Many investors are worried about the effects of Obamacare on their health insurance, quality of medical care and the economy. But one health care sub-sector that is booming despite the proposed changes is the biotechnology industry.

Biotech has always been a niche piece of many growth investors' portfolios, but with the blossoming of the ETF industry you now have access to these cutting edge companies in just a single fund. So far this year biotech is one of the leading sectors in terms of absolute performance which is why it's a perfect way to diversify your portfolio in a sector that continues to add alpha.

Large Cap Biotech

The largest ETF in the biotech sector is the iShares Biotech ETF (IBB). The fund currently has $2.88 billion in total assets spread among 120 companies with an expense ratio of 0.48%. The top three holdings in IBB include: Regeneron Pharmaceuticals (REGN), Gilead Sciences Inc. (GILD), and Amgen Inc. (AMGN). Together these three companies make up approximately 26% of the fund.

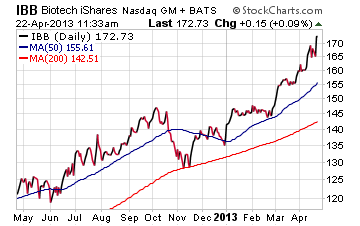

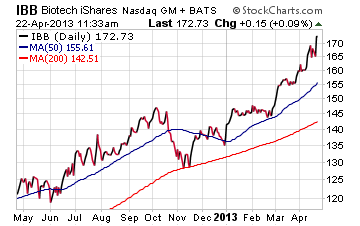

Looking at a chart of IBB above you can see that it is breaking out to new highs today. So far this year the fund is up nearly 26% which handily beats the 20% return of the more diversified Healthcare Select Sector SPDR (XLV). While biotech stocks tend to be more volatile than the broad-based healthcare sector, they have also posted periods of much stronger returns.

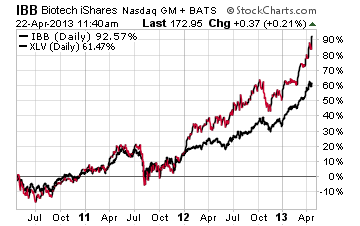

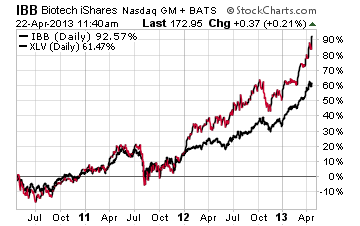

This chart compares the price performance of IBB versus XLV over the last three years. As you can see the biotech ETF has beaten its benchmark sector by over 30% during that time frame.

However, there are also periods of time when increased volatility in the biotech sector has led to significant underperformance versus the defensive stalwart XLV.

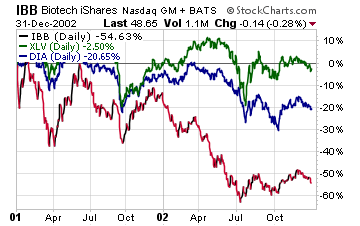

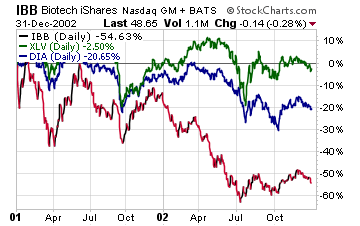

This chart compares the performance of IBB, XLV, and the SPDR Dow Jones Industrial Average ETF (DIA) from January 2001 to January 2003. As you can see, the Healthcare Select Sector SPDR held up the best during the sell-off with only minimal losses while the iShares Biotech ETF fell more than 50%. The mega-cap weighted DIA was right in the middle.

Investors should consider that with increased industry specialty in the healthcare sector that you are going to naturally see more volatility.

Equal Weight Biotech

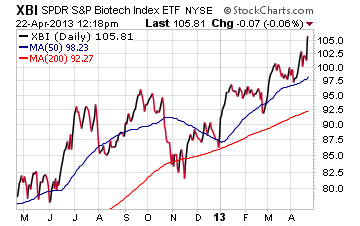

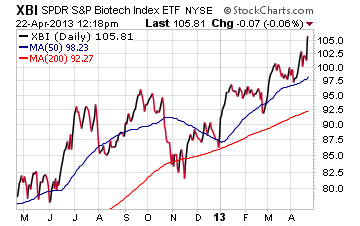

Another well-known ETF in the biotech sector that takes a more equal weight approach to its indexing methodology is the SPDR S&P Biotech ETF (XBI). This fund currently has over $800 million in total assets spread among 53 holdings with an expense ratio of just 0.35%. The average market cap of the companies in XBI is $8.9 billion vs. $24 billion for IBB. Therefore XBI has more exposure to small and mid-cap companies that differentiates it from its peers.

According to the fund providers website, the indexing methodology for XBI is as follows: "The S&P Biotechnology Select Industry Index is an equal-weighted index that draws constituents from the GICS Biotechnology sub-industry." Therefore no single company is overweight to ensure that you get more uniform exposure across the industry.

XBI is also hitting new year-to-date highs today with its 2013 performance gain of 20.50%.

The Final Word

There are numerous other ETFs in the biotech field that have different indexing methodologies and merits. IBB and XBI are two of the biggest and most well-established funds that give investors confidence in their track record and trading liquidity.

The healthcare industry is continuing to evolve with additional regulatory and governmental oversight. I believe that biotechnology stocks are going to continue to thrive given their essential function of discovering new medical advancements.

Investors that have exposure to biotech stocks and ETFs should be mindful of the big run up in price over the last six months. I recommend that you use a trailing stop loss on these positions to guard against downside risk.

In addition, I advise new investors in this sector to wait and buy on a pull back to increase your opportunities for success. The 50-day moving average can be used as a buy point with a tight stop loss.

Additional disclosure: David Fabian, Fabian Capital Management, and/or its clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

Biotech has always been a niche piece of many growth investors' portfolios, but with the blossoming of the ETF industry you now have access to these cutting edge companies in just a single fund. So far this year biotech is one of the leading sectors in terms of absolute performance which is why it's a perfect way to diversify your portfolio in a sector that continues to add alpha.

Large Cap Biotech

The largest ETF in the biotech sector is the iShares Biotech ETF (IBB). The fund currently has $2.88 billion in total assets spread among 120 companies with an expense ratio of 0.48%. The top three holdings in IBB include: Regeneron Pharmaceuticals (REGN), Gilead Sciences Inc. (GILD), and Amgen Inc. (AMGN). Together these three companies make up approximately 26% of the fund.

Looking at a chart of IBB above you can see that it is breaking out to new highs today. So far this year the fund is up nearly 26% which handily beats the 20% return of the more diversified Healthcare Select Sector SPDR (XLV). While biotech stocks tend to be more volatile than the broad-based healthcare sector, they have also posted periods of much stronger returns.

This chart compares the price performance of IBB versus XLV over the last three years. As you can see the biotech ETF has beaten its benchmark sector by over 30% during that time frame.

However, there are also periods of time when increased volatility in the biotech sector has led to significant underperformance versus the defensive stalwart XLV.

This chart compares the performance of IBB, XLV, and the SPDR Dow Jones Industrial Average ETF (DIA) from January 2001 to January 2003. As you can see, the Healthcare Select Sector SPDR held up the best during the sell-off with only minimal losses while the iShares Biotech ETF fell more than 50%. The mega-cap weighted DIA was right in the middle.

Investors should consider that with increased industry specialty in the healthcare sector that you are going to naturally see more volatility.

Equal Weight Biotech

Another well-known ETF in the biotech sector that takes a more equal weight approach to its indexing methodology is the SPDR S&P Biotech ETF (XBI). This fund currently has over $800 million in total assets spread among 53 holdings with an expense ratio of just 0.35%. The average market cap of the companies in XBI is $8.9 billion vs. $24 billion for IBB. Therefore XBI has more exposure to small and mid-cap companies that differentiates it from its peers.

According to the fund providers website, the indexing methodology for XBI is as follows: "The S&P Biotechnology Select Industry Index is an equal-weighted index that draws constituents from the GICS Biotechnology sub-industry." Therefore no single company is overweight to ensure that you get more uniform exposure across the industry.

XBI is also hitting new year-to-date highs today with its 2013 performance gain of 20.50%.

The Final Word

There are numerous other ETFs in the biotech field that have different indexing methodologies and merits. IBB and XBI are two of the biggest and most well-established funds that give investors confidence in their track record and trading liquidity.

The healthcare industry is continuing to evolve with additional regulatory and governmental oversight. I believe that biotechnology stocks are going to continue to thrive given their essential function of discovering new medical advancements.

Investors that have exposure to biotech stocks and ETFs should be mindful of the big run up in price over the last six months. I recommend that you use a trailing stop loss on these positions to guard against downside risk.

In addition, I advise new investors in this sector to wait and buy on a pull back to increase your opportunities for success. The 50-day moving average can be used as a buy point with a tight stop loss.

Additional disclosure: David Fabian, Fabian Capital Management, and/or its clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.