Hewlett Packard Enterprise Co (HPE, Financial) has been witnessing a significant daily gain of 5.83% and a 3-month gain of 23.45%. This performance is backed by an Earnings Per Share (EPS) of 0.78. However, the question that arises is whether the stock is modestly overvalued? This article aims to answer this question by providing a comprehensive valuation analysis. So, let's delve into the financials of Hewlett Packard Enterprise Co.

A Snapshot of Hewlett Packard Enterprise Co

Hewlett Packard Enterprise Co is a leading information technology vendor, offering hardware and software to enterprises. Its primary products include compute servers, storage arrays, and networking equipment. Hewlett Packard Enterprise Co aims to be a complete edge-to-cloud company, enabling hybrid clouds and hyperconverged infrastructure. The company operates with an outsourced manufacturing model and employs 60,000 people worldwide.

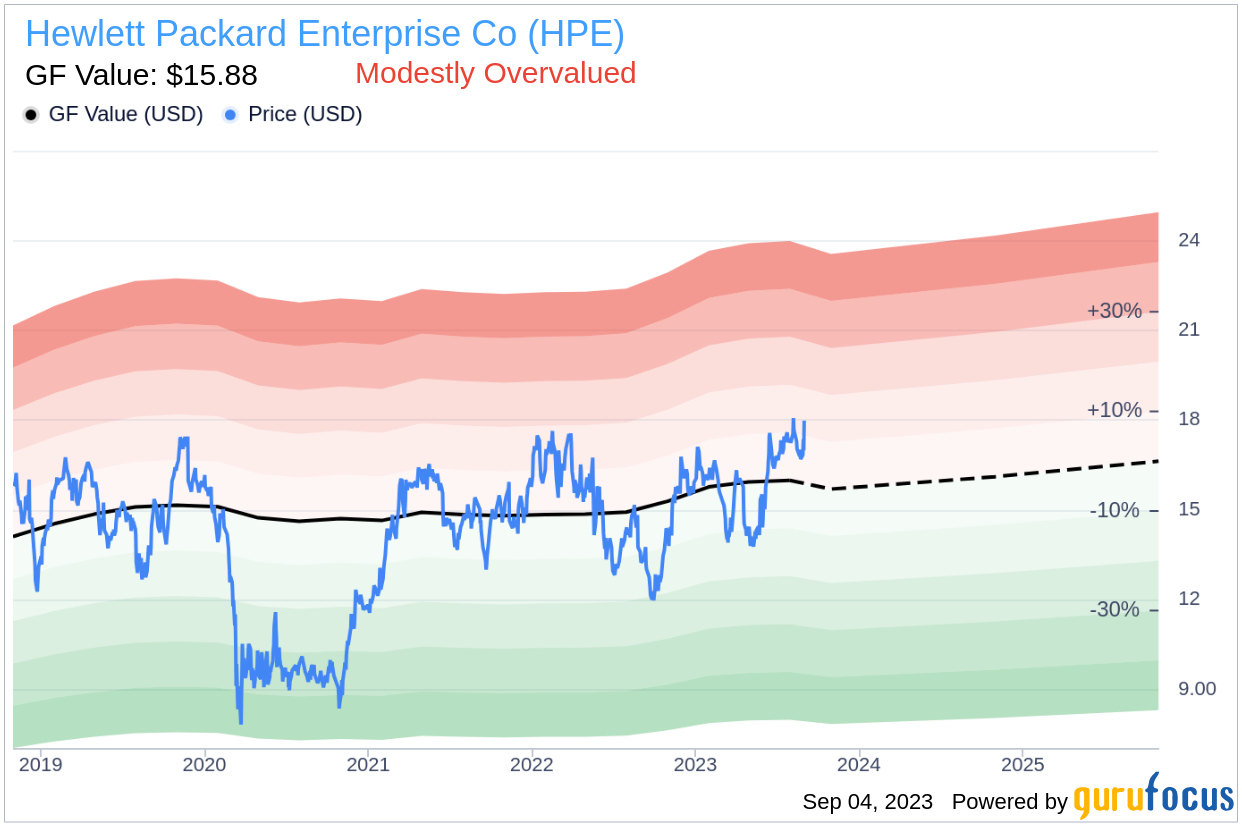

The current stock price of Hewlett Packard Enterprise Co is $17.98, while the GF Value, an estimation of fair value, stands at $15.88. This comparison indicates that the stock might be modestly overvalued. However, to get a clearer picture, let's dive deeper into the company's value assessment.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line represents the fair value at which the stock should ideally trade. If the stock price is significantly above the GF Value Line, it is likely overvalued and may yield poor future returns. Conversely, if the stock price is significantly below the GF Value Line, it is undervalued and may yield higher future returns.

Based on this methodology, Hewlett Packard Enterprise Co's stock appears to be modestly overvalued. This suggests that the long-term return of its stock is likely to be lower than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

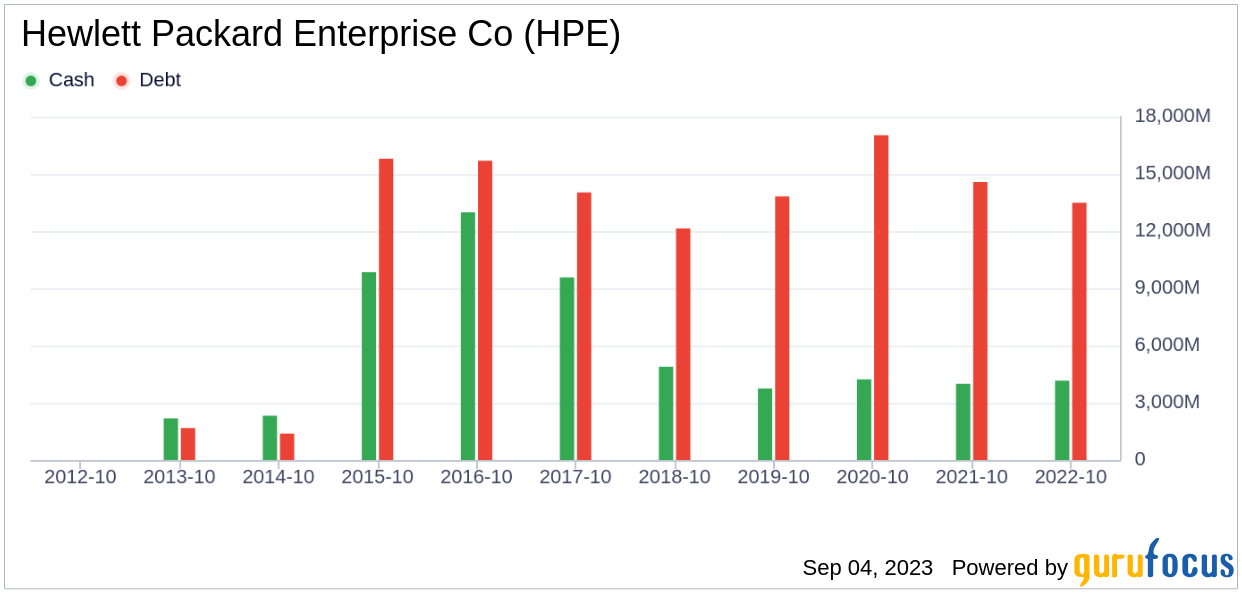

Assessing the Financial Strength

Before investing in a company, it is crucial to check its financial strength. Companies with poor financial strength pose a higher risk of permanent loss. The cash-to-debt ratio and interest coverage are reliable indicators of a company's financial strength. Hewlett Packard Enterprise Co has a cash-to-debt ratio of 0.22, ranking lower than 86.87% of 2353 companies in the Hardware industry. This gives Hewlett Packard Enterprise Co a financial strength score of 5 out of 10, indicating fair financial health.

Profitability and Growth Analysis

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. Hewlett Packard Enterprise Co has been profitable 9 over the past 10 years. With a revenue of $29.60 billion and an Earnings Per Share (EPS) of $0.78 over the past twelve months, the company's operating margin is 8.88%, ranking better than 72.96% of 2422 companies in the Hardware industry. This gives Hewlett Packard Enterprise Co a profitability rank of 7 out of 10, indicating fair profitability.

Growth is a critical factor in a company's valuation. Faster-growing companies are more likely to create value for shareholders, especially if the growth is profitable. However, Hewlett Packard Enterprise Co's 3-year average annual revenue growth rate is 0.4%, ranking lower than 61.89% of 2317 companies in the Hardware industry. Its 3-year average EBITDA growth rate is -4.9%, ranking lower than 74.96% of 1941 companies in the Hardware industry.

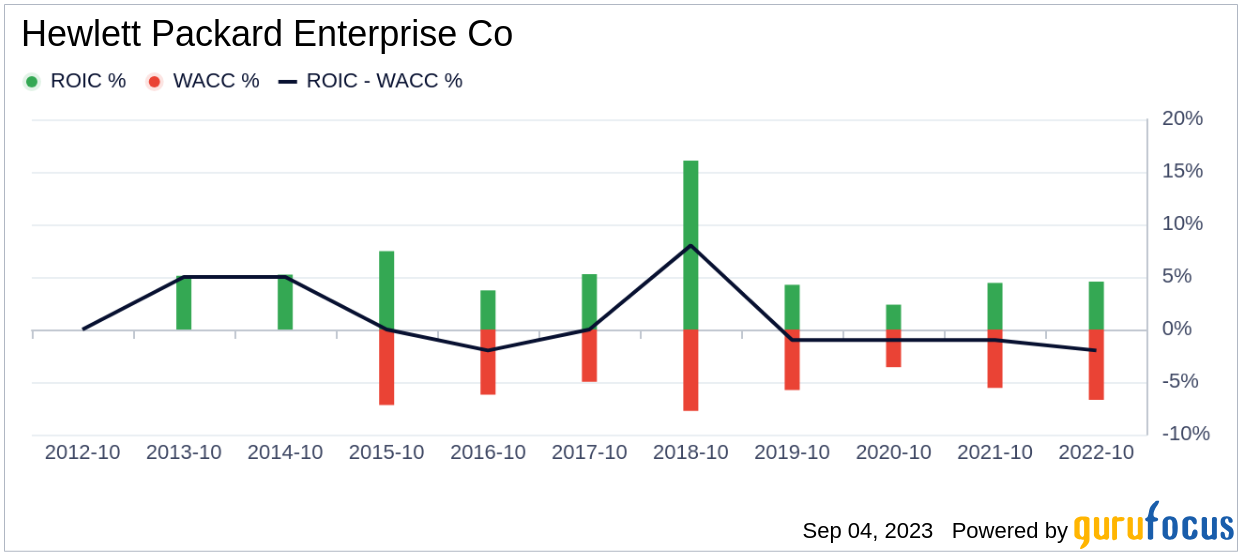

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) with its weighted average cost of capital (WACC) can also provide insight into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Over the past 12 months, Hewlett Packard Enterprise Co's ROIC was 4.51, while its WACC was 7.98.

Conclusion

In conclusion, Hewlett Packard Enterprise Co's stock appears to be modestly overvalued. The company's financial condition is fair, and its profitability is fair. However, its growth ranks lower than 74.96% of companies in the Hardware industry. To learn more about Hewlett Packard Enterprise Co's financials, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.