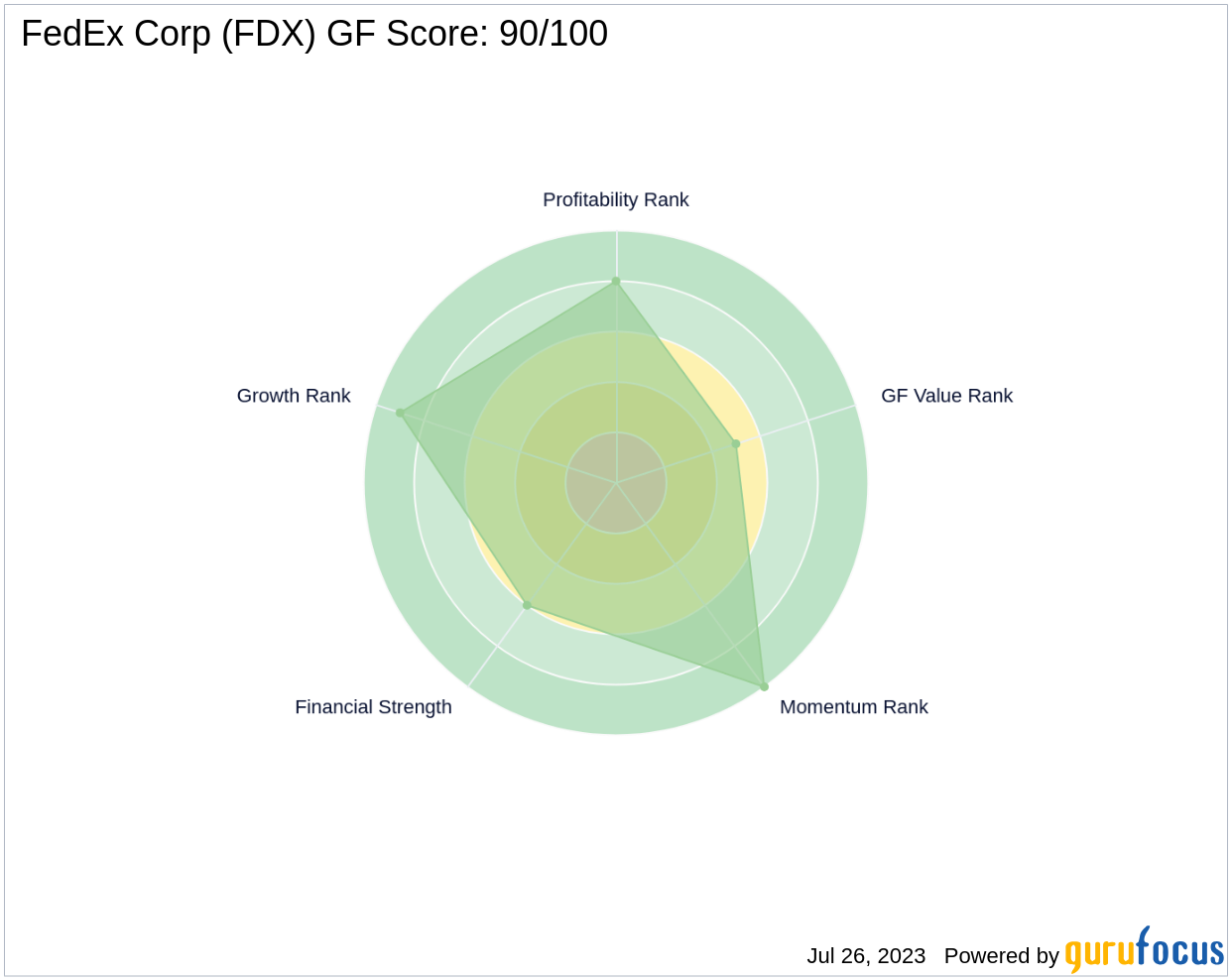

FedEx Corp (FDX, Financial), a leading player in the transportation industry, is currently trading at $268.43 with a market cap of $67.42 billion. The company's stock price has seen a gain of 3.38% today and a significant increase of 14.09% over the past four weeks. In this article, we will delve into FedEx's GF Score and its implications for the company's future performance. The GF Score is a stock performance ranking system developed by GuruFocus, which has been found to be closely correlated with the long-term performances of stocks. It ranges from 0 to 100, with 100 as the highest rank. FedEx Corp's GF Score stands at an impressive 90 out of 100, indicating good outperformance potential.

FedEx Corp's Financial Strength Analysis

The Financial Strength Rank measures the robustness of a company's financial situation. FedEx Corp's Financial Strength Rank is 6 out of 10, indicating a relatively strong financial position. The company's interest coverage is 10.76, suggesting it can comfortably meet its interest expenses. Its debt to revenue ratio is 0.43, which is manageable. The Altman Z score is 2.53, indicating a low risk of bankruptcy.

Profitability Rank Analysis

The Profitability Rank assesses a company's profitability and its likelihood of remaining profitable. FedEx Corp's Profitability Rank is 8 out of 10, suggesting a high level of profitability. The company's Operating Margin is 5.92%, and its Piotroski F-Score is 4, indicating a stable financial situation. The company has consistently been profitable over the past 10 years.

Growth Rank Analysis

The Growth Rank measures a company's revenue and profitability growth. FedEx Corp's Growth Rank is 9 out of 10, indicating strong growth potential. The company's 5-year revenue growth rate is 8.70%, and its 3-year revenue growth rate is 10.10%, suggesting consistent growth in its business operations.

GF Value Rank Analysis

The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth. FedEx Corp's GF Value Rank is 5 out of 10, suggesting that the company is fairly valued.

Momentum Rank Analysis

The Momentum Rank assesses a company's stock price performance. FedEx Corp's Momentum Rank is 10 out of 10, indicating strong momentum in its stock price performance.

Competitive Analysis

When compared to its main competitors in the transportation industry, FedEx Corp holds its ground with a GF Score of 90. ZTO Express (Cayman) Inc (ZTO, Financial) has a GF Score of 94, JB Hunt Transport Services Inc (JBHT, Financial) has a GF Score of 95, and Expeditors International of Washington Inc (EXPD, Financial) has a GF Score of 96. Despite the intense competition, FedEx Corp's strong financial strength, profitability, growth, and momentum ranks suggest that it is well-positioned for future performance.

In conclusion, FedEx Corp's high GF Score, strong financial strength, profitability, growth, and momentum ranks, and fair valuation suggest that it has good outperformance potential. However, investors should also consider the competitive landscape and other factors before making investment decisions.