Expedia Group Inc (EXPE, Financial) recently experienced a daily loss of -1.4%, yet over the past three months, it has seen an impressive gain of 54.08%. With an Earnings Per Share (EPS) of 5.57, investors are keen to understand if the current stock price reflects the company's true market value. The central question we aim to answer is whether Expedia Group Inc (EXPE) is modestly undervalued, as suggested by the GuruFocus Value analysis. Read on for an in-depth valuation assessment that could inform your investment decisions.

Company Overview

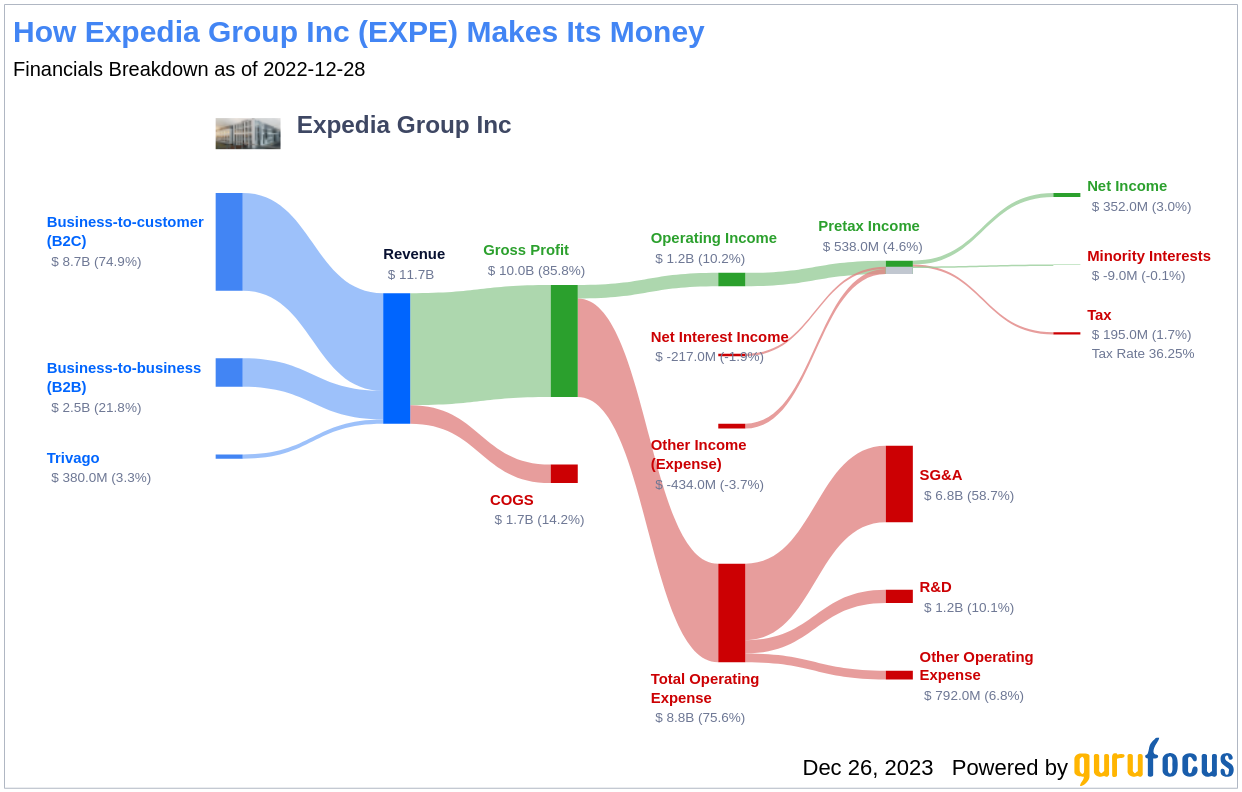

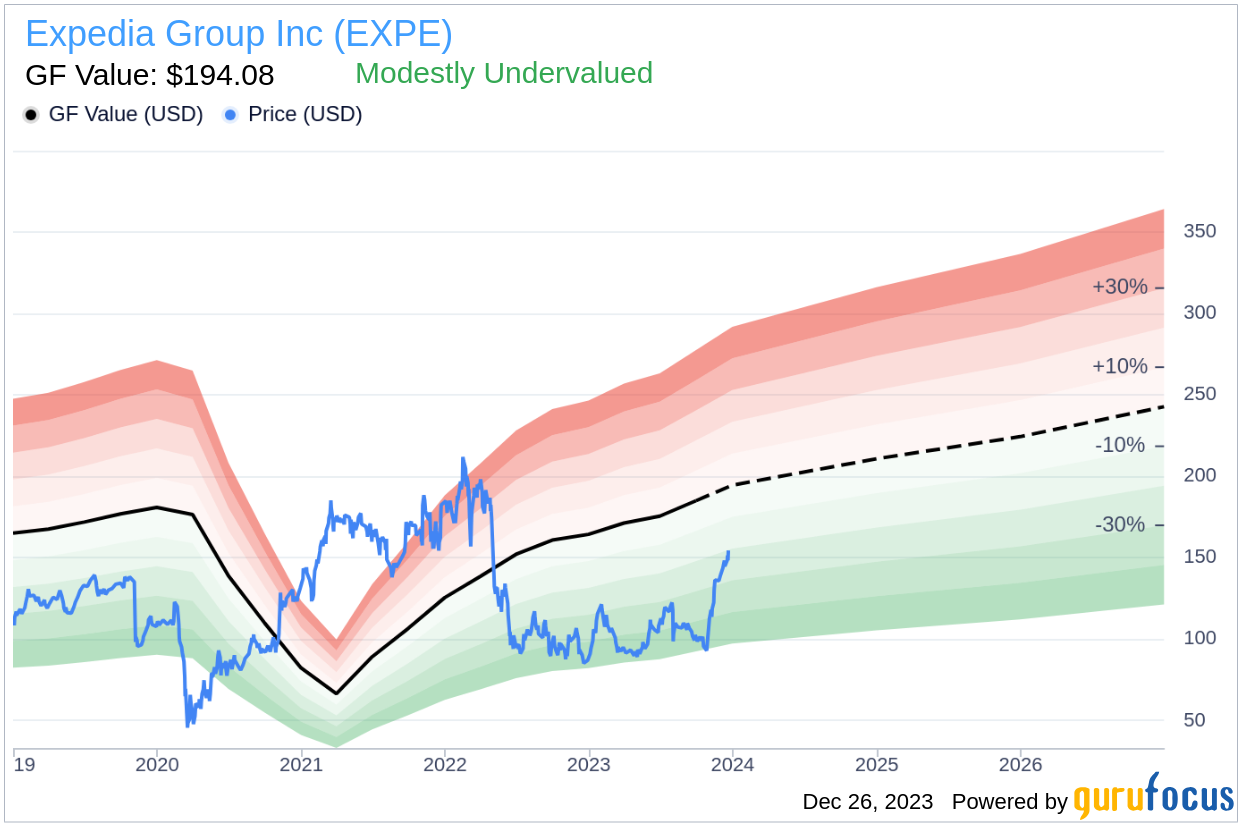

As the world's second-largest online travel agency by bookings, Expedia Group offers a range of services including lodging, air tickets, rental cars, cruises, and more. The company's diverse portfolio of travel booking sites, such as Expedia.com, Hotels.com, and Vrbo, along with its metasearch brand Trivago, has positioned it as a leader in the travel industry. With a current stock price of $153.14 and a market cap of $21.30 billion, Expedia Group's valuation compared to its GF Value of $194.08 is a pivotal aspect for investors to consider.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, incorporating historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. This fair value estimate provides a benchmark for investors, suggesting that stocks priced significantly above the GF Value Line may be overvalued, while those below it could offer higher future returns.

Currently, Expedia Group (EXPE, Financial) is deemed modestly undervalued, indicating that the long-term return on its stock could surpass its business growth. This presents an opportunity for investors looking for potential value in the market.

Link: These companies may deliver higher future returns at reduced risk.Financial Strength

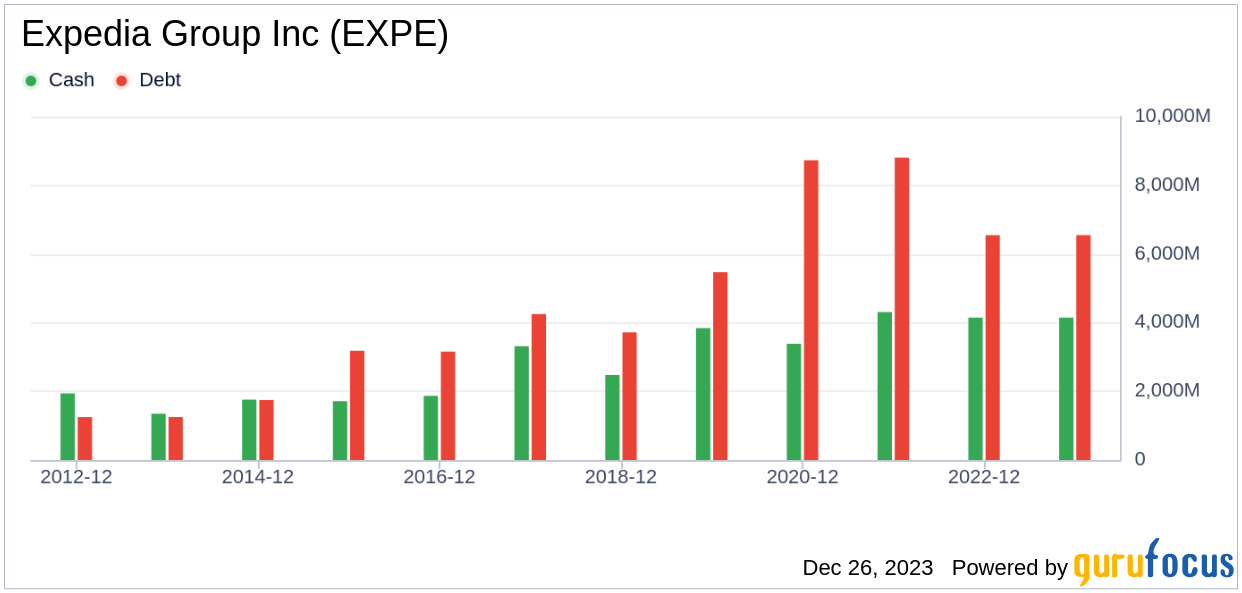

Investing in companies with robust financial strength is crucial to minimize the risk of capital loss. Expedia Group's cash-to-debt ratio of 0.77, which ranks in the upper half of the Travel & Leisure industry, reflects a fair balance sheet according to GuruFocus' ranking of 5 out of 10.

Profitability and Growth

Profitability is often a sign of lower risk and potential for better performance. Expedia Group has maintained profitability for 9 out of the past 10 years, with a 12-month revenue of $12.60 billion and an operating margin that surpasses over half of its industry peers. While its profitability is considered fair, its growth rates are less impressive, falling behind 57.59% of companies in the industry for 3-year average revenue growth and ranking lower than 68.7% for 3-year average EBITDA growth.

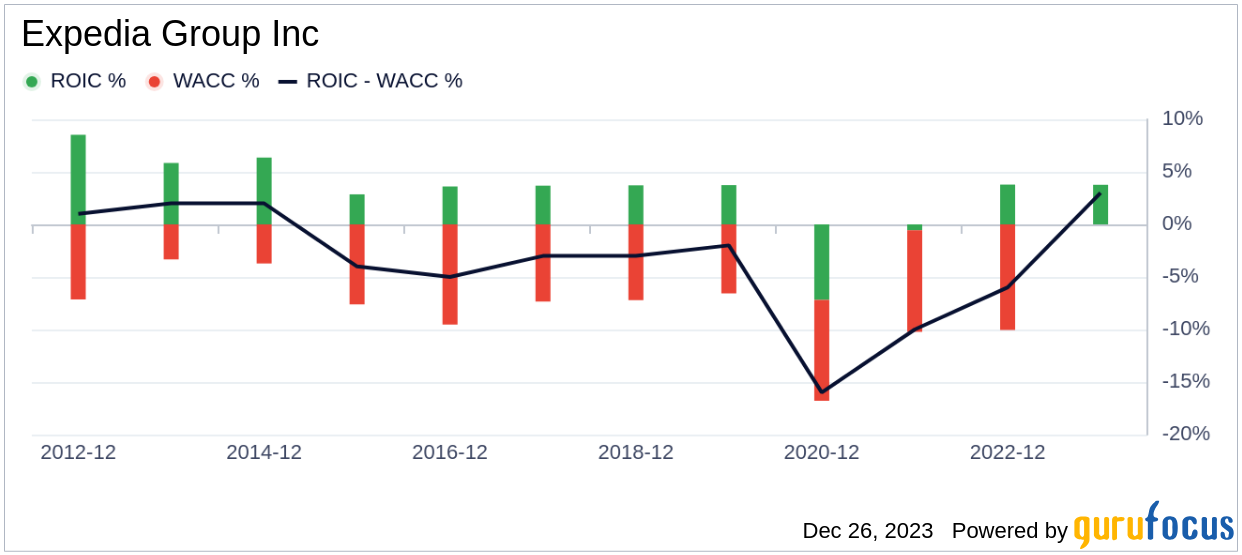

ROIC vs. WACC

Comparing a company's Return on Invested Capital (ROIC) with its Weighted Average Cost of Capital (WACC) provides insight into its value creation. Expedia Group's ROIC of 4.41 is currently below its WACC of 11.09, suggesting that it is not generating sufficient returns relative to its capital costs.

Conclusion

In summary, Expedia Group (EXPE, Financial) appears to be modestly undervalued, with fair financial condition and profitability. However, its growth prospects and current ROIC relative to WACC raise important considerations for investors. For a deeper understanding of Expedia Group's financials, investors are encouraged to review its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.