The electric vehicle industry is growing rapidly due to the fight against global warming and a series of regulatory tailwinds. According to Precedence Research, the global EV market was valued at $170 billion in 2021 and is forecast to grow at a rapid 23.1% compound annual growth rate (CAGR), reaching a value of over $1.1 trillion by 2030.

The Chinese EV market grew 63% in the first half of 2022. In total, approximately 26% of vehicle sales in China were electric vehicles, and this number is growing. The Chinese government has also announced a range of subsidies which range between $689 and $1,800 per vehicle. Subsidies such as these are expected to entice China’s growing EV population to purchase more EVs. Thus, in this article, I'm going to reveal my top three favorite Chinese electric vehicle stocks which are poised to benefit from this trend; let’s dive in.

1. Nio

Nio (NIO, Financial) is a Chinese electric vehicle company which has targeted the luxury end of the market. Its flagship product is the ES8 SUV, which is known for its premium leather interior and luxurious design. Tesla's products have been criticized for build quality issues in the past, and Nio has spotted a gap in the market to provide a product to the luxury-focused Chinese consumer.

A unique feature of Nio is its “battery swap” technology. This enables a driver to simply visit a battery swap station, as opposed to having to wait for the vehicle to charge up. This is a genius solution as it also enables Nio vehicles to be sold at different price points depending upon the range required. Similar to Tesla, Nio has created an entire community around its product. I don't see Nio having as much of a "cult following" as Tesla does, but it does appear to have a strong brand image. For example, the company hires famous celebrities and Chinese pop singers for its launch events.

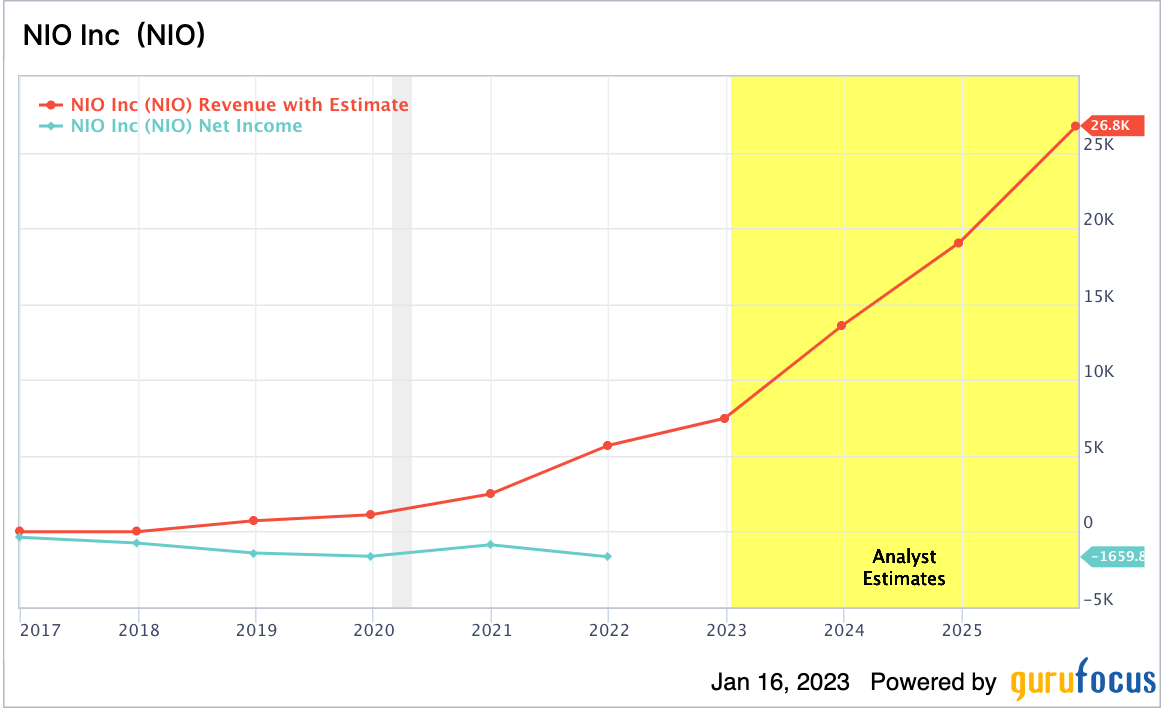

Growing financials

Nio generated strong financial results for the third quarter of 2022. Its revenue was $1.81 billion, which surpassed analyst expectations by $27.12 million and rose by over 20% year over year.

These fantastic results were driven by strong growth in its vehicle deliveries, which increased by 29.3% year over year to 31,607.

In addition, Nio reported a “teaser” for its fourth quarter results by revealing its delivery numbers in January 2023. These results indicated record vehicle deliveries of 15,815 for December which rose by a staggering 50.8% year over year. This was primarily driven by the sales of its flagship SUV (6,842 units). In addition, this included sales of its new EV sedan the ET5, which competes directly with Tesla.

The beautiful thing about Nio’s manufacturing is that the company has developed a base platform called “NT2.0” which enables the rapid delivery of models.

Moving on to profitability, Nio reported a loss per share of $0.35, which was lower than analyst estimates by $0.21. This was due to higher expenses and foreign exchange headwinds.

The company has also continued to invest into building out its infrastructure and now has approximately 1,300 battery swap stations across China. In addition, the company has scored partnerships with over half a million third party charging station providers.

Valuation and guru investors

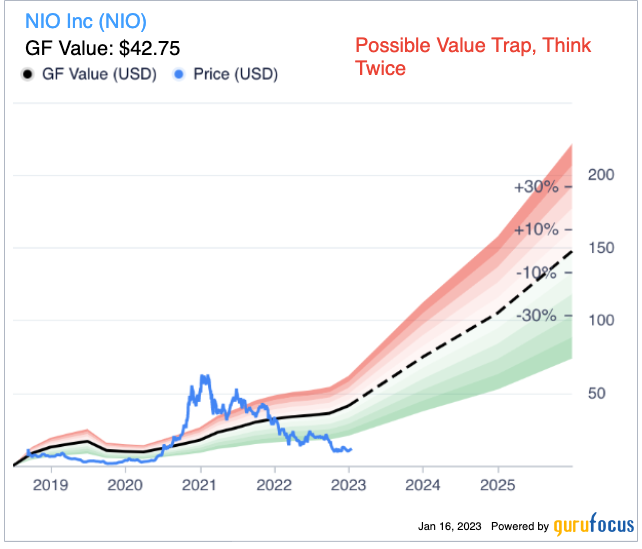

Nio trades at a price-sales ratio of 3.17, which is 69% cheaper than its five-year average.

The GF Value chart indicates a fair value of $42 per share, meaning the stock is undervalued at it is trading around $12 at the time of writing.

Notable guru investors into the stock include the world's largest hedge fund - Ray Dalio (Trades, Portfolio)'s Bridgewater, as well as growth stock investing firm Baillie Gifford (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio). These investors purchased shares in the third quarter of 2022 according to their 13Fs, when shares were trading for an average price of $19.79, which is 40% more expensive than where the stock trades at the time of writing.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

BYD Co

BYD Co (BYDDY, Financial) stands for “build your dreams” and it is the second largest electric vehicle manufacturer in the world, just below Tesla (TSLA, Financial) - at least in terms of market cap. In 2022, BYD actually overtook Tesla as the largest EV manufacturer in the world in terms of EVs produced. Either way, the company is still the largest EV supplier in China and is poised to benefit from this growing market.

Buffett-backed

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial) invested into BYD back in 2008, upon the recommendation of Charlie Munger (Trades, Portfolio). Buffett was reluctant to invest at first but Munger convinced him after explaining the founder was a combination of “Bill Gates (Trades, Portfolio) and Thomas Edison!” This has been a fantastic investment for Buffett and the stock price has increased by over 1,700% since then, though we have little information on the holding since Buffett invested in the Hong Kong listing, so it is not reported on the 13F.

Range of vehicles

BYD offers a massive range of vehicles which include mainly hybrid models. Its legacy vehicles are not the best looking but are very practical and cost effective. Recently the company has launched a stylish EV sedan called BYD Han, which competes directly with the Tesla Model 3. A comparison of the specifications between the two rivals shows the BYD Han has slightly longer range, which is a positive selling point.

BYD also has major plans to launch a 4X4 Jeep style EV, which will compete directly with the quirky looking Cyberstruck by Tesla.

Financial review

BYD reported strong financials for the third quarter of 2022. The business generated $16.5 billion in revenue, which increased by an outstanding 95% year over year.

BYD also recently reported its fourth quarter deliveries, which boasted record results. Its number of “new EV” sales increased by a blistering 150% year over year to 235,197. Approximately 111,939 of these vehicles were classed as “pure” electric battery vehicles with the remainder being the hybrid format.

In the third quarter of 2022, the company also reported strong operating income of ~$1 billion, which increased by over 297% year over year, which was incredible.

Valuation

BYD trades at a price-sales ratio of 1.55, which is 81% lower than its five-year average. The stock also trades cheaper than rivals such as Tesla (which has a huge gigafactory in China) and Nio.

The GF Value calculator shows a fair value of ~$82 per share and therefore the stock is classed as “modestly undervalued” at the time of writing.

XPeng

XPeng (XPEV, Financial) is a Chinese EV manufacturer which has been dubbed as the “Tesla of China" by some analysts due to its innovative culture. Its vehicles include the stylish P7 sedan, which competes directly with the Tesla Model 3. Its P7 boasts 706 kilometers (439 miles) of range, which beats the Tesla Model 3’s 374 miles of range. The P7 is classed as the vehicle with the longest range in China. I also personally believe its P7 is more stylish than a Tesla, and its new winged door edition is pretty captivating.

The XPeng vehicles also include “XPilot 3.0” which is its “self-driving” feature. Generally this looks to include mostly highway driving assistance, although the company is improving its technology. In 2021, Tesla sued XPeng and a former Tesla engineer who reportedly defected to the company. Tesla claimed the engineer stole source code used in Tesla’s self driving system. The details of this case are unknown to the public, but we do know it was settled out of court.

XPeng's other vehicles include the G9 SUV, which competes directly with Nio and Tesla’s Model Y.

Flying car

XPeng says it is not just an EV company but a total “mobility company." Recently the company has showcased a futuristic flying car. This vehicle looks very similar to the EHang EVTOL and was developed with HT Aero. Although this vehicle is still in the development stage it does open a new avenue for the business, with huge potential.

Financial review

XPeng reported strong financial results for the third quarter of 2022. Its revenue was $959.1 million, which increased by 8.13% year over year, but came in ~$33 million below analyst expectations.

XPeng is still relatively small compared to Tesla and reported 29,570 vehicle deliveries in the third quarter of 2022, up 15% year over year. Over the last nine months the company has delivered 98,553 vehicles, which has increased by ~75% year over year.

In terms of earnings, XPeng reported a loss per share of $0.39, which beat analyst expectations by $0.03.

The company also has a strong balance sheet with $4.496 billion in cash and short term investments compared to $1.5 billion in total debt, of which the majority is long term debt.

Valuation

XPeng trades at a price-sales ratio of 2, which is cheaper than its historic average. This metric is also cheaper than most other EV stocks apart from BYD.

Final thoughts

China has the biggest population in the world and the largest electric vehicle market. Pure Chinese players may have a “home advantage” in China, and thus the three I have outlined on my list have a solid opportunity. Personally, I think BYD offers the most potential due to its vast scale and vertically integrated nature of the business. The ownership by Warren Buffett (Trades, Portfolio) also adds a seal of approval. However, Nio and XPeng are great “growth stocks” which offer a competitive product lineup that may entice customers away from purchasing a Tesla.