One energy company has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

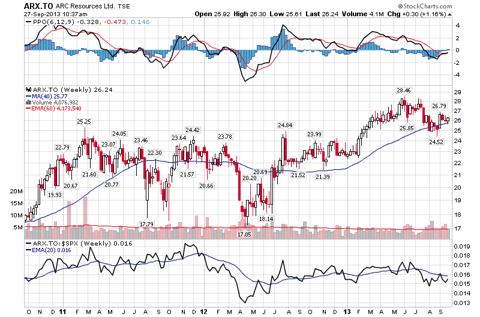

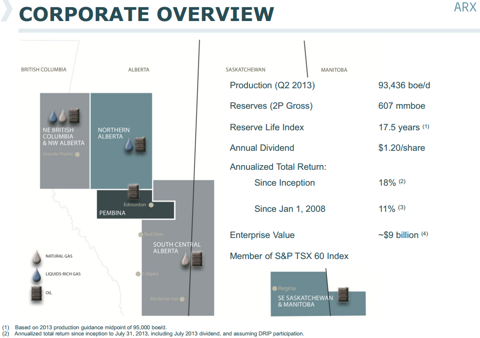

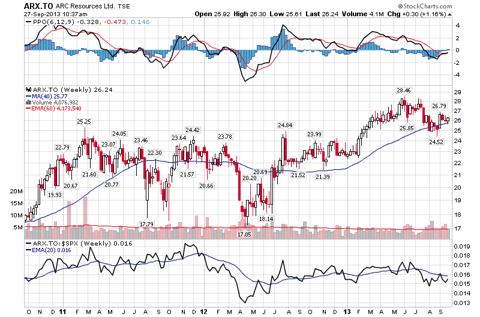

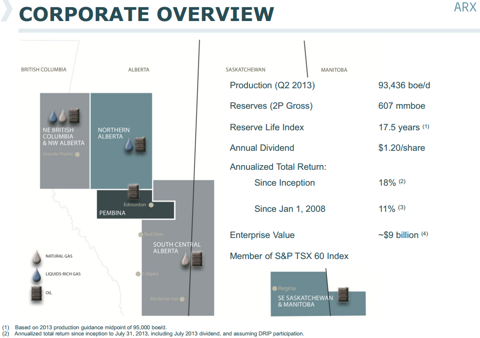

ARC Resources (TSX:ARX) engages in the acquisition, development, exploration and production of oil and gas in Western Canada.

Insider Buying During the Last 30 Days

Here is a table of ARC Resources' insider-trading activity by calendar month.

There have been 120,753 shares purchased and there have been zero shares sold by the insiders since April 2013.

Financials

ARC Resources reported the second-quarter financial results on Aug. 1 with the following highlights:

Outlook

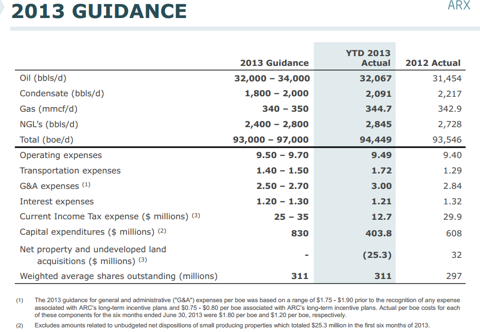

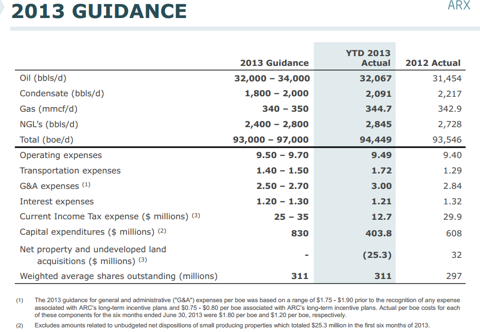

ARC expects third quarter 2013 production to decline relative to the second quarter, prior to increasing in the fourth quarter of 2013 as new pad wells are brought on production at Ante Creek. ARC expects 2013 full year production to average between 93,000 and 97,000 boe per day.

Competition

ARC Resources' competitors include Pengrowth Energy (TSX:PGF), Baytex Energy (TSX:BTE) and Lightstream Resources (TSX:LTS).

Here is a table of these competitors' insider-trading activities during the last six months.

Only ARC Resources has seen intensive insider buying during the last 30 days.

Conclusion

There have been eight different insiders buying ARC Resources and there have not been any insiders selling ARC Resources during the last 30 days. Six of these eight insiders increased their holdings by more than 10%.

There are seven analyst buy ratings, 10 neutral ratings and one sell rating with an average target price of $29.24. ARC is paying $0.10 monthly dividends, which gives the stock a dividend yield of 4.6%. ARC's proved plus probable reserves are 607 mmboe. I believe the stock could be a good pick from the current price level based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

ARC Resources (TSX:ARX) engages in the acquisition, development, exploration and production of oil and gas in Western Canada.

Insider Buying During the Last 30 Days

- Terry Anderson purchased 15,210 shares on Aug. 27 to 28 and currently controls 43,741 shares or less than 0.1% of the company. Terry Anderson is senior vice president, engineering and land of ARC Resources. Terry Anderson increased his holdings by 53.3% during the last 30 days.

- Jay Billesberger purchased 1,314 shares on Sept. 18 pursuant to a purchase/ownership plan. Jay Billesberger currently controls 3,536 shares or less than 0.1% of the company. Jay Billesberger is vice president, information technology of ARC Resources. Jay Billesberger increased his holdings by 59.1% during the last 30 days.

- Terrence Gill purchased 13,583 shares on Sept. 18 pursuant to a purchase/ownership plan. Terrence Gill currently controls 28,806 shares or less than 0.1% of the company. Terrence Gill is senior vice president, corporate services of ARC Resources. Terrence Gill increased his holdings by 89.2% during the last 30 days.

- Neil Groeneveld purchased 2,303 shares on Sept. 16 to 18 pursuant to a purchase/ownership plan. Neil Groeneveld currently controls 31,754 shares or less than 0.1% of the company. Neil Groeneveld is vice president, geosciences and exploration of ARC Resources. Neil Groeneveld increased his holdings by 7.8% during the last 30 days.

- Cameron Kramer purchased 10,096 shares on Sept. 18 pursuant to a purchase/ownership plan. Cameron Kramer currently controls 13,096 shares or less than 0.1% of the company. Cameron Kramer is senior vice president and chief operating officer of ARC Resources. Cameron Kramer increased his holdings by 336.5% during the last 30 days.

- Wayne Lentz purchased 2,103 shares on Sept. 18 pursuant to a purchase/ownership plan. Wayne Lentz currently controls 8,214 shares or less than 0.1% of the company. Wayne Lentz is vice president, strategy and business development of ARC Resources. Wayne Lentz increased his holdings by 34.4% during the last 30 days.

- Karen Nielsen purchased 2,540 shares on Sept. 6 and currently controls 2,540 shares or less than 0.1% of the company. Karen Nielsen is vice president, operations of ARC Resources. Karen Nielsen increased her holdings from zero shares to 2,540 shares during the last 30 days.

- Myron Stadnyk purchased 18,952 shares on Aug. 27 to Sept. 18 and currently controls 248,281 shares or less than 0.1% of the company. Myron Stadnyk is president and chief executive officer of ARC Resources. Myron Stadnyk increased his holdings by 8.3% during the last 30 days.

Here is a table of ARC Resources' insider-trading activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| September 2013 | 40,891 | 0 |

| August 2013 | 37,682 | 0 |

| July 2013 | 891 | 0 |

| June 2013 | 4,922 | 0 |

| May 2013 | 35,565 | 0 |

| April 2013 | 802 | 0 |

There have been 120,753 shares purchased and there have been zero shares sold by the insiders since April 2013.

Financials

ARC Resources reported the second-quarter financial results on Aug. 1 with the following highlights:

| Funds from operations | $201.2 million |

| Net income | $93.3 million |

| Net debt | $883.7 million |

| Production | 93,436 boepd |

Outlook

ARC expects third quarter 2013 production to decline relative to the second quarter, prior to increasing in the fourth quarter of 2013 as new pad wells are brought on production at Ante Creek. ARC expects 2013 full year production to average between 93,000 and 97,000 boe per day.

Competition

ARC Resources' competitors include Pengrowth Energy (TSX:PGF), Baytex Energy (TSX:BTE) and Lightstream Resources (TSX:LTS).

Here is a table of these competitors' insider-trading activities during the last six months.

Only ARC Resources has seen intensive insider buying during the last 30 days.

Conclusion

There have been eight different insiders buying ARC Resources and there have not been any insiders selling ARC Resources during the last 30 days. Six of these eight insiders increased their holdings by more than 10%.

There are seven analyst buy ratings, 10 neutral ratings and one sell rating with an average target price of $29.24. ARC is paying $0.10 monthly dividends, which gives the stock a dividend yield of 4.6%. ARC's proved plus probable reserves are 607 mmboe. I believe the stock could be a good pick from the current price level based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.