When it comes to the world of business, the term "insiders" refers to the CEO, chief financial officer, directors and other members of the executive suite of a company. These insiders generally have more knowledge of the business and its outlook than the general public. Therefore, it makes sense for investors to track if they have recently invested into their own company's stock, as this may prove an importnat data point for further research.

Normal insider trades should not be confused with the illegal variety. Illegal insider trading occurs when an insider buys or sells a stock based upon “material information” which isn’t public.

This article will take a look at two technology stocks that insiders have been buying in 2023; let’s dive in.

1. Coinbase

Coinbase (COIN, Financial) is the most popular crypto exchange in the world and the second most popular exchange in the U.S., according to trading volume by Coinmarket cap. The company benefited from the huge stimulus-fuelled boom in cryptocurrency prices during 2020 and 2021, and Bitcoin reached an all-time high in 2021. However, since that point, Bitcoin and other crypto assets have declined in price as economic conditions changed. Similar to stock investing, lower prices tends to result in less trading activity on brokerage platforms, and thus less revenue for Coinbase overall. This is fairly ironic as during a bear market, assets are cheaper, so I believe crypto is less risky than average at the moment.

Mixed financials

Coinbase reported mixed financial results for the fourth quarter of 2022. Its revenue was $605 million, which increased by 5% sequentially and beat analyst forecasts of $590 million, according to data from Refinitiv. This was positive, but year over year, Coinbase’s revenue was down nearly 76%, which is atrocious. This revenue decline correlates mainly to Bitcoin’s price.

The only silver lining is there has been a consolidation in the crypto sphere after exchanges such as FTX went bankrupt. Therefore, I believe further regulation is coming which could help cement Coinbase’s position at the top.

Another positive for Coinbase is its institutional trading volume as a portion of the total increased from 67.8% in the fourth quarter of 2021 to approximately 87% by the fourth quarter of 2022. Given retail crypto traders tend be more vulnerable to market challenges and more emotional, institutional support is a positive sign for stability. For example, in late 2022, Coinbase scored a huge partnership with the worlds largest asset manager BlackRock (BLK, Financial) for its Aladdin platform.

Coinbase is still struggling with profitability and reported a loss per share of $2.46, which was much worse than the fantastic $4 earnings per share profit reported in the year-ago quarter. Despite the decline, this metric still surpassed analysis forecasts, which estimated a worse loss of $2.55 per share.

Insider trading

A board member of Coinbase, Tobias Lutke, who is also the CEO of Shopify (SHOP, Financial), has been loading up on Coinbase stock. Last year, Lutke purchased $3 million worth of shares in Coinbase over a two-month period in third quarter of 2022. More recently, in 2023, he has made six transactions of between ~5,000 shares and 11,000 shares. His latest in February 2023 was for 4,960 shares. At an average price of ~$73 per share, this buy was worth a substantial $361,832.

Valuation

In terms of valuation, Coinbase trades at a price-sales ratio of 3.77, which is cheaper than its five-year average.

2. Akamai Technologies Inc.

Akamai Technologies Inc. (AKAM, Financial) is a leading content delivery network that has built a footprint of over 365,000 servers across 135 countries globally. The idea of a CDN is to increase both website performance and security. For example, let’s say you are in Austin, Texas and wish to access a website based in Tokyo, Japan. Without a CDN, your computer will send a TCP (Transfer Control Protocol) request to the host in Japan and wait for files to be transferred back, which could cause slower website loading etc. However, with a CDN, a “cached” copy of the website is stored across a range of data centres internationally. In the prior example, the request would go to your closest data center, in this case Austin, Texas.

Given a forecast by PwC indicates internet usage will grow at a rapid 35.7% compounded annual growth rate up until 2025, Akamai is poised to benefit from this trend.

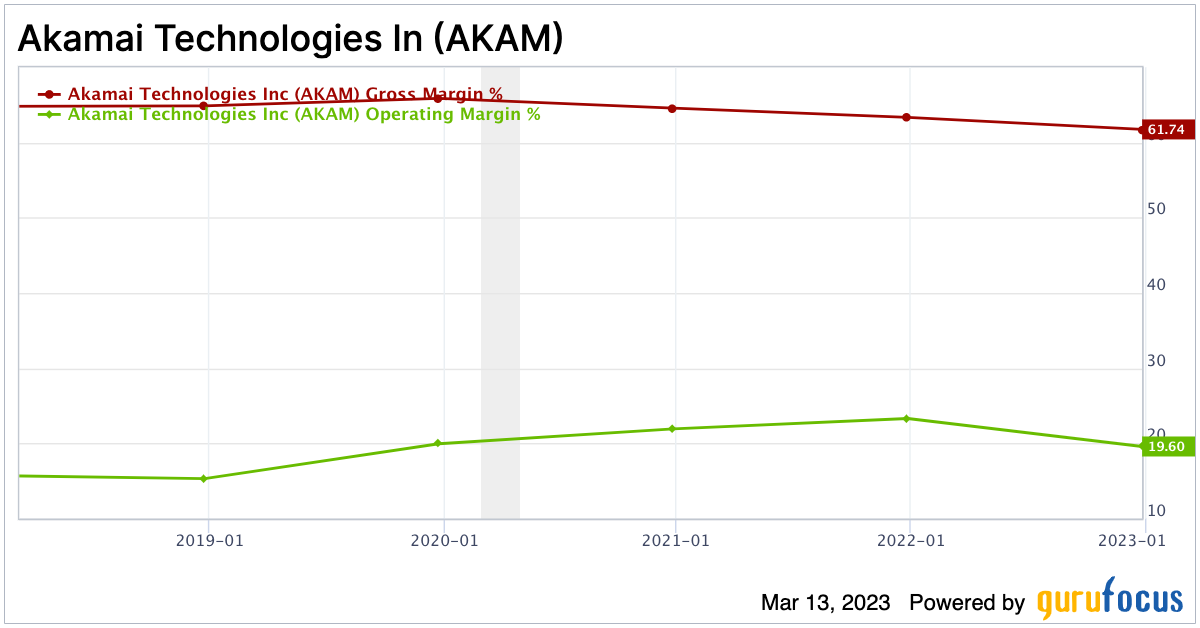

Stable financials

Akamai reported strong financial results for the fourth quarter of 2022. Its revenue was $927.78 million, which beat analyst forecasts by $22.98 million and increased by 2.48% year over year.

This is not an amazingly fast growth and is slower than the 5.92% growth rate reported in the second quarter of 2022 and the 7.23% growth rate reported in the first quarter.

A positive is the company increased its revenue by 6% year over year on a constant currency basis. Given the currency markets tend to be cyclical by nature, this is a positive in the long term.

The majority (55%) of its revenue growth was driven by strength in the security segment, which increased by 22% on a constant currency basis. Its notable customers which have adopted cybersecurity benefits include Priceline, which is owned by Booking Holdings (BKNG, Financial), one of the most popular travel websites in the world. In addition, the company provides a web application firewall to Lufthansa, Germany’s largest airline.

I believe this is a great strategy, as the company can effectively benefit from upselling cybersecurity products to its CDN customers.

Moving on to profitability, the company reported earnings per share of $0.82, which beat analyst forecasts by $0.03 and increased by 13.4% year over year.

The company also has a strong balance sheet with cash and short term investments of $1.1 billion and total debt of $3.147 billion, $2.285 billion of which is long term debt.

Insider trades

Akamai’s CEO Thomas Leighton purchased 1,027 shares of his company's stock at an average price of $73 per share in the first quarter of 2023. The estimated value of this trade was $75,196, which isn’t a massive amount for a CEO. However, Leighton does have over 2.4 million shares in total and thus skin in the game, which is a positive sign.

Valuation

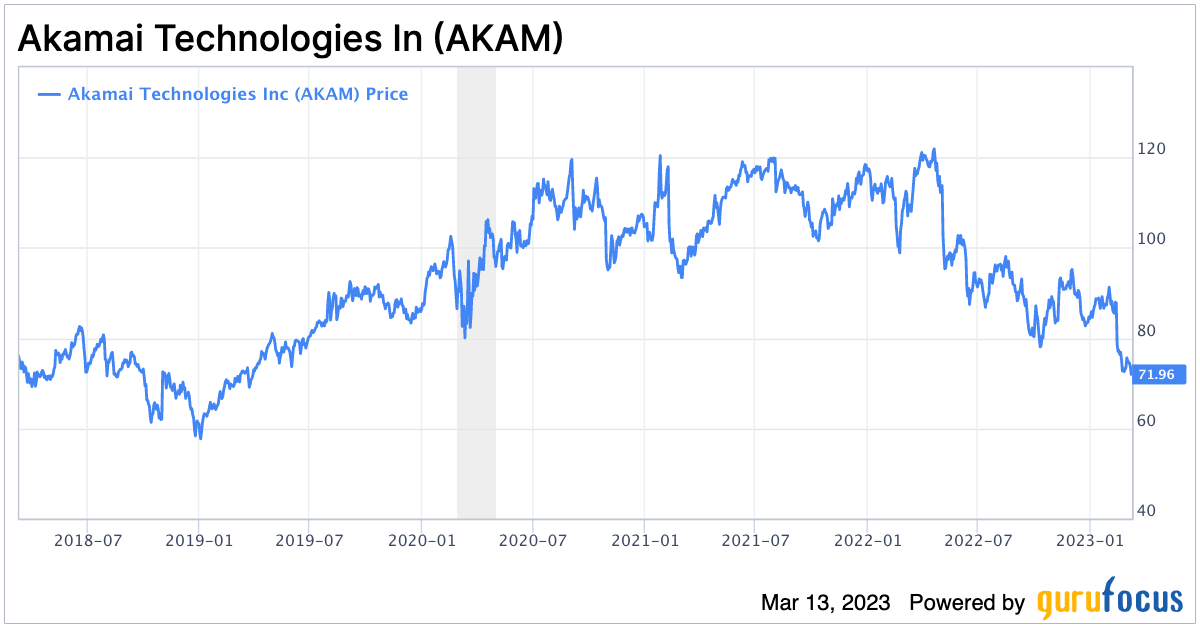

The company trades at a forward price-earnings ratio of 13.14. Its price-sales ratio is 3.21..

The GF Value chart indicates a fair value of $124 per share and thus the stock is “significantly undervalued” at the time of writing.

Final thoughts

Both Coinbase and Akamai are two fantastic technology companies. Coinbase is facing a series of headwinds related to the “crypto winter," but the rising interest from institutional investors could mean its place is cemented in the long term. Akamai on the other hand is poised to benefit from the growth in both internet usage and cybersecurity, two trends that show no sign of slowing down.