As the hype around artificial intelligence continues to escalate, concerns about overvaluations and market exuberance are mounting. Amid this frenzy, Nvidia Corp. (NVDA, Financial) has been riding the wave of optimism with its array of AI platforms and collaborations. However, a closer examination of the company's endeavors reveals a need for caution.

While Nvidia's advancements in AI technology are commendable, the current market valuations may need to be more consistent with the underlying fundamentals. As the AI bubble expands, investors must tread carefully, considering factors such as monetary policies, concentration risks in the market and technical indicators that signal an impending correction.

AI platforms across industries

It is evident that Nvidia is making significant strides in AI and accelerated computing. The company's focus on AI platforms across industries indicates a strong commitment to driving innovation and transformation in computing.

One of the key highlights is the introduction of the DGX GH200, a large-memory AI supercomputer. Its remarkable performance capabilities and massive shared memory opens up possibilities for developing complex AI models for applications, such as generative AI chatbots, recommender systems and fraud detection. In addition, the DGX GH200 is expected to be accessible to major players like Alphabet's (GOOG, Financial) Google Cloud, Meta (META, Financial) and Microsoft (MSFT, Financial), paving the way for future hyperscale generative AI infrastructure.

Nvidia's plans for building its own AI supercomputer, Helios, further demonstrate its commitment to pushing the boundaries of the technology. By utilizing the DGX GH200 systems linked with Nvidia Quantum-2 InfiniBand networking, Helios aims to enhance data throughput for training large AI models.

The company's modular reference architecture, Nvidia MGX, is designed to cater to data centers of various sizes. Offering a common architecture and modular components enables system manufacturers to create a wide range of server configurations to suit AI, high-performance computing and Nvidia Omniverse applications. The collaboration with QCT, Supermicro (SMCI, Financial) and other manufacturers to implement MGX designs indicates that Nvidia's accelerated computing solutions will be more accessible and versatile.

Furthermore, Nvidia's involvement in 5G and 6G wireless and video communications is noteworthy. The partnership with SoftBank (TSE:9984, Financial) to build a distributed network of data centers in Japan showcases its contribution to delivering 5G services and generative AI applications. The utilization of GH200 Superchips, BlueField-3 DPUs and Spectrum Ethernet switches also demonstrates Nvidia's concentration on ensuring precise timing, cost efficiency and reduced energy consumption in 5G networks.

Additionally, the introduction of Nvidia Spectrum-X, a purpose-built networking platform, addresses the need for improved performance and efficiency in ethernet-based AI clouds. By combining Spectrum-4 Ethernet switches with BlueField-3 DPUs, Nvidia aims to enhance AI performance and power efficiency, catering to the growing demands of AI workflows.

Nvidia's focus on generative AI in gaming with the Avatar Cloud Engine shows its focus on enhancing the gaming experience. By enabling developers to build custom AI models for speech, conversation and animation, Nvidia ACE for Games has the potential to revolutionize non-playable characters, making them more lifelike and responsive.

Finally, in collaboration with Microsoft, Nvidia is driving innovation for Windows PCs in the generative AI era. By providing tools, frameworks and drivers that make it easier for PC developers to develop and deploy AI, the partnership aims to boost performance and extend the reach of AI-accelerated Windows applications.

Source: Investor presentation

Vital industry collaborations

Nvidia's partnerships with Foxconn (TPE:2354, Financial) and SoftBank highlight its commitment to transforming the manufacturing sector.

With Foxconn Industrial Internet, Nvidia is leveraging its generative AI, 3D collaboration, simulation and autonomous machine technologies to create a comprehensive reference workflow. This workflow enables electronics manufacturers to plan, build, operate and optimize their factories more efficiently, reducing costs and improving quality and safety. As more electronics makers embrace digitalization using Nvidia's technology, its influence in the manufacturing space is set to grow.

The company's collaborations extend beyond hardware manufacturers to include service providers and software development companies. Its partnership with SoftBank in developing a platform for generative AI as well as 5G and 6G applications is particularly significant. The platform will provide enhanced performance, scalability and resource utilization by combining Nvidia's GH200 Grace Hopper Superchip with SoftBank's distributed AI data centers. This collaboration has the potential to revolutionize the architecture of data centers, supporting the rapid deployment of generative AI applications worldwide.

In terms of product offerings, Nvidia's Isaac Sim application and Metropolis Vision AI framework play vital roles in its industrial digitalization strategy. Isaac Sim allows manufacturers to build and optimize AI-based robots, enabling them to program tasks in simulation before deployment. Meanwhile, the Metropolis Vision AI framework empowers industrial solution providers and manufacturers to develop customized quality-control solutions, resulting in cost savings and improved production throughput. These products, combined with Nvidia's Omniverse platform, which connects leading 3D, simulation and generative AI providers, lead the company in industrial automation and digitalization.

As the demand for accelerated computing and generative AI continues to grow, Nvidia's portfolio is well equipped to meet these requirements. The Nvidia Grace Hopper Superchip and BlueField-3 data processing units will enable high-performance software-defined 5G vRAN and generative AI applications without requiring specialized hardware accelerators. Additionally, the Nvidia Spectrum Ethernet switch with BlueField-3 provides precise timing protocols for 5G, supporting the development of highly efficient and low-latency networks.

Overall, Nvidia's partnerships, comprehensive workflow solutions and cutting-edge technologies position it for continued growth in the industrial digitalization and generative AI sectors. The company's ability to collaborate with industry leaders and provide innovative solutions will solidify its standing as a key player in transforming manufacturing processes and driving the adoption of advanced technologies across various industries.

Source: Investor presentation

Leads in digital advertising

The partnership between Nvidia and WPP PLC (WPP, Financial) holds significant potential for revolutionizing digital advertising and brand content creation. By leveraging Nvidia's Omniverse and AI technologies, the content engine being developed aims to enable creative teams to produce high-quality commercial content faster, more efficiently and at scale. Furthermore, this collaboration aligns with the growing trend of utilizing AI in marketing and advertising to deliver personalized and engaging consumer experiences.

Integrating 3D design, manufacturing and creative supply chain tools, including those from Adobe (ADBE, Financial) and Getty Images (GETY, Financial), will empower WPP's artists and designers to combine 3D content creation with generative AI. This will result in highly personalized and immersive brand experiences, while ensuring the accuracy and fidelity of the brand identity. By leveraging generative AI tools and content from its partners, WPP's designers can create diverse and high-fidelity visuals based on text prompts. In addition, this technology will create large volumes of brand-accurate images and videos for advertising and interactive 3D product configurators for a more engaging customer experience.

The content engine built on Omniverse Cloud will offer speed, efficiency and superior performance compared to traditional content creation methods. In addition, the engine will streamline the content creation process by connecting disparate tools and systems, eliminating the need for manual content creation from disconnected data sources. This will enable WPP's creative teams to produce content efficiently while maintaining brand consistency and quality.

In addition to the digital advertising industry, Nvidia and WPP also plan to target the manufacturing sector with their AI technologies. By digitalizing factories and utilizing AI-enabled tools, the company hopes to enable manufacturers to build digital twins of their factories, optimizing processes and saving costs. The integration of Isaac Sim for simulating and testing robots, Metropolis for automated optical inspection and the newly introduced Isaac AMR platform for managing fleets of autonomous mobile robots demonstrates Nvidia's commitment to driving AI innovation in the manufacturing industry.

Further, the partnership with WPP reinforces Nvidia's position as a leader in generative AI and accelerates its expansion into new industries. By offering unique solutions exclusively to WPP's clients, the company is solidifying its market presence and gaining a competitive advantage in advertising and creative applications.

Overall, the success of this collaboration will be measured by the adoption of the content engine by WPP's clients and the impact it has on their advertising campaigns. If the engine delivers on its promises of increased efficiency, scalability and personalization, it has the potential to disrupt the digital advertising landscape and reshape the way brands create content. Moreover, the expansion into the manufacturing sector with AI-driven solutions could position Nvidia as a key player in the digital transformation of factories, with the potential to drive significant cost savings and process optimization for manufacturers worldwide.

Short-term bearish catalysts

AI hype, regulations and overvaluation may put a damper on its progress, however.

The hype surrounding AI has led to comparisons with the dot-com bubble of the early 2000s, raising concerns about potential overvaluations in AI-related stocks. While there is undoubtedly significant growth potential in the AI industry, taking a forward-looking perspective and considering various factors is important.

Source: sireats.com

On the positive side, artificial intelligence can revolutionize multiple sectors, such as health care, finance and transportation, by enhancing productivity and efficiency. Moreover, integrating the technology into product lines and developing advanced algorithms can lead to significant profit growth. Goldman Sachs (GS, Financial) predicts that AI technology could increase S&P 500 profits by 30% or more over the next decade. This optimistic outlook suggests that the AI hype might be somewhat justified.

However, it is crucial to exercise caution regarding potential overvaluations. Comparisons to the dot-com bubble serve as a reminder of the risks associated with hype-driven markets. The excessive enthusiasm and investor frenzy surrounding AI could result in inflated stock prices that are not necessarily supported by the underlying fundamentals of the companies. This raises concerns about a potential market correction or bubble burst in the future.

One critical factor that could impact the valuation of the AI sector is the Federal Reserve's monetary policy. A policy error, such as a pause in rate hikes followed by a restart, could burst the bubble. This scenario is similar to what happened during the dot-com era, when the Fed restarted policy tightening in 1999, eventually leading to the dot-com bubble bursting. Therefore, it is essential for investors to closely monitor the Fed's actions and their impact on interest rates, as this could influence sentiment and valuations.

Notably, any statutory action to regulate emerging AI developments may also impact Nvidia's market value as the ecosystem leader. The impact can be drastic, even if there is a temporary halt to the technology's industrial progress.

Another aspect to consider is the market concentration of AI-related stocks. The five largest stocks on the S&P 500, including Apple (AAPL, Financial), Microsoft, Alphabet, Amazon (AMZN, Financial) and Nvidia, now account for nearly 25% of the index's total value. This concentration raises concerns about market stability and the potential impact if there is a correction or downturn in these high-growth stocks.

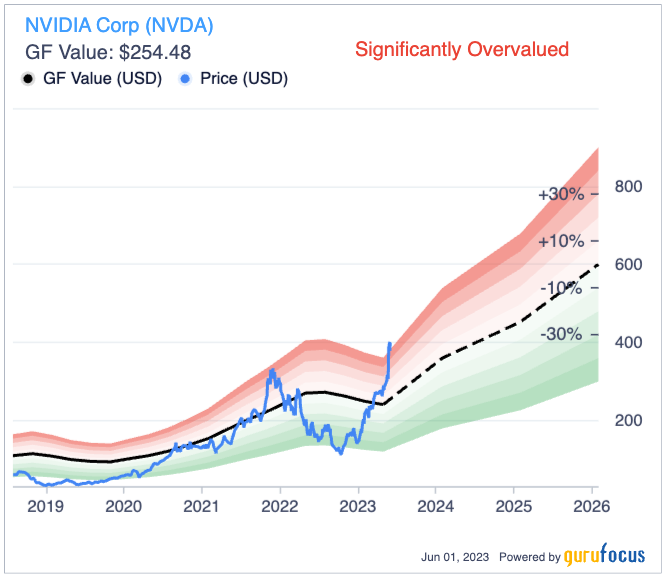

From a technical standpoint, Nvidia's weekly share price movement has exceeded overbought levels, as indicated by the relative strength index and Bollinger bands. This suggests a possible downtrend in the coming weeks.

Moreover, according to the Gartner hype cycle for AI, there is a peak of inflated expectations, which may lead to a short-term generalization of the hype. While the efficient market may have already priced in the potential outcomes, as reflected in the rapid price boosts of AI stocks, these companies need to demonstrate solid performance to sustain their bullish trajectory. Furthermore, it is logical to assume that not all companies will be able to fully capitalize on the advantages due to operational weaknesses, issues with adaptability and inefficient utilization.

Furthermore, even with AI integration, competition within the industry may remain fierce. If every company jumps on the bandwagon, there may be no competitive advantage left from the technology. It is well known that only some AI stocks have strong fundamentals to support their market valuation. Therefore, it is prudent for investors to consider booking profits at the current elevated levels. It is important to avoid behavioral biases during the ongoing AI hype and instead follow the logic behind the market pricing cycle, which suggests being cautious when everyone becomes overly bullish.

Conclusion

In conclusion, while Nvidia's advancements in AI technology and its collaborations across various industries are nurturing potential long-term bullish momentum, a significant bearish consideration warrants caution.

The current market valuations may be detached from the underlying fundamentals, reminiscent of the dot-com bubble. By overcoming behavioral biases, investors can better evaluate their positions. The potential risks of an AI bubble, monetary policy impact, tech concentration and technical indicators signaling a correction raise concerns about the sustainability of Nvidia's ongoing bullish trajectory.

As a result, investors may want to exercise caution.