Take-Two Interactive Software Inc (TTWO, Financial) has experienced a daily change with a loss of 1.98%, yet it has managed to gain 8.42% over the past three months. With a Loss Per Share of $8.95, investors are presented with the critical question: is Take-Two Interactive Software fairly valued? The following analysis aims to shed light on this query, offering a comprehensive look at the company's valuation in the current market.

Company Overview

Founded in 1993, Take-Two Interactive Software Inc (TTWO, Financial) is a prominent name in the world of video game publishing, with a portfolio featuring blockbuster titles such as "Grand Theft Auto," "NBA 2K," and "Civilization." Its labels—Rockstar Games, 2K, and Zynga—are known for their significant contributions to the gaming industry across various platforms. With a current stock price of $154.21 and a Fair Value (GF Value) of $146.64, Take-Two Interactive Software presents an intriguing case for valuation analysis. This comparison sets the stage for an in-depth evaluation of the company's worth.

Understanding GF Value

The GF Value is a unique measure, reflecting the intrinsic value of a stock based on historical trading multiples, an adjustment factor from GuruFocus, and future business performance forecasts. This valuation tool suggests that Take-Two Interactive Software (TTWO, Financial), with a market cap of $26.20 billion, is trading close to its fair value. Since the stock price is currently aligned with the GF Value Line, it indicates that the long-term return of its shares could be proportional to the company's business growth rate.

Link: These companies may deliver higher future returns at reduced risk.Financial Strength Analysis

Investing in companies with robust financial strength is crucial to mitigate the risk of capital loss. Take-Two Interactive Software's financial strength, with a cash-to-debt ratio of 0.23, is fair, albeit lower than many of its industry peers. This metric, alongside the company's financial strength ranking of 5 out of 10, suggests a moderate risk profile for potential investors.

Profitability and Growth Prospects

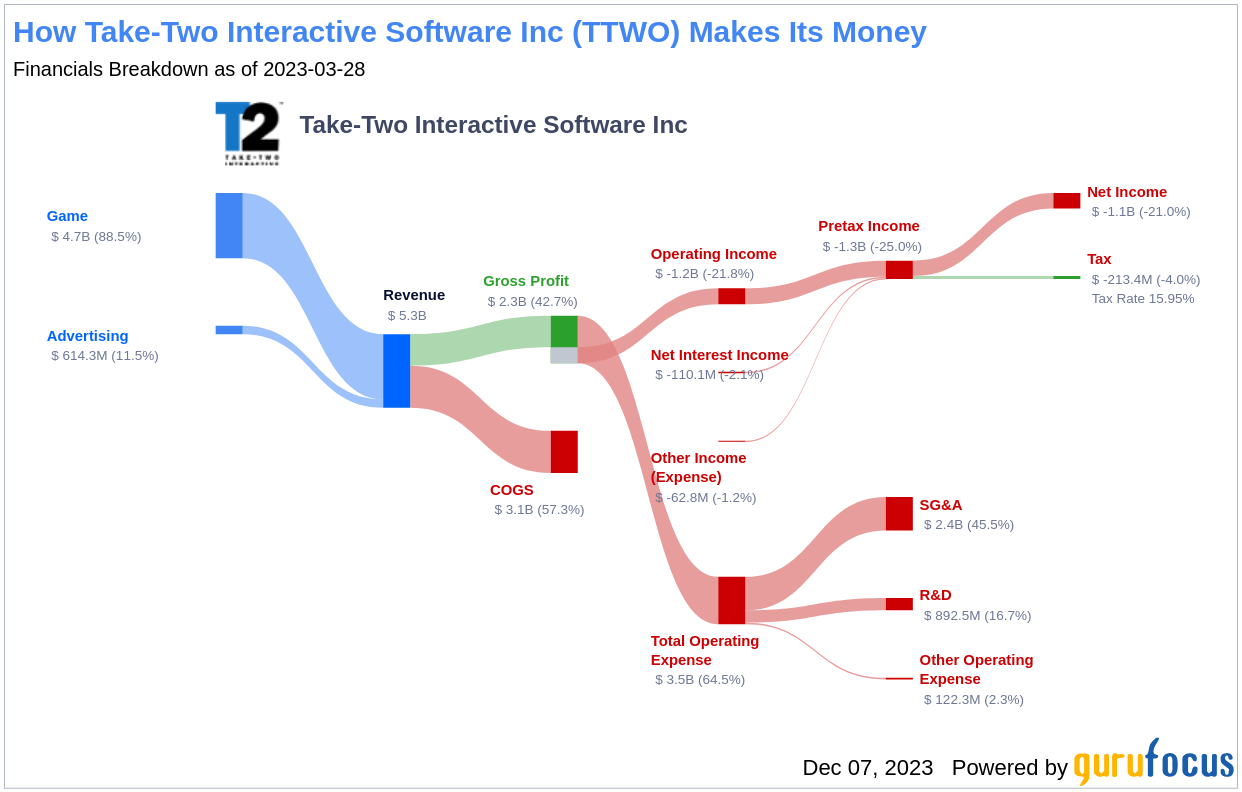

Profitability is a key indicator of a company's financial health. Take-Two Interactive Software has maintained profitability over seven of the past ten years. Despite a challenging operating margin of -26.81%, its long-term profitability is deemed fair. Growth is equally significant for valuation, and Take-Two Interactive Software's average annual revenue growth stands at 7.3%. However, its 3-year average EBITDA growth rate of -15.9% is lower than many competitors in the Interactive Media industry, indicating areas for potential improvement.

ROIC vs. WACC: A Profitability Indicator

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) offers insights into value creation. Take-Two Interactive Software's ROIC of -8.08 is less than its WACC of 9.76, suggesting that the company is not currently generating positive value for its shareholders.

Final Thoughts on Take-Two Interactive Software's Valuation

In summary, Take-Two Interactive Software Inc (TTWO, Financial) appears to be fairly valued, with a fair financial condition and profitability. However, its growth and value creation metrics show room for improvement. For a more detailed financial analysis, interested parties can review Take-Two Interactive Software's 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.