One sector of the market that has continued to show excellent relative strength this year is utilities. Despite one or two minor bumps in the road for the major indices, the utilities sector has been a safe haven for many income investors seeking both a high dividend yield and capital appreciation. This sector is considered to be one of the most stalwart in terms of its base of established companies providing essential services to nearly every consumer in the country.

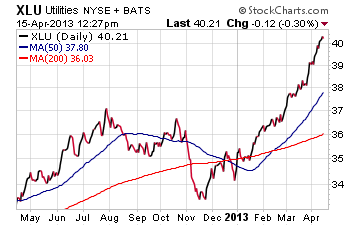

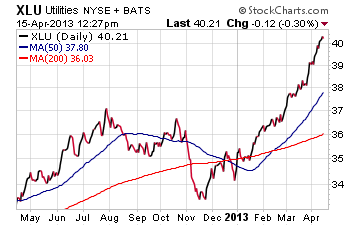

My favorite ETF for monitoring the utility sector is the Utilities Select Sector SPDR (XLU, Financial). This fund is made up of 33 companies whose top holdings include: Duke Energy Corp. New (DUK), Southern Co. (SO) and Dominion Resources Inc. (D). The expense ratio for XLU is a reasonable 0.18% and its current 30-day SEC dividend yield is a healthy 3.51%.

Looking at the chart above for XLU we can see it has increased more than 14% in 2013 with barely a hiccup in terms of volatility. Because this fund is approximately 10% above its 200-day moving average, I would not be looking to establish a new position at these price levels. I would prefer to wait for a pullback to at least the 50-day moving average before buying XLU with new money.

In addition, for those that own this sector, be sure to keep a stop loss in or around the 200-day moving average in order to protect your gains in the event that we see a reversal of the long-term price trend.

Diversify Your Utilities Exposure by Going Global

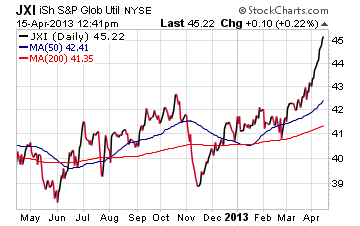

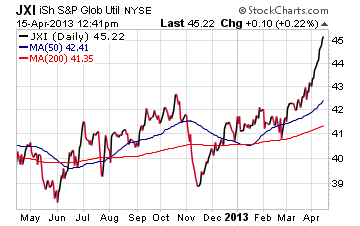

Another way to access the utilities sector is through a more global and diversified portfolio via the iShares S&P Global Utilities ETF (JXI, Financial). This fund is made up of 72 holdings with a 52% weighting in U.S. companies, 12% UK and 6% Germany as the top countries. The gross expense ratio of JXI is 0.48% and its current 30-day SEC yield is 3.99%.

One of the benefits of owning a fund like JXI is that you get exposure to both domestic and international stocks in a single fund. In addition, the yield is more attractive than its domestic counterpart in XLU.

Another item to note from an income standpoint is that JXI only pays distributions semi-annually instead of the typical quarterly calendar that most dividend equity funds adhere to. So investors that are looking for yield will have to be patient when it comes to collecting dividends from this ETF.

High Yielding Utility Fund

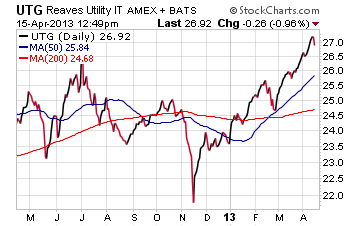

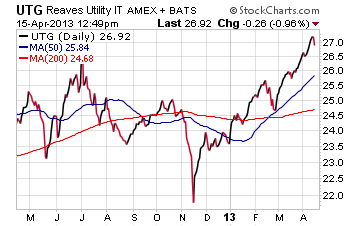

One of my favorite closed-end funds for generating high yield from the utility sector is the Reaves Utility Income Fund (UTG, Financial). This actively managed CEF focuses on a much broader interpretation of utility companies which includes telecommunication stocks, master limited partnerships, and even preferred utilities stocks. The current indicated yield on UTG is 5.85% (distributed monthly) and it is trading at a 4.43% discount to its NAV as of the last trading price.

According to the latest press release by Reaves: "The investment objective of the Fund is to provide a high level of income and total return consisting primarily of tax-advantaged dividend income and capital appreciation."

Because UTG is structured as a closed-end fund it has the capability to use leverage to boost its dividend yield and total returns. According to the last annual report, UTG was using 38% leverage in its portfolio to increase its exposure in the utility sector. As I have mentioned in the past, leverage can be both a blessing and a curse, so investors in UTG need to be mindful of the risks.

The Final Word

I believe that utilities represent an excellent long-term value for both income and growth investors, but putting money to work at these levels is asking for trouble given their lofty price levels. I would look to add exposure on a 5% to 10% pull back in this sector which will present a much better buying opportunity.

Finally, I always recommend that you set a stop loss on your invested positions to guard against downside risk. Its important to be disciplined when investing because there are always exogenous events that can impact even the most well supported investment theme.

Additional disclosure: David Fabian, Fabian Capital Management and/or its clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

My favorite ETF for monitoring the utility sector is the Utilities Select Sector SPDR (XLU, Financial). This fund is made up of 33 companies whose top holdings include: Duke Energy Corp. New (DUK), Southern Co. (SO) and Dominion Resources Inc. (D). The expense ratio for XLU is a reasonable 0.18% and its current 30-day SEC dividend yield is a healthy 3.51%.

Looking at the chart above for XLU we can see it has increased more than 14% in 2013 with barely a hiccup in terms of volatility. Because this fund is approximately 10% above its 200-day moving average, I would not be looking to establish a new position at these price levels. I would prefer to wait for a pullback to at least the 50-day moving average before buying XLU with new money.

In addition, for those that own this sector, be sure to keep a stop loss in or around the 200-day moving average in order to protect your gains in the event that we see a reversal of the long-term price trend.

Diversify Your Utilities Exposure by Going Global

Another way to access the utilities sector is through a more global and diversified portfolio via the iShares S&P Global Utilities ETF (JXI, Financial). This fund is made up of 72 holdings with a 52% weighting in U.S. companies, 12% UK and 6% Germany as the top countries. The gross expense ratio of JXI is 0.48% and its current 30-day SEC yield is 3.99%.

One of the benefits of owning a fund like JXI is that you get exposure to both domestic and international stocks in a single fund. In addition, the yield is more attractive than its domestic counterpart in XLU.

Another item to note from an income standpoint is that JXI only pays distributions semi-annually instead of the typical quarterly calendar that most dividend equity funds adhere to. So investors that are looking for yield will have to be patient when it comes to collecting dividends from this ETF.

High Yielding Utility Fund

One of my favorite closed-end funds for generating high yield from the utility sector is the Reaves Utility Income Fund (UTG, Financial). This actively managed CEF focuses on a much broader interpretation of utility companies which includes telecommunication stocks, master limited partnerships, and even preferred utilities stocks. The current indicated yield on UTG is 5.85% (distributed monthly) and it is trading at a 4.43% discount to its NAV as of the last trading price.

According to the latest press release by Reaves: "The investment objective of the Fund is to provide a high level of income and total return consisting primarily of tax-advantaged dividend income and capital appreciation."

Because UTG is structured as a closed-end fund it has the capability to use leverage to boost its dividend yield and total returns. According to the last annual report, UTG was using 38% leverage in its portfolio to increase its exposure in the utility sector. As I have mentioned in the past, leverage can be both a blessing and a curse, so investors in UTG need to be mindful of the risks.

The Final Word

I believe that utilities represent an excellent long-term value for both income and growth investors, but putting money to work at these levels is asking for trouble given their lofty price levels. I would look to add exposure on a 5% to 10% pull back in this sector which will present a much better buying opportunity.

Finally, I always recommend that you set a stop loss on your invested positions to guard against downside risk. Its important to be disciplined when investing because there are always exogenous events that can impact even the most well supported investment theme.

Additional disclosure: David Fabian, Fabian Capital Management and/or its clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.