Having already boosted his Occidental Petroleum Corp. (OXY, Financial) stake twice in May, Warren Buffett (Trades, Portfolio) revealed on Tuesday his firm increased the position once again, buying $275 million worth of shares.

The legendary guru, who leads Omaha, Nebraska-based insurance conglomerate Berkshire Hathaway (BRK.A, Financial) (BRK.B, Financial), along with his two portfolio managers, Ted Weschler and Todd Combs, follows a long-term value investing approach that focuses on companies with understandable business models, favorable long-term prospects and competent management teams that are available at attractive prices.

According to Form 4 filings with the Securities and Exchange Commission, Buffett invested in a combined 4.66 million shares of the Houston-based energy company on May 25, 26 and 30. The share price ranged between $58.30 and $58.85 on the dates of purchase.

He now holds around 222 million shares. GuruFocus estimates Buffett has gained 8.41% on the investment so far, which the 13F filing for the first quarter showed was his sixth-largest holding with a weight of 4.17%.

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Berkshire now holds 24.90% of the oil company’s outstanding shares, up slightly from 24.37% on May 18. While the conglomerate has received regulatory approval to purchase up to 50% of the stock, sparking debate that it may buy the entire company, Buffett said during the annual shareholder meeting last month that he has no intention of taking over.

"We will not be making any offer for control of Occidental," he said.

The guru’s firm also owns $10 billion worth of Occidental’s preferred stock and has warrants to buy up to $5 billion worth of common shares at a fixed price.

About Occidental

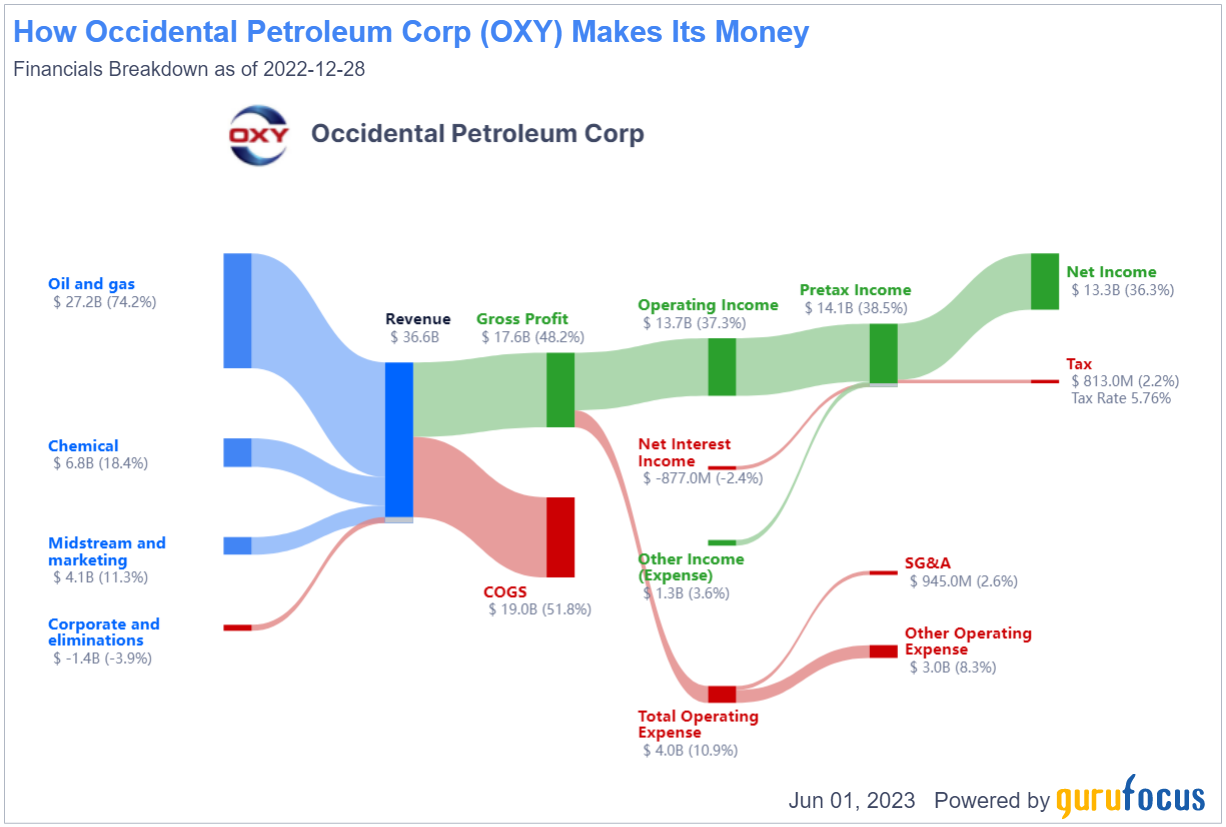

The exploration and production company, which was founded in 1920, has operations in the U.S., Canada, Latin America and the Middle East. Occidental is divided into four segments, with oil and gas making up the majority of its revenue at $27.2 billion in fiscal 2022.

Valuation

Occidental had a banner year in 2022, more than doubling in price to become the top performer in the S&P 500. It has retreated about 4.62% so far this year, however, on the back of falling energy prices.

The oil and gas producer has a $51.91 billion market cap; its shares were trading around $58.21 on Thursday with a price-earnings ratio of 6.67, a price-book ratio of 2.54 and a price-sales ratio of 1.64.

The GF Value Line suggests the stock is fairly valued currently based on its historical ratios, past financial performance and analysts’ future earnings projections.

At 73 out of 100, the GF Score indicates Occidental is likely to have average performance going forward. While the company received a high rating for profitability, the financial strength, momentum and growth ranks were more moderate and the value was low.

Earnings

Occidental disclosed its first-quarter 2023 financials on May 9.

For the three months ended March 31, the company posted revenue of $7.23 billion, which was down 13% from the prior-year quarter. The net income of $1.26 billion, or adjusted earnings of $1.09 per share, also declined from a year ago.

In a statement, President and CEO Vicki Hollub praised the company’s performance.

"Our teams continue to deliver outstanding operational performance, which drives our financial success,” she said. “We are well-positioned to build on the successful first quarter and have raised full-year guidance for Oil & Gas production, as well as OxyChem pre-tax earnings."

Share buybacks

During the quarter, Occidental repurchased $752 million worth of shares, accounting for more than 25% of the $3 billion buyback program it started recently.

Further, the company began to redeem its preferred stock during the quarter; a move which Hollub says is “further advancing the transfer of enterprise value to our common shareholders.”

Guru interest

Unsurprisingly, Buffett remains the largest guru shareholder of Occidental.

Other gurus with large positions in the stock include Dodge & Cox, the Smead Value Fund (Trades, Portfolio), Prem Watsa (Trades, Portfolio) and Steven Cohen (Trades, Portfolio).

Over the past year, the guru buys volume has outpaced the volume of sells.

Portfolio composition and performance

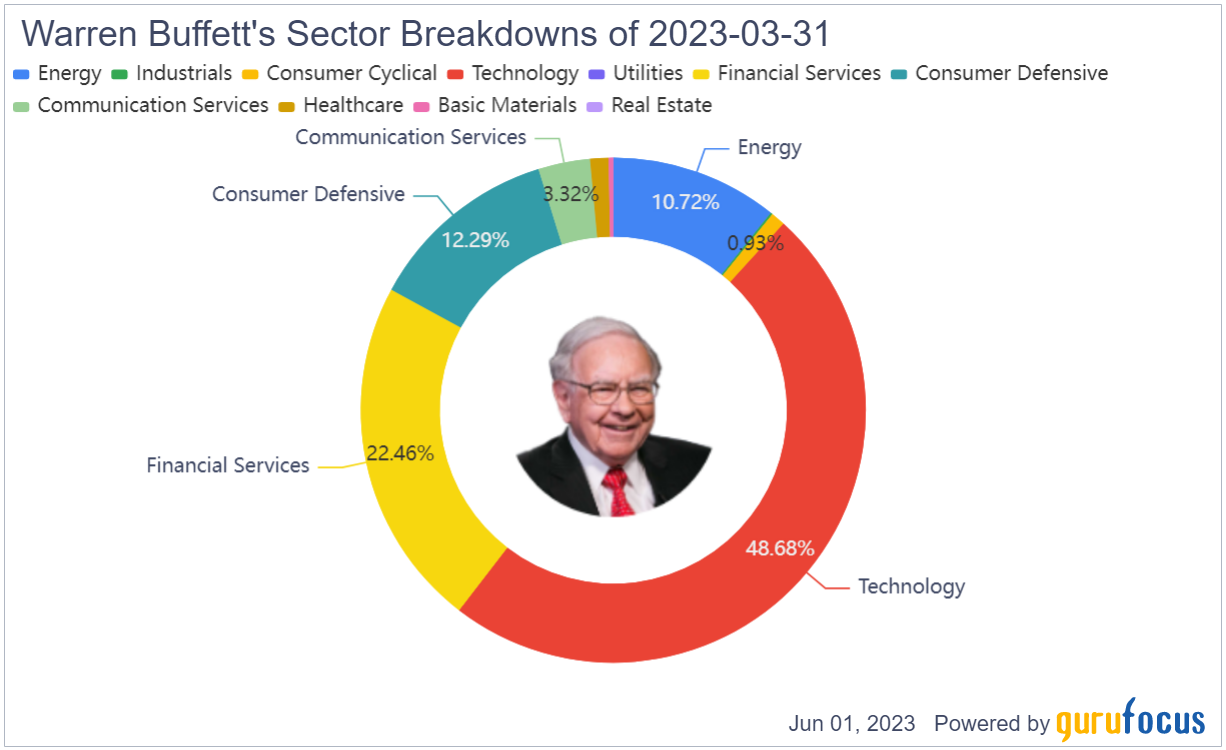

The majority of Berkshire’s $325.11 billion equity portfolio, which was composed of 48 stocks as of the end of the first quarter, was invested in the technology and financial services sectors.

Other stocks in the energy sector it held as of March 31 were Chevron Corp. (CVX, Financial) and Vitesse Energy Inc. (VTS, Financial).

GuruFocus data shows Buffett’s firm returned 4% in 2022, outperforming the S&P 500’s return of -18.11%.