Adobe Inc (ADBE, Financial) has recently seen a daily gain of 2.37% and an impressive 3-month gain of 15.73%, with an Earnings Per Share (EPS) standing at 11.11. The pertinent question on investors' minds is whether Adobe's stock is fairly valued at its current price. To shed light on this query, we delve into a valuation analysis that aims to determine the stock's intrinsic worth relative to its market price. Read on for an insightful examination of Adobe's financials and market position.

Company Overview

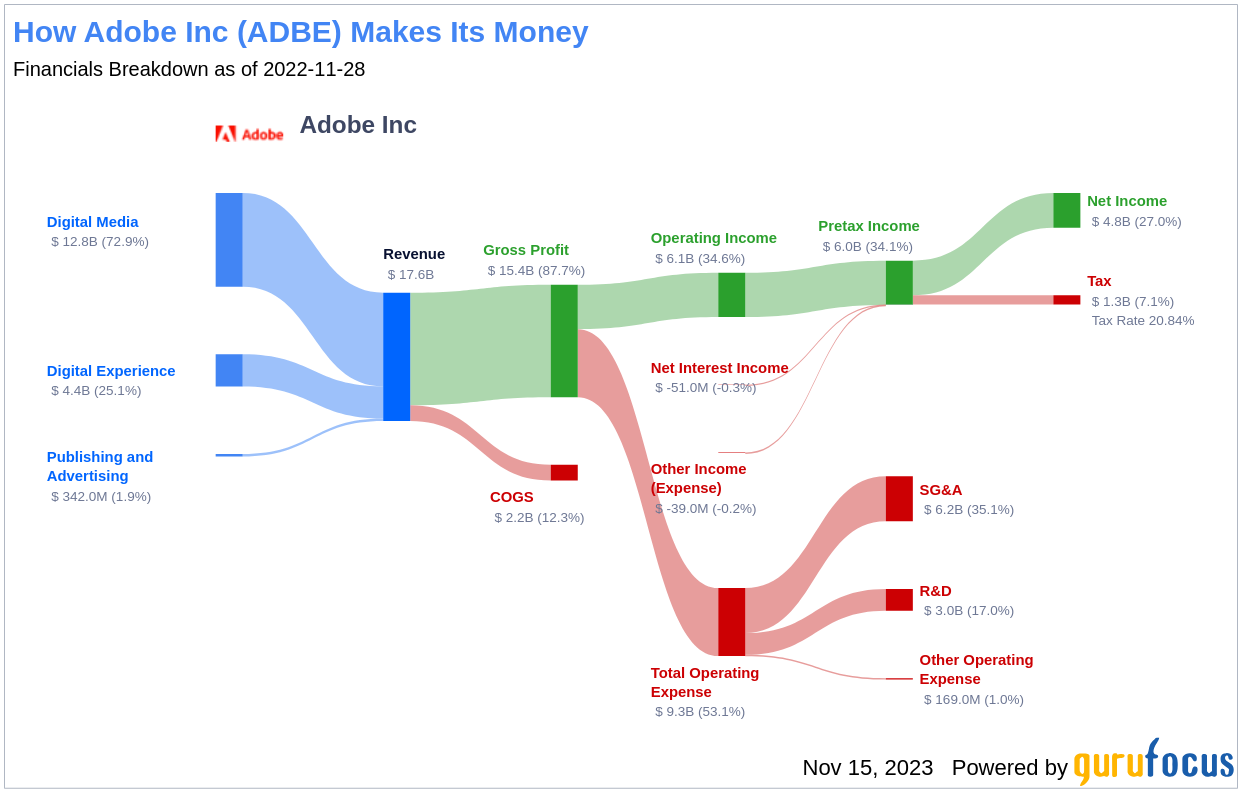

Adobe Inc (ADBE, Financial) is a powerhouse in content creation, document management, and digital marketing and advertising software and services. The company caters to creative professionals and marketers, offering solutions that span multiple operating systems, devices, and media. Operating in three key segments—digital media content creation, digital experience for marketing solutions, and publishing—Adobe has established itself as a leader in its field. With a current stock price of $604.38 and a GF Value of $567.21, we are poised to explore whether Adobe stands as a fairly valued entity in the marketplace.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, incorporating historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, along with future business performance estimates. The GF Value Line provides a visual representation of the stock's fair trading value. When a stock's price significantly exceeds this line, it may be overvalued, suggesting a potentially lower future return. Conversely, if the price falls well below the line, the stock may be undervalued, indicating a higher future return potential.

With Adobe's market cap at $275.20 billion and a current share price of $604.38, GuruFocus estimates that Adobe is fairly valued. This suggests that the long-term return of Adobe's stock is likely to align closely with the company's business growth rate.

Link: These companies may deliver higher future returns at reduced risk.

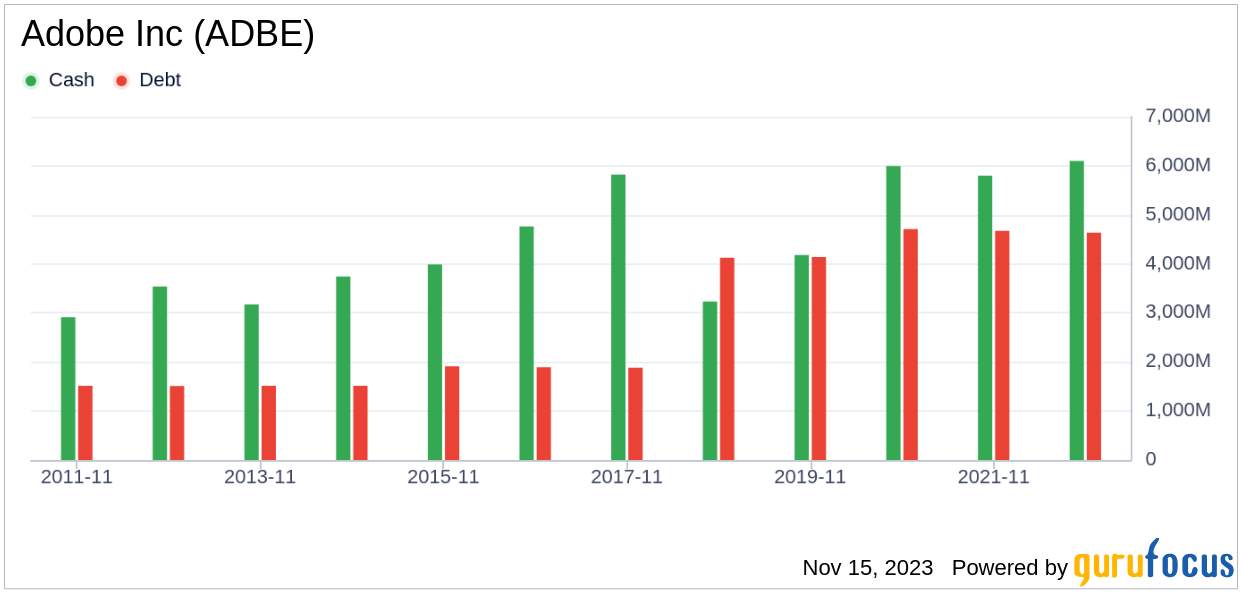

Financial Strength

Investing in companies with robust financial strength is crucial to avoid permanent capital loss. Adobe's cash-to-debt ratio of 1.84 may not be the best in the industry, but it still reflects a strong balance sheet, earning a financial strength rating of 8 out of 10 from GuruFocus.

Profitability and Growth

Investing in profitable companies, especially those with a track record of consistent profitability, is generally less risky. Adobe's impressive operating margin of 33.95% ranks highly within the industry, reflecting the company's strong profitability. Additionally, Adobe's growth metrics are encouraging, with a 3-year average revenue growth rate that surpasses many in the Software industry.

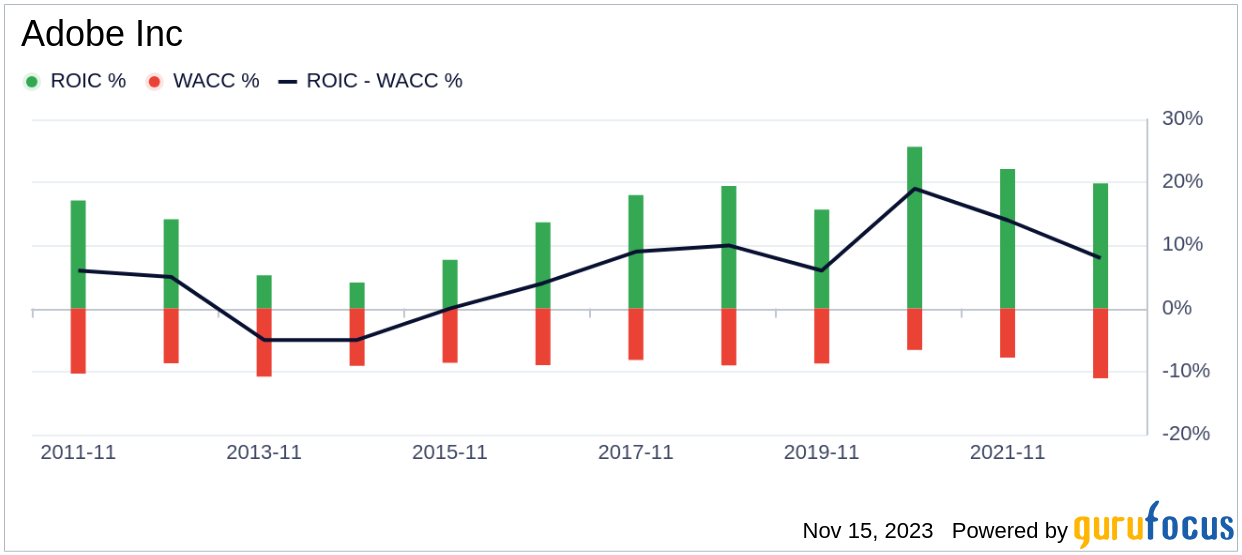

ROIC vs. WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) provides insight into its profitability. Adobe's ROIC of 20.57 is greater than its WACC of 13.73, indicating that the company is creating value for its shareholders.

Conclusion

In summary, Adobe (ADBE, Financial) appears to be fairly valued, with strong financial health and profitability. Its growth outperforms a significant portion of its industry peers. For a deeper dive into Adobe's financials, interested investors can explore the company's 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.