Artificial Intelligence (AI, Financial) has been a hot topic recently, but it's more than just a buzzword. Microsoft (MSFT, Financial) CEO Satya Nadella recently stated he believes AI is at an “inflection point” and every app will become an “AI powered” app. Therefore, it is no surprise that the AI industry was valued at $199.78 billion in 2022 and is forecast to grow at a rapid 38.1% compounded annual growth rate, reaching a value of $1.59 trillion by 2039, according to predictions from Presedence Research.

In this article, we'll take a look at my top two favorite AI stocks that are poised to benefit from this trend; let’s dive in.

1. C3.ai

C3.ai (AI, Financial) was founded in 2009 and has a “first mover” advantage in its particular AI niche. The company has positioned itself as an "AI as a service" provider for enterprises and large organizations. The market opportunity is vast, as C3.ai already serves multiple industries from energy to defense.

The C3.ai platform is an end to end platform which enables data scientists to accomplish all major tasks from data preparation to machine learning model generation. The company has also recently announced a Generative AI product which integrates directly into OpenAI’s GPT-3 and the new GPT-4 model. This is the basis of the viral platform ChatGPT. Therefore, C3.ai is basically offering an easy way for large organization to integrate the power of ChatGPT into their workflows.

Stable financials, huge potential

Despite the share price of C3.ai increasing by over 100% since January 2023, the financials have been fairly muted so far. For the third quarter of the company's fiscal year 2023, it reported $66.7 million in revenue, which surpassed analyst forecasts by 3.38%, but declined by 4.45% year over year.

Therefore, the market looks to be factoring in future growth potential on the back of the tailwinds surrounding the industry. In addition, enterprise sales cycles tend to take multiple months and thus revenue isn’t realized right away. A positive is that C3.ai reported a solid 35% growth in its deals won year over year, and its number of customers increased by 8% year over year to 236.

The business also has continued to win larger contracts with six contracts worth between $1 million and $5 million won in the third quarter of 2023.

The company has also aggressively expanded its partnerships with major consultancies such a Accenture (ACN, Financial) and Booz Allen Hamilton (BAH, Financial). In addition, the company has expanded its partnership with Amazon's (AMZN, Financial) AWS to offer C3.ai’s product to law enforcement agencies globally.

C3.ai is still facing challenges with profitability, as the company reported an eye watering operating loss of $72 million in the third quarter of fiscal 2023. This was a substantial increase over $47.3 million loss reported in the year-ago quarter. The only silver lining is around $14 million of the increase in expenses was related to investments into Research and Development. Therefore I don’t necessarily deem this as a bad sign given the company must continually invest to innovate and release new products such as its GPT-3 service.

Valuation and guru investors

C3.ai trades at a price-sales ratio of 8.95, which is cheaper than historic highs.

According to his firm's latest 13F report, Paul Tudor Jones (Trades, Portfolio) increased his position in the stock by 10.58% in the fourth quarter of 2022, during which shares traded at an average price of $12.52. Steven Cohen (Trades, Portfolio) of Point 72 also increased his firm's position in the stock.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

2. Nvidia

Nvidia (NVDA, Financial) is a leading semiconductor chip designer which has ~80% market share in the high performance GPU market (discrete type). Its GPUs power gaming PCs, but the company also has a lucrative data center business. Its A100 data center GPU powers some of the biggest supercomputers in the world, from its own Megatron to Meta Platforms' (META, Financial) huge AI supercomputer.

However, the company has recently announced a new H100 GPU which is even more powerful. The H100 offers up to 30 times faster performance than its predecessor for large language model workloads. This is the exact workload type used for generative AI applications, which power platforms such as ChatGPT.

Given Microsoft was an early investor in OpenAI and recently invested $10 billion into the company, the future scale of AI applications is expected to become even more mainstream. In November 2022, Microsoft announced a multi-year deal with Nvidia to build an AI supercomputer, which is expected to be one of the largest in the world.

On March 13, Microsoft announced that it is offering businesses access to its more powerful AI infrastructure through its Azure cloud and virtual machines. This is also based upon Nvidia architecture and thus offers huge potential.

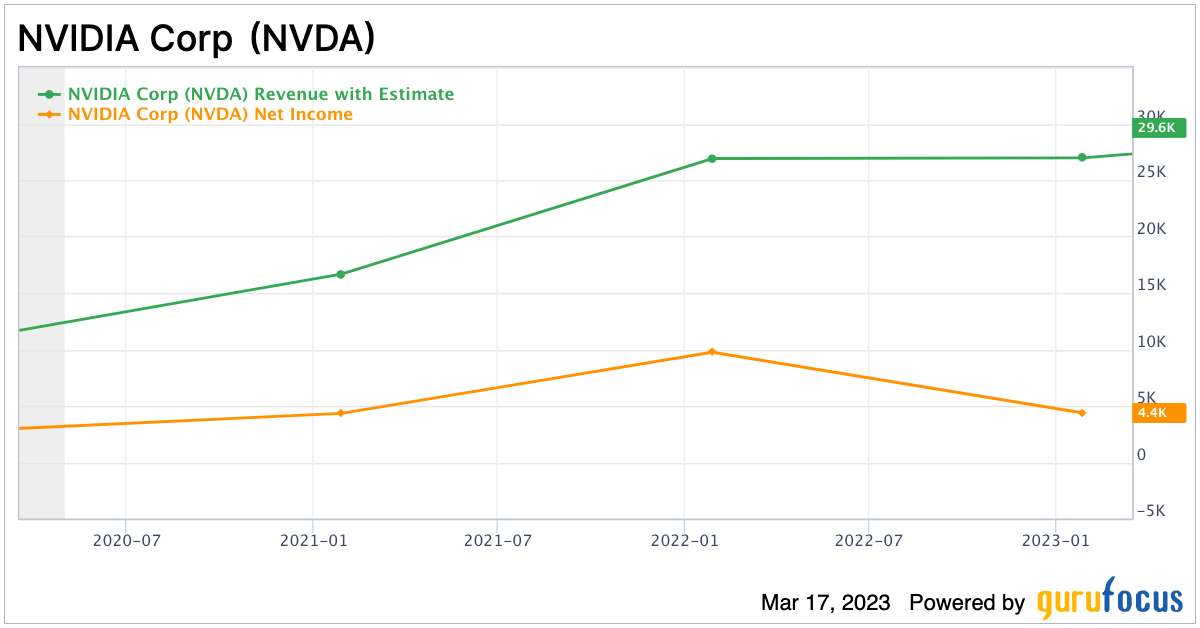

Recovering financials, market leadership

Despite the strong market position, Nvidia’s financials have been struggling in the recent quarters. Its revenue was $6.05 billion in the fourth quarter of its fiscal year 2023, which was down 20.8% year over year. The silver lining was its revenue was up 2% quarter over quarter. The main decline was caused by lower demand in the gaming market. This resulted in Nvidia’s gaming revenue falling by an atrocious 46% year over year to $1.83 billion. A positive is the gaming market tends to be cyclical by nature, and thus I forecast a rebound long term.

Nvidia still reported solid growth in its data center segment, which increased its revenue by 11% year over year to $3.62 billion. Its automotive revenue also continued to expand by a blistering 135% year over year to $294 million. This was driven by tailwinds such as self driving and Nvidia’s DRIVE Orin technology.

Its operating income did decline by a staggering 58% year over year to $1.256 billion, but it did improve substantially from the $601 million reported in the prior quarter. In addition, its earnings per share was $0.57, which surpassed analyst forecasts by $0.09. Its earnings issues were mainly driven by increased operating expenses related to infrastructure costs. Overall, I don’t deem this to be bad necessarily as the company should be able to leverage this as its growth returns.

Nvidia has a fortress balance sheet with $13.3 billion in cash and short term investments compared to total debt of ~$12 billion, $9.7 billion of which is long term debt and thus manageable.

Valuation and guru investors

Nvidia trades at a price-sales ratio of 21, which is ~42% higher than its five-year average.

Nvidia’s stock price has increased by over 127% since October 2022, with the vast majority of these gains occurring since the start of 2023. Although I believe Nvidia is the “backbone of the AI industry," there is a lot of hype around the stock, thus investors interested in the stock may want to wait for a pullback.

The GF Value chart estimates the stock is “fairly valued” at the time of writing, based on a combo of past returns, historical valuation multiples and analysts' estiamtes of future business results.

Growth stock investing firm Baillie Gifford (Trades, Portfolio) increased its position in the stock by ~14% in the fourth quarter of 2022, during which shares traded at an average price of $146. Ron Baron (Trades, Portfolio) was also buying the stock.

Final thoughts

Both C3.ai and Nvidia are two tremendous technology companies which are poised to benefit from the growth in the AI industry. C3.ai is in a prime position to provide AI as a service to enterprises, whereas Nvidia’s latest GPU (H100) is poised to be the building block of almost every high powered super computer. The only issue is there is a lot of hype surrounding the AI industry currently, so valuations are high. Thus, value investors may prefer to add these stocks to their watch lists and wait for a pullback.