Whenever we see a modest pull back in the market the question on every investor's mind is: Does this dip represent a buying opportunity or is it time to bank some gains and stand aside?

The answer to this question is largely dependent on your portfolio makeup, asset allocation, time horizon, risk tolerance and investment objectives. This is a perfect time to survey the landscape and determine if the investments in your portfolio are performing as expected or dragging down your returns. In addition, it can serve as an opportunity to build your watch list and prepare to deploy capital to areas of the market that you want exposure to.

Market Analysis

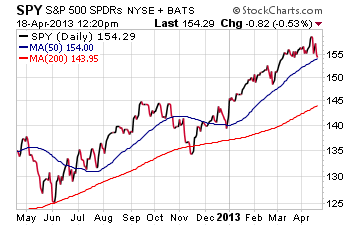

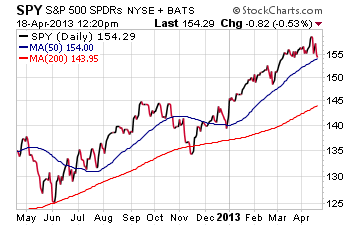

The first yellow flag that I have on my radar is the SPDR S&P 500 (SPY, Financial) today pulled back to its 50-day moving average (blue line). This is the first time this year that the large cap benchmark index has touched this trend line and we will be watching closely for follow through in the days and weeks ahead.

If SPY pierces its 50-day moving average and heads for the 200-day moving average, I will have a higher level of concern for the strength of this rally. As a trend follower, I will be looking to get more defensive if the broad market breaks below the 200-day average. This long-term trend line has historically been a significant level of support for stocks and is one that many institutional investors also monitor.

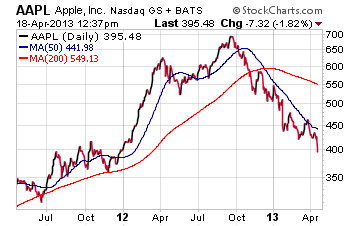

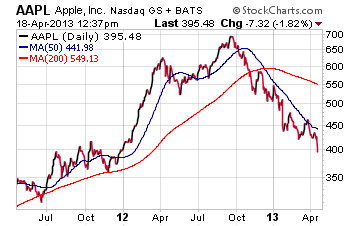

Another area of concern for me, besides the widely publicized bear market in gold, is the move today in Apple Inc. (AAPL, Financial) breaking below the $400 price mark and setting a new 52-week low.

The real question is whether or not AAPL can hold the $350 level which is the next line of significant support on the chart. I am not an owner of AAPL stock but it is a company that I track closely because it is an excellent barometer of consumer spending and investor confidence in the technology sector.

Two Ways to Play This Market

As an investment adviser I am always counseling my clients to remain neutral on the market and not let emotion impact any investment decision. With that goal in mind its time to look at your options and put in place a game plan to play this market. I still believe that ultimately we are going to see a steeper price correction on the horizon in 2013, which is why I would be looking to get more defensive with at least a portion of your holdings. There are two ways you can do that:

1. Move out of stocks and into cash or short-duration bonds to ride out the storm.

2. Move out of higher volatility positions and into sectors or allocation strategies that will lower your exposure to a big correction.

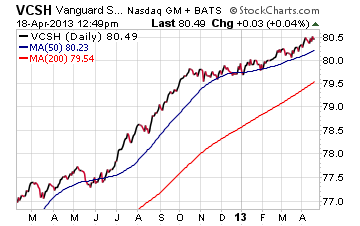

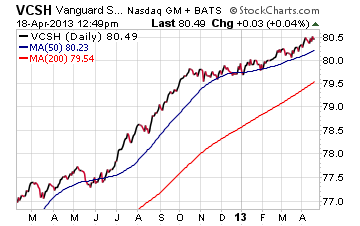

An excellent short duration bond fund to hide out in is the Vanguard Short-Term Corporate Bond Fund ETF (VCSH, Financial). VCSH investors access to a short duration portfolio of investment grade corporate bonds with a very low expense ratio of just 0.12%. The current 30-day SEC yield is 1.17%.

The benefit of owning a fund such as VCSH is that it gives you the ability to still generate a modest yield on your capital without being susceptible to a great deal of interest rate risk. Because the fund has an average duration of only 2.9 years and investment-grade credit quality, the share price should remain quite stable over the long term.

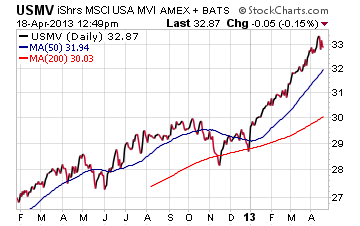

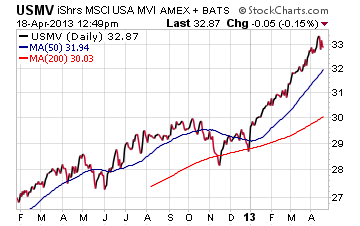

For those investors who still want to have correlation to the stock market in a low volatility position, I would recommend the iShares MSCI U.S. Minimum Volatility ETF (USMV, Financial). This fund holds a basket of stocks that is made up of 125 historically low volatility companies in its index. Generally these companies are more concentrated in the health care, consumer staples, utilities and financial sectors. What you are left with is a unique portfolio of stocks that typically have very steady returns and smaller price fluctuations.

All things being equal, you should see this low volatility fund decline less than its fully loaded index peers during periods of price decline. For trend followers and active managers this type of fund may give us the ability to stay invested during periods of short-term market corrections instead of getting stopped out of a position.

USMV can make an excellent large-cap core holding for investors that still want to have a portion of their portfolio correlated to stocks so that they don't miss out on the next growth phase. It can also make for a great starter position for the portfolio that is lacking stock exposure.

The Final Word

Whether you decide to move your portfolio to a more defensive posture or are looking at this pull back as a buying opportunity, it pays to have a game plan and watch list at your disposal. Write down 3-5 stocks or ETFs that you want to buy and look to purchase them opportunistically at inflection points in the market. In addition, make sure that you are thoroughly researching your investments ahead of time and setting a trailing stop loss to guard against downside risk.

Additional disclosure: David Fabian, Fabian Capital Management, and/or its clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

The answer to this question is largely dependent on your portfolio makeup, asset allocation, time horizon, risk tolerance and investment objectives. This is a perfect time to survey the landscape and determine if the investments in your portfolio are performing as expected or dragging down your returns. In addition, it can serve as an opportunity to build your watch list and prepare to deploy capital to areas of the market that you want exposure to.

Market Analysis

The first yellow flag that I have on my radar is the SPDR S&P 500 (SPY, Financial) today pulled back to its 50-day moving average (blue line). This is the first time this year that the large cap benchmark index has touched this trend line and we will be watching closely for follow through in the days and weeks ahead.

If SPY pierces its 50-day moving average and heads for the 200-day moving average, I will have a higher level of concern for the strength of this rally. As a trend follower, I will be looking to get more defensive if the broad market breaks below the 200-day average. This long-term trend line has historically been a significant level of support for stocks and is one that many institutional investors also monitor.

Another area of concern for me, besides the widely publicized bear market in gold, is the move today in Apple Inc. (AAPL, Financial) breaking below the $400 price mark and setting a new 52-week low.

The real question is whether or not AAPL can hold the $350 level which is the next line of significant support on the chart. I am not an owner of AAPL stock but it is a company that I track closely because it is an excellent barometer of consumer spending and investor confidence in the technology sector.

Two Ways to Play This Market

As an investment adviser I am always counseling my clients to remain neutral on the market and not let emotion impact any investment decision. With that goal in mind its time to look at your options and put in place a game plan to play this market. I still believe that ultimately we are going to see a steeper price correction on the horizon in 2013, which is why I would be looking to get more defensive with at least a portion of your holdings. There are two ways you can do that:

1. Move out of stocks and into cash or short-duration bonds to ride out the storm.

2. Move out of higher volatility positions and into sectors or allocation strategies that will lower your exposure to a big correction.

An excellent short duration bond fund to hide out in is the Vanguard Short-Term Corporate Bond Fund ETF (VCSH, Financial). VCSH investors access to a short duration portfolio of investment grade corporate bonds with a very low expense ratio of just 0.12%. The current 30-day SEC yield is 1.17%.

The benefit of owning a fund such as VCSH is that it gives you the ability to still generate a modest yield on your capital without being susceptible to a great deal of interest rate risk. Because the fund has an average duration of only 2.9 years and investment-grade credit quality, the share price should remain quite stable over the long term.

For those investors who still want to have correlation to the stock market in a low volatility position, I would recommend the iShares MSCI U.S. Minimum Volatility ETF (USMV, Financial). This fund holds a basket of stocks that is made up of 125 historically low volatility companies in its index. Generally these companies are more concentrated in the health care, consumer staples, utilities and financial sectors. What you are left with is a unique portfolio of stocks that typically have very steady returns and smaller price fluctuations.

All things being equal, you should see this low volatility fund decline less than its fully loaded index peers during periods of price decline. For trend followers and active managers this type of fund may give us the ability to stay invested during periods of short-term market corrections instead of getting stopped out of a position.

USMV can make an excellent large-cap core holding for investors that still want to have a portion of their portfolio correlated to stocks so that they don't miss out on the next growth phase. It can also make for a great starter position for the portfolio that is lacking stock exposure.

The Final Word

Whether you decide to move your portfolio to a more defensive posture or are looking at this pull back as a buying opportunity, it pays to have a game plan and watch list at your disposal. Write down 3-5 stocks or ETFs that you want to buy and look to purchase them opportunistically at inflection points in the market. In addition, make sure that you are thoroughly researching your investments ahead of time and setting a trailing stop loss to guard against downside risk.

Additional disclosure: David Fabian, Fabian Capital Management, and/or its clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.