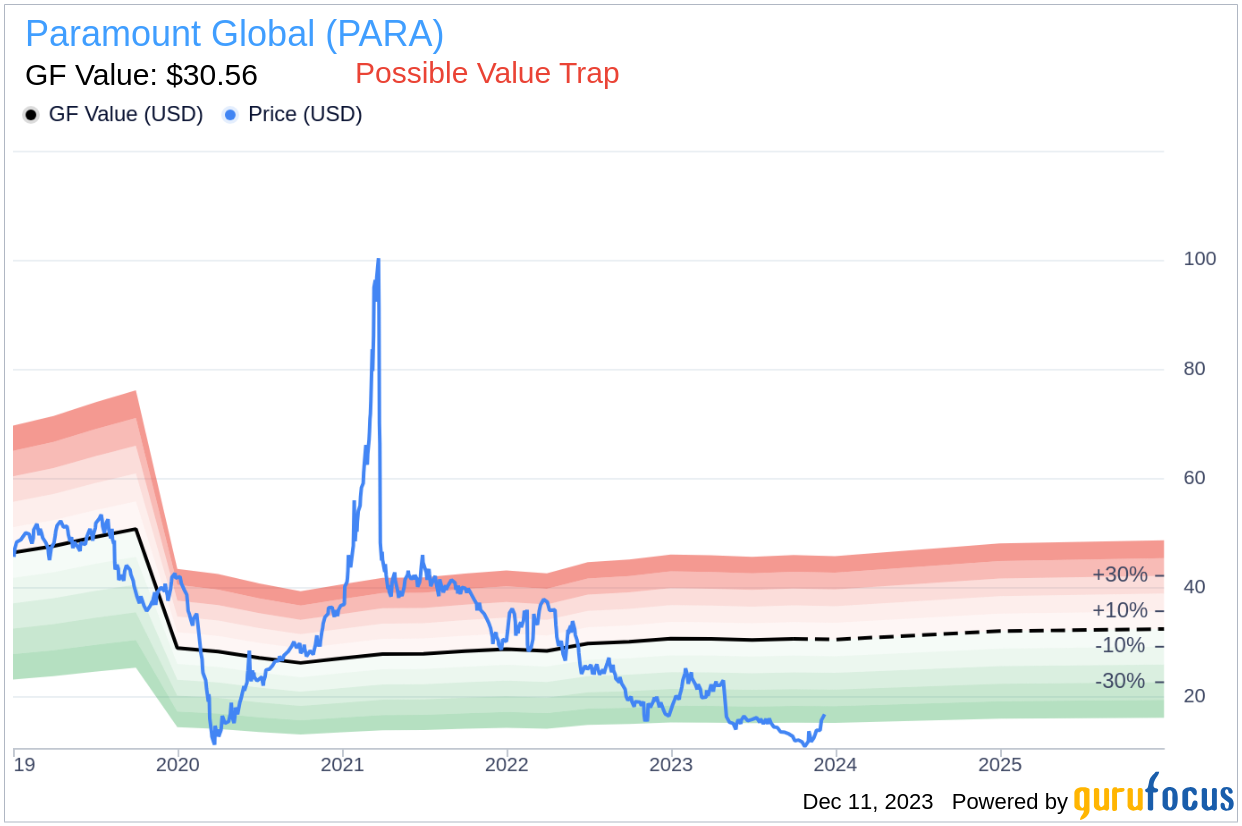

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is Paramount Global (PARA, Financial). The stock, which is currently priced at $16.85, recorded a gain of 12.11% in a day and a 3-month increase of 23.82%. The stock's fair valuation is $30.56, as indicated by its GF Value.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on historical multiples such as PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow, adjusted by the company's past returns and growth, and future estimates of business performance. The GF Value Line is a benchmark for fair value, and stock prices tend to oscillate around it. A price significantly above suggests overvaluation, while one significantly below implies potential for higher returns.

However, investors need to consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with Paramount Global should not be ignored. These risks are primarily reflected through its low Piotroski F-score of 1 and Altman Z-score of 1.13. These indicators suggest that Paramount Global, despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

Financial Health Indicators: Piotroski F-Score and Altman Z-Score

The Piotroski F-score is a tool used to assess the strength of a company's financial health. It looks at profitability, leverage, liquidity, and operating efficiency, with scores ranging from 0 to 9. Paramount Global's score of 1 indicates potential financial issues. The Altman Z-score, meanwhile, predicts the probability of bankruptcy, with a score below 1.8 suggesting a high risk of financial distress. Paramount Global's score of 1.13 is a red flag for investors, hinting at potential troubles ahead.

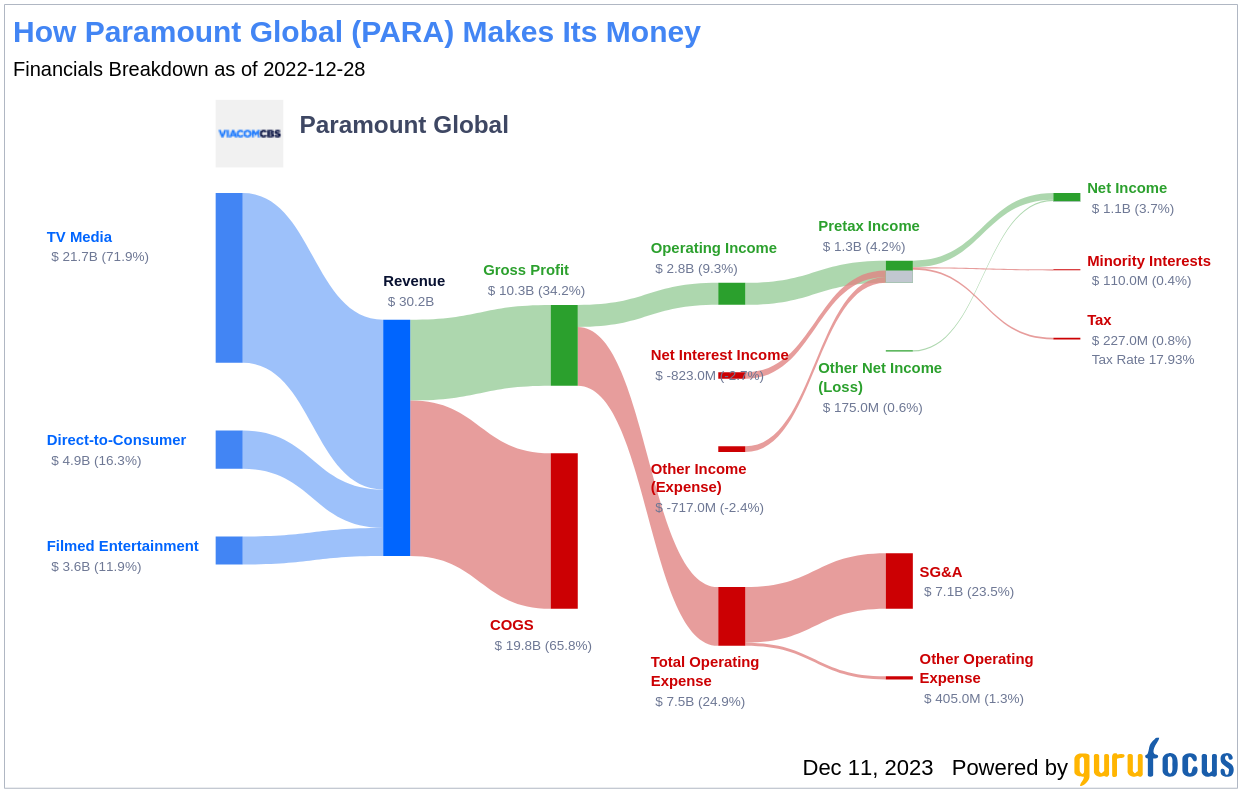

Paramount Global's Business Overview

Paramount Global is the rebranded recombination of CBS and Viacom, resulting in a media conglomerate with significant global scale. Its assets include well-known television networks, cable channels, and streaming services, as well as Paramount Pictures, which boasts a library of 2,500 films. The comparison between the stock price and the GF Value, which estimates fair value, is crucial for investors seeking to understand the company's value proposition.

Profitability Concerns

Looking at profitability, Paramount Global's declining return on assets (ROA) is alarming, with a drop from 6.10% in 2021 to -1.95% in 2023. This trend indicates the company's challenges in generating profit from its assets. A discrepancy between cash flow from operations and net income also raises concerns about the quality of earnings and the sustainability of operations.

Leverage, Liquidity, and Source of Funds

Paramount Global's financial stability is further questioned when examining its declining current ratio, which has decreased from 1.66 in 2021 to 1.26 in 2023. This suggests a weakening ability to cover short-term liabilities and manage financial obligations efficiently.

Operating Efficiency Issues

The company's operating efficiency also raises concerns. An increase in Diluted Average Shares Outstanding could dilute the value of existing shares, while a decrease in gross margin percentage and asset turnover suggests Paramount Global is struggling with cost management and asset utilization.

Breaking Down the Low Altman Z-Score

A closer look at Paramount Global's Altman Z-score components, such as the Retained Earnings to Total Assets and EBIT to Total Assets ratios, reveals a company potentially on the brink of financial distress. These indicators suggest Paramount Global may not be effectively reinvesting its profits or managing its operational efficiency to avoid financial troubles.

Conclusion: The Value Trap Potential of Paramount Global

While the low GF Value of Paramount Global may seem enticing, the concerning signals from its Piotroski F-score and Altman Z-score cannot be overlooked. These financial health indicators suggest that Paramount Global could indeed be a value trap. Investors seeking to avoid such pitfalls can utilize tools like the Piotroski F-score screener and the Walter Schloss Screen available to GuruFocus Premium members to find more secure investment opportunities. As always, thorough due diligence is paramount when navigating the intricate landscape of stock investments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.