O'Reilly Automotive Inc (ORLY, Financial) has recently captured the attention of investors and financial analysts with its strong financial performance. With a current share price of $1,083.94 and a daily gain of 3.16%, complemented by a three-month change of 3.71%, the company shows promising signs of substantial growth. A detailed analysis, supported by the GF Score, positions O'Reilly Automotive Inc as a frontrunner for future market leadership.

What Is the GF Score?

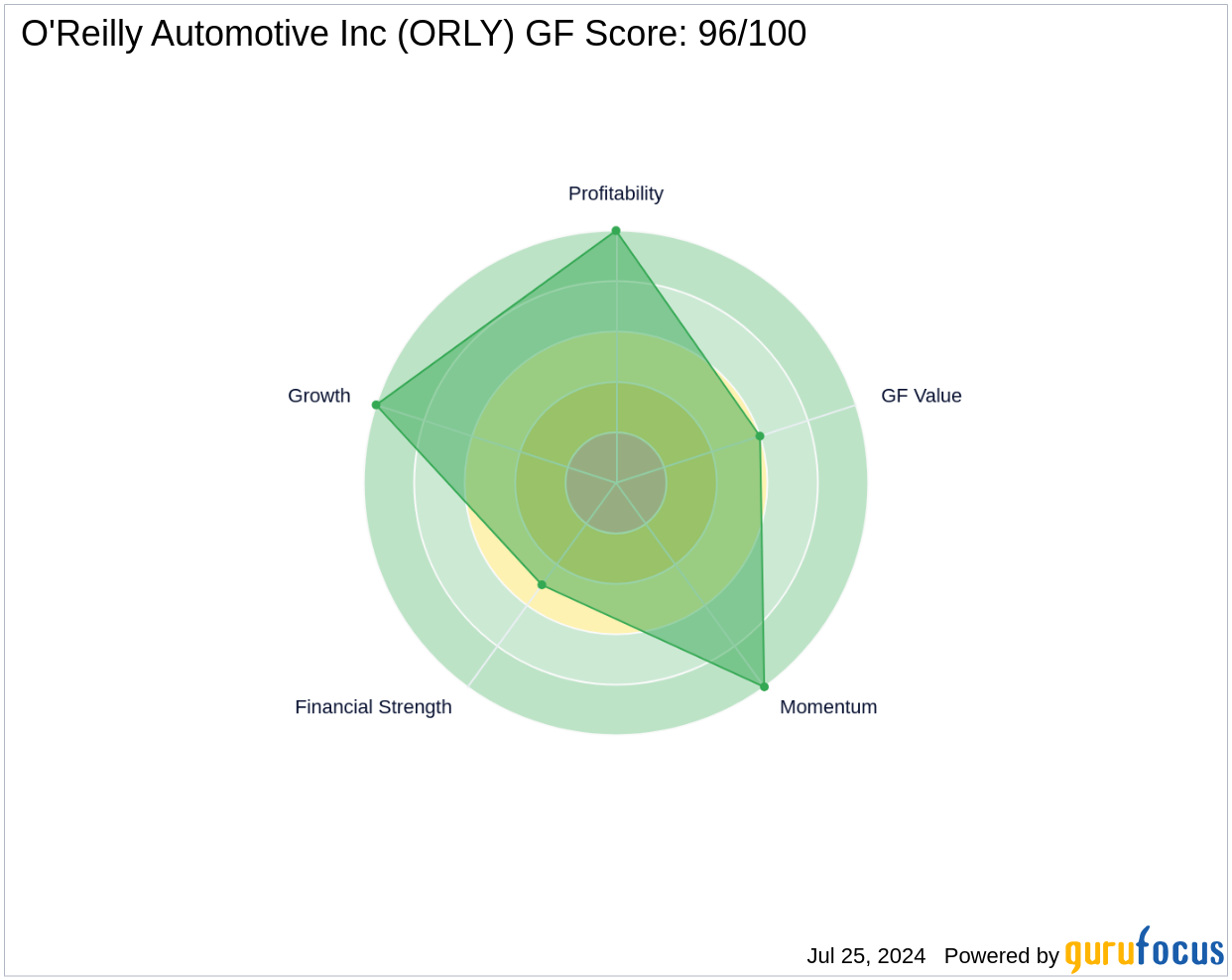

The GF Score is a proprietary ranking system from GuruFocus, assessing stocks based on five key aspects: financial strength, profitability, growth, GF Value, and momentum. These components are crucial for predicting long-term stock performance. O'Reilly Automotive Inc boasts a GF Score of 96 out of 100, indicating a high potential for market outperformance. Here's a breakdown of its scores:

- Financial strength rank: 5/10

- Profitability rank: 10/10

- Growth rank: 10/10

- GF Value rank: 6/10

- Momentum rank: 10/10

Understanding O'Reilly Automotive Inc's Business

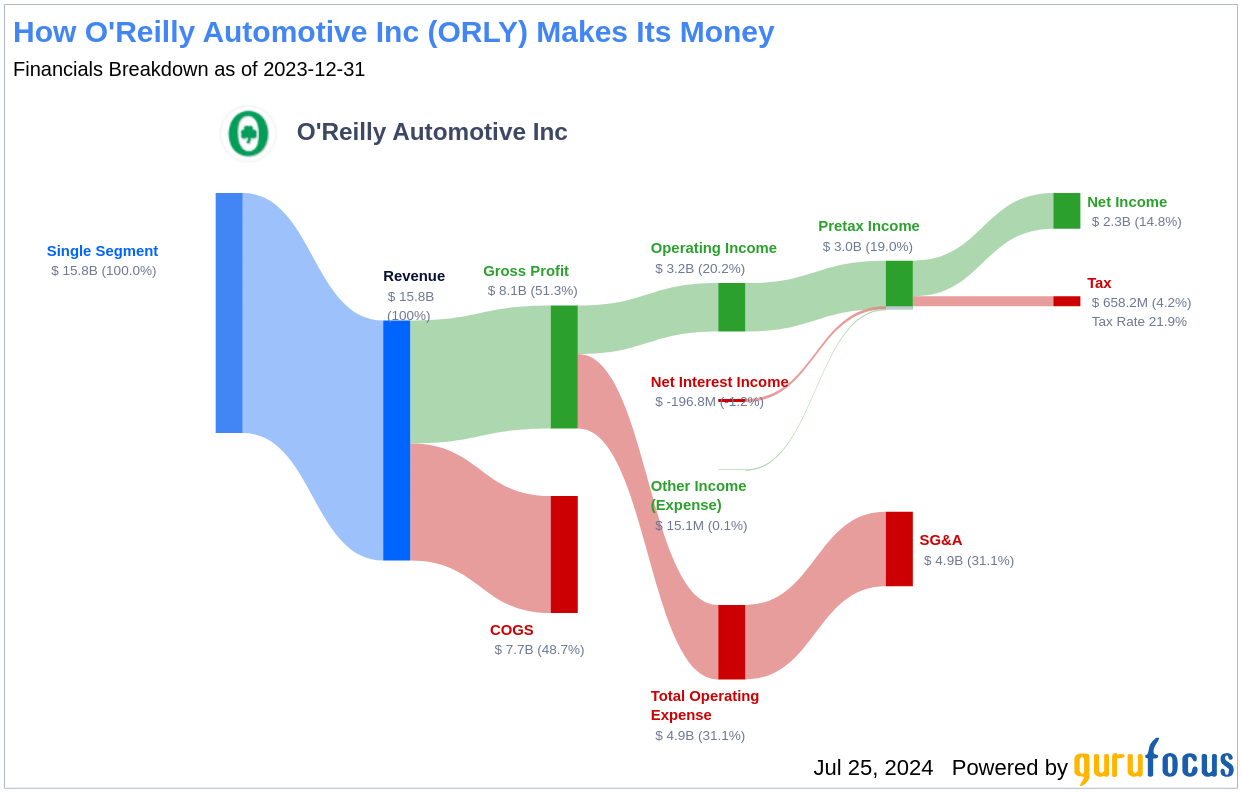

O'Reilly Automotive Inc, with a market cap of $62.91 billion and annual sales of $16.08 billion, operates as a leading aftermarket automotive parts retailer in the U.S. and Mexico. The company serves both DIY customers and professional service providers through over 6,000 stores. O'Reilly stands out in the fragmented auto parts industry by offering superior customer service and a robust distribution network, ensuring a wide range of products for various vehicle makes and models.

Profitability and Growth Metrics

O'Reilly Automotive Inc's Operating Margin has shown a steady increase over the past five years, demonstrating enhanced profitability. The company's Piotroski F-Score and Predictability Rank further affirm its solid financial health and consistent operational performance.

Ranked highly in Growth, O'Reilly Automotive Inc has demonstrated a commitment to expansion, evidenced by a 3-Year Revenue Growth Rate of 18.5%, outperforming 77.43% of its industry peers. The company's EBITDA growth also highlights its capability to sustain profitability and expansion.

Conclusion: A Leader Poised for Continued Success

Given O'Reilly Automotive Inc's robust financial strength, impressive profitability, and strategic growth initiatives, the GF Score underscores the company's strong position for potential market outperformance. Investors looking for high-performing stocks should consider O'Reilly Automotive Inc as a compelling option.

For more insights into companies with strong GF Scores, visit our GF Score Screen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.