stock by a healthy 6.16% on Wednesday, reaching a seven-month peak of $20.34 per share before pulling back slightly.

The main discussion point coming out of earnings was the subscriber growth for the fourth quarter of 2022, which surpassed Wall Street's estimates. The telecom giant added 217 million customers to its divisions during the fourth quarter, outpacing projected figures of 215 million.

Despite AT&T reporting a big fourth-quarter loss from continuing operations of $23.1 billion, or $3.20 a share, investors were undeterred. During the fourth quarter, significant operating losses were incurred due to non-cash goodwill impairments, asset abandonment and restructuring charges, amounting to $26.8 billion. Excluding the one-time expenses, the company could have achieved EPS of 61 cents compared to 56 cents in the corresponding quarter a year ago.

Perhaps most importantly, the company's free cash flow position remains robust. Cash flow from operating activities was $10.3 billion, capital expenditure was $4.1 billion and total capital investments from operations were $4.7 billion. However, the free cash flow for the period exceeded expectations at an impressive $6.1 billion. After paying dividends of $2.01 billion, there was a leftover amount of $4.1 billion in free cash flow.

Before its media detour, the telecommunications giant cultivated an image of a strong dividend payer. Now that it's back to its core business, the company is also looking to regain lost ground with income investors. To do so, it needs a strong cash position. So far, there have been no hiccups since the spinoff of its media assets. Although there have been calls by analysts for the company to slash its dividend and concentrate more on debt reduction, it has the cash reserves to pare down debt and keep paying a healthy dividend.

The future is 5G

It's no secret that AT&T's success and profitability in the future depend on 5G. If it wants to remain competitive, its focus should be on this technology. Recent news show it is doing just that.

AT&T plans to invest an impressive $48 billion in 5G and fiber services by 2023. The number of 5G users in the U.S. is currently around 72 million, according to Statista, but it's estimated to increase to over 168 million in 2024. AT&T is at the forefront of this vast market and plays a crucial role.

These are still the early days for AT&T's 5G business. In these initial years, it has to spend more money to ensure it remains ahead of the pack. But the situation will not remain the same forever. AT&T anticipates generating no less than $16 billion in free cash flow by 2023. The company is investing heavily in its 5G and fiber network construction during this period, but that will slow down from 2024 onward. So, investors can rest easy, knowing that the 5G business is not a significant strain on the overall business.

Useless landlines are a steep obsolescence cost

AT&T has succeeded in its cellular and broadband sectors. However, the traditional landline arm has been suffering. Unfortunately, it is a sign of the times, and there is little AT&T can do about it.

Landlines are quickly becoming obsolete in the modern world. With the rise of mobile phones and other communication technologies, landlines are no longer necessary for people to keep in touch with their loved ones. Mobile phones have become much cheaper and more accessible than ever before, making them a more attractive option than a traditional landline. As a result, the number of U.S. households with a landline has drastically fallen from over 90% in 2004 to around 30% today, as reported by Statista.

Although AT&T is growing at a healthy pace, unfortunately, the company also has a landline business which has been devalued to the tune of $25 billion due to declining demand. Last year, the company declared it would reduce its copper market share by 50% by 2025 to improve its 5G and fiber optic networks.

While traditional landlines are becoming less common, AT&T and other communication service providers are not abandoning home phones entirely. Rather, they're shifting to using an internet connection instead of a standalone line for their phone setup. But the markdown of $25 billion is a significant headache nonetheless.

Takeaway

With solid financials, widespread infrastructure and a growing customer base, as well as kicking off the beginning of the 5G era by growing its market share, I believe AT&T's performance should continue to be strong in the years to come. Plus, the dividends paid out every quarter make this an attractive investment for income investors who plan to be in it for the long haul.