Wells Fargo Analysis:

Wells Fargo Company (WFC) is the fourth biggest bank in the U.S. by asset size and the second largest by market capitalization. WFC can generally be labeled a plain vanilla bank as it mostly derives its revenue from fee income and the interest spread between deposits and loans.

Overview:

The five main points regarding WFC

#1) Diversified and stable revenue stream:

WFC puts big emphasis on cross-selling its various products and thereby increasing their overall stickiness. The thinking is that the more products a client has with a bank, the more cumbersome/ inconvenient and hence unlikely it is that he or she will switch to another bank.

Wells Fargo's cross-selling has grown from 4.6 products/ household in 2004 to 6.04 products/ household in August 2012.

Cross-selling products is very important as it not only creates a sort of moat for a bank but also enables it to collect more fees related to the various products which diversifies its revenue stream and makes it less dependent on interest rates (and fluctuations thereof).

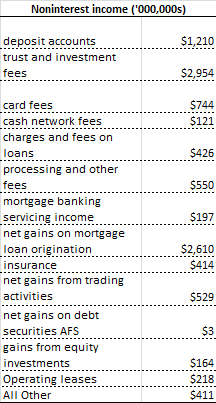

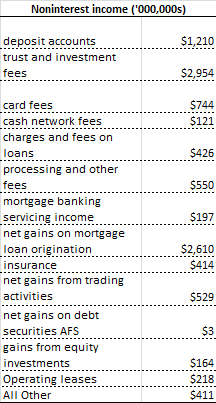

The make-up of non-interest income is also very important - WFC has only a small portion of trading income, a very unstable revenue stream (to be kind). Currently, ~50% of WFC's revenue is non-interest revenue and the non-interest income itself is much diversified and of high quality.

#2) Comparatively low funding cost:

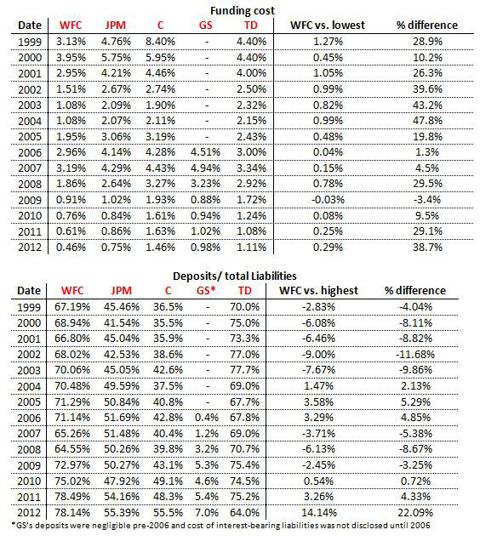

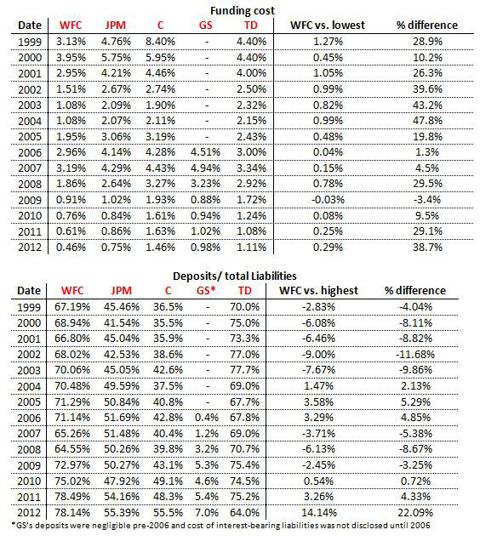

WFC has very low funding costs and high deposits relative to total liabilities. Deposits are generally very sticky, however WFC's are even more so due its strategic focus on cross-selling, which enables it to keep its customers even though it is offering the lowest interest rates (as compared to competitors) on its accounts. This gives WFC a sort of pricing power in a commodity market (every bank offers basically the same checking and savings accounts, loans, etc.). To illustrate, in 2012, WFC's funding cost was ~39% lower than that of JPM which had the next lowest funding cost within the group, and WFC has a very large amount of deposits relative to its overall liabilities. WFC has beaten every of these 4 major competitors in terms of their funding cost in all but 1 of the last 14 years.

(click to enlarge)

#3&4) High RoA and comparatively low leverage

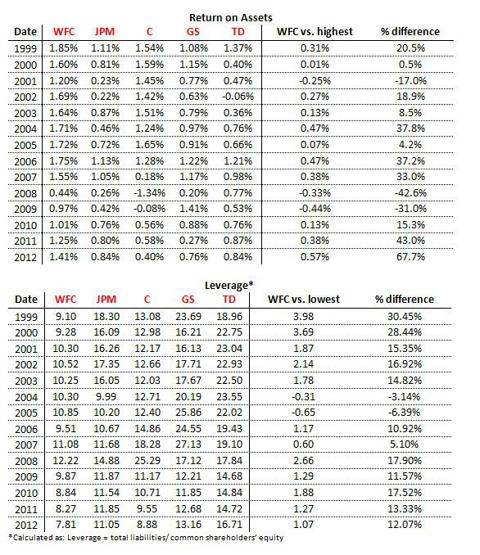

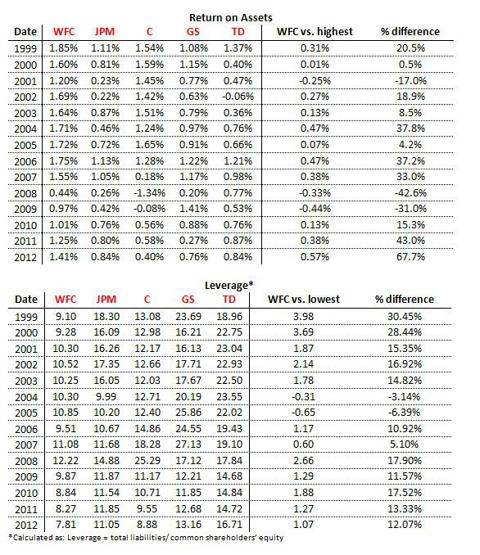

WFC has consistently had a far higher RoA than its competitors (in large part due to its lower funding costs) and can reasonably earn around ~1.4-1.5% (RoA) in a normalized environment - looking at 2012, that's 67.7% higher than TD and JPM which have the next highest RoA within the group.

WFC is also by far less leveraged than any of its competitors, which, in addition to the low-risk and diversified non-interest revenue, makes it a very strong player in the financial services industry. (I am focusing on RoA rather than RoE to avoid the skewing effect that the vastly different leverages would have on RoE)

(click to enlarge)

#5) Conservatively managed

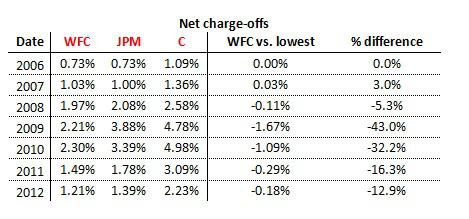

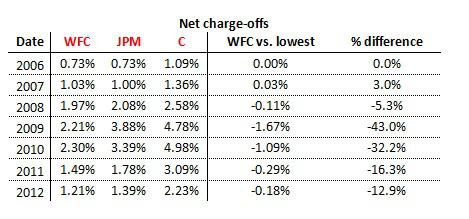

WFC has historically mostly steered clear of industry hypes/ asset bubbles (e.g. 2007 mortgage bubble, late 1980s/ early 1990s highly leveraged transactions etc.). WFC had far lower net charge-offs (loan write-offs) post 2007 than its competitors despite purchasing Wachovia which had lots of bad loans mainly due to its Pick-a-Pay loan portfolio (the name says it all).

WFC emerged out of the 2007/08 bubble burst far stronger than it was before, as the Wachovia transaction added a lot of value. Increasing the deposit base is very difficult for a bank as people generally perceive it as too inconvenient to switch their bank and only do so if there are tremendous benefits associated with it.

Based on WFC's normalized return on deposits which can (conservatively) be pegged at ~1.8-1.9% (for the year ended Dec.31 2012 it was at 1.87%), the Wachovia transaction added between $7.67B to $8.1B in earning power wherefore WFC snapped up Wachovia at a price of only ~3.5 - 3.7 times normalized earnings (for a total price of $23.1B + $5B in integration costs) and thereby grew its deposits by $426.2B to $781.4B (55% growth).

Free Cash Flow & Valuation:

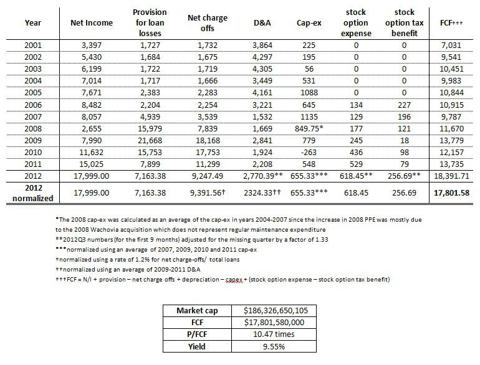

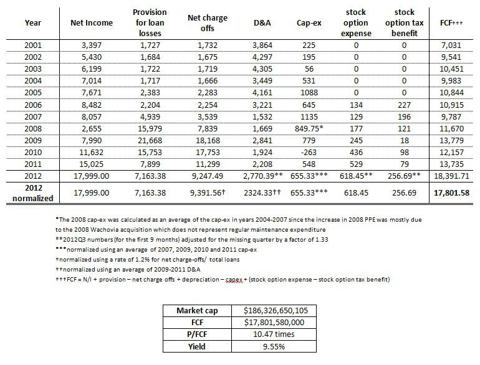

Looking at WFC's P/FCF shows that WFC sells at around 10.47 times FCF (186.3B diluted market cap), which equates to an equity yield of ~9.55%

(click to enlarge)

(click to enlarge)

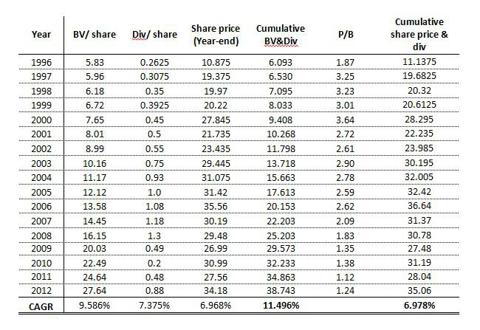

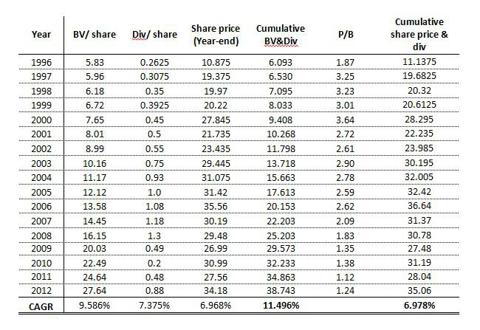

Factoring in dividends, WFC's BV has compounded at ~11.5%/ year over the last 17 years while the share price (including div's) has compounded at ~6.98%. This gap in the two CAGRs stems from the 2007/08 financial crisis (which can also be seen at the sudden drop in WFC's P/B multiple).

Between 1996 and 2006, Book Value + Dividends had a CAGR of 11.43% while the share price had a CAGR of 11.49% (almost exactly the same). Since 2007, book value continued to compound at a very similar pace while the share price declined (pulling down the share price CAGR) - in the long run however, share prices grow at rates similar to the companies' BV growth.

Between 1996 and 2006, WFC sold at an average P/B multiple of 2.84 times which is 129% larger than today's multiple. Normalized earnings over the next 5+ years and a less depressed Mr. Market should bring WFC back to above a 2.0 P/B multiple (the premium afforded to such a strong bank).

Interest rate risk:

WFC has a natural hedge against interest rate fluctuations as it is a large originator of MBS. The 2011 10-K provides a breakdown of selected loans ($332B out of WFC's ~$780B portfolio) of which 88% of 1-5 year loans and 74% of 5+ year loans are variable rate. These loans will fluctuate with interest rates while WFC's existing MBS are largely hedged through interest rate swaps, and the company can keep new MBS, originated at higher interest rates, on its book to counter-act any pressure on its interest rate spread.

Mortgages and consumer loans:

WFC's net charge-offs are starting to normalize again at a level of 1.2% of average total loans. As of December 31, 2012, approximately 39% of Wachovia's Pick-A-Pay portfolio has been liquidated (since 2008) and the entire liquidation portfolio has shrunk by ~50% since 2008.

At Sept. 30, 2012, out of the $318.6M real estate consumer loans, ~10% had a LTV (Loan-to-Value) between 100-120% and ~9.6% a LTV greater than 120%. With the housing market having hit a bottom and beginning to recover, even if a significant portion of the >100% LTV customers were to default, the losses would not have a major impact. Even under the extreme assumption of a 20% default of the 100-120% LTV loans and 40% default of >120% loans (and assuming an average 140% LTV value for the >120% loans), the losses would be between $8.77B and $14.2B which is considerably below WFC's remaining loan loss allowance which was at $17.8B at Dec. 31, 2012.

Investment Banking:

WFC has started to focus on investment banking as a new growth opportunity. As long as the focus is on underwriting new company offerings and cross-selling products that involve minimal risk for the company itself, this has the potential to be a good new non-interest revenue stream. However, one should watch out for any significant revenue from principal transactions and trading revenue (more specifically, the proportion of 'market-making' revenue and what types of assets (and in what size) the company has to keep on its balance sheet to facilitate the market-making in a way that satisfies its customers).

Conclusion:

Wells Fargo is a very strong bank which by far outperforms its largest competitors in the most important areas. It has a diversified non-interest revenue stream and low funding costs (which lead to high net interest revenue) both of which explain its high return on assets. WFC has a very low leverage multiple and is a bank that focuses on the core business of a retail bank, that is, deposit taking and loan origination, and avoids most of the bad stuff such as lax operating standards and a heavy reliance on trading. At a P/FCF of 10.47 times and a P/B multiple of only 1.24 times, WFC is still a cheap buy and has a lot of upside potential over the long-run when market values of financial companies will again more closely resemble their underlying economics.

Wells Fargo Company (WFC) is the fourth biggest bank in the U.S. by asset size and the second largest by market capitalization. WFC can generally be labeled a plain vanilla bank as it mostly derives its revenue from fee income and the interest spread between deposits and loans.

Overview:

The five main points regarding WFC

- Diversified and stable revenue stream

- Comparatively low funding cost

- High RoA

- Comparatively low leverage

- Conservatively managed

#1) Diversified and stable revenue stream:

WFC puts big emphasis on cross-selling its various products and thereby increasing their overall stickiness. The thinking is that the more products a client has with a bank, the more cumbersome/ inconvenient and hence unlikely it is that he or she will switch to another bank.

Wells Fargo's cross-selling has grown from 4.6 products/ household in 2004 to 6.04 products/ household in August 2012.

Cross-selling products is very important as it not only creates a sort of moat for a bank but also enables it to collect more fees related to the various products which diversifies its revenue stream and makes it less dependent on interest rates (and fluctuations thereof).

The make-up of non-interest income is also very important - WFC has only a small portion of trading income, a very unstable revenue stream (to be kind). Currently, ~50% of WFC's revenue is non-interest revenue and the non-interest income itself is much diversified and of high quality.

#2) Comparatively low funding cost:

WFC has very low funding costs and high deposits relative to total liabilities. Deposits are generally very sticky, however WFC's are even more so due its strategic focus on cross-selling, which enables it to keep its customers even though it is offering the lowest interest rates (as compared to competitors) on its accounts. This gives WFC a sort of pricing power in a commodity market (every bank offers basically the same checking and savings accounts, loans, etc.). To illustrate, in 2012, WFC's funding cost was ~39% lower than that of JPM which had the next lowest funding cost within the group, and WFC has a very large amount of deposits relative to its overall liabilities. WFC has beaten every of these 4 major competitors in terms of their funding cost in all but 1 of the last 14 years.

(click to enlarge)

#3&4) High RoA and comparatively low leverage

WFC has consistently had a far higher RoA than its competitors (in large part due to its lower funding costs) and can reasonably earn around ~1.4-1.5% (RoA) in a normalized environment - looking at 2012, that's 67.7% higher than TD and JPM which have the next highest RoA within the group.

WFC is also by far less leveraged than any of its competitors, which, in addition to the low-risk and diversified non-interest revenue, makes it a very strong player in the financial services industry. (I am focusing on RoA rather than RoE to avoid the skewing effect that the vastly different leverages would have on RoE)

(click to enlarge)

#5) Conservatively managed

WFC has historically mostly steered clear of industry hypes/ asset bubbles (e.g. 2007 mortgage bubble, late 1980s/ early 1990s highly leveraged transactions etc.). WFC had far lower net charge-offs (loan write-offs) post 2007 than its competitors despite purchasing Wachovia which had lots of bad loans mainly due to its Pick-a-Pay loan portfolio (the name says it all).

WFC emerged out of the 2007/08 bubble burst far stronger than it was before, as the Wachovia transaction added a lot of value. Increasing the deposit base is very difficult for a bank as people generally perceive it as too inconvenient to switch their bank and only do so if there are tremendous benefits associated with it.

Based on WFC's normalized return on deposits which can (conservatively) be pegged at ~1.8-1.9% (for the year ended Dec.31 2012 it was at 1.87%), the Wachovia transaction added between $7.67B to $8.1B in earning power wherefore WFC snapped up Wachovia at a price of only ~3.5 - 3.7 times normalized earnings (for a total price of $23.1B + $5B in integration costs) and thereby grew its deposits by $426.2B to $781.4B (55% growth).

Free Cash Flow & Valuation:

Looking at WFC's P/FCF shows that WFC sells at around 10.47 times FCF (186.3B diluted market cap), which equates to an equity yield of ~9.55%

(click to enlarge)

(click to enlarge)

Factoring in dividends, WFC's BV has compounded at ~11.5%/ year over the last 17 years while the share price (including div's) has compounded at ~6.98%. This gap in the two CAGRs stems from the 2007/08 financial crisis (which can also be seen at the sudden drop in WFC's P/B multiple).

Between 1996 and 2006, Book Value + Dividends had a CAGR of 11.43% while the share price had a CAGR of 11.49% (almost exactly the same). Since 2007, book value continued to compound at a very similar pace while the share price declined (pulling down the share price CAGR) - in the long run however, share prices grow at rates similar to the companies' BV growth.

Between 1996 and 2006, WFC sold at an average P/B multiple of 2.84 times which is 129% larger than today's multiple. Normalized earnings over the next 5+ years and a less depressed Mr. Market should bring WFC back to above a 2.0 P/B multiple (the premium afforded to such a strong bank).

Interest rate risk:

WFC has a natural hedge against interest rate fluctuations as it is a large originator of MBS. The 2011 10-K provides a breakdown of selected loans ($332B out of WFC's ~$780B portfolio) of which 88% of 1-5 year loans and 74% of 5+ year loans are variable rate. These loans will fluctuate with interest rates while WFC's existing MBS are largely hedged through interest rate swaps, and the company can keep new MBS, originated at higher interest rates, on its book to counter-act any pressure on its interest rate spread.

Mortgages and consumer loans:

WFC's net charge-offs are starting to normalize again at a level of 1.2% of average total loans. As of December 31, 2012, approximately 39% of Wachovia's Pick-A-Pay portfolio has been liquidated (since 2008) and the entire liquidation portfolio has shrunk by ~50% since 2008.

At Sept. 30, 2012, out of the $318.6M real estate consumer loans, ~10% had a LTV (Loan-to-Value) between 100-120% and ~9.6% a LTV greater than 120%. With the housing market having hit a bottom and beginning to recover, even if a significant portion of the >100% LTV customers were to default, the losses would not have a major impact. Even under the extreme assumption of a 20% default of the 100-120% LTV loans and 40% default of >120% loans (and assuming an average 140% LTV value for the >120% loans), the losses would be between $8.77B and $14.2B which is considerably below WFC's remaining loan loss allowance which was at $17.8B at Dec. 31, 2012.

Investment Banking:

WFC has started to focus on investment banking as a new growth opportunity. As long as the focus is on underwriting new company offerings and cross-selling products that involve minimal risk for the company itself, this has the potential to be a good new non-interest revenue stream. However, one should watch out for any significant revenue from principal transactions and trading revenue (more specifically, the proportion of 'market-making' revenue and what types of assets (and in what size) the company has to keep on its balance sheet to facilitate the market-making in a way that satisfies its customers).

Conclusion:

Wells Fargo is a very strong bank which by far outperforms its largest competitors in the most important areas. It has a diversified non-interest revenue stream and low funding costs (which lead to high net interest revenue) both of which explain its high return on assets. WFC has a very low leverage multiple and is a bank that focuses on the core business of a retail bank, that is, deposit taking and loan origination, and avoids most of the bad stuff such as lax operating standards and a heavy reliance on trading. At a P/FCF of 10.47 times and a P/B multiple of only 1.24 times, WFC is still a cheap buy and has a lot of upside potential over the long-run when market values of financial companies will again more closely resemble their underlying economics.