On October 9, 2024, Applied Digital Corp (APLD, Financial) released its 8-K filing for the fiscal first quarter ended August 31, 2024. The company, a leader in next-generation digital infrastructure, reported a significant revenue increase, although it faced challenges with net losses. Applied Digital Corp operates across North America, providing digital infrastructure solutions and cloud services, primarily generating revenue from its Data Center Hosting Business.

Performance Overview and Challenges

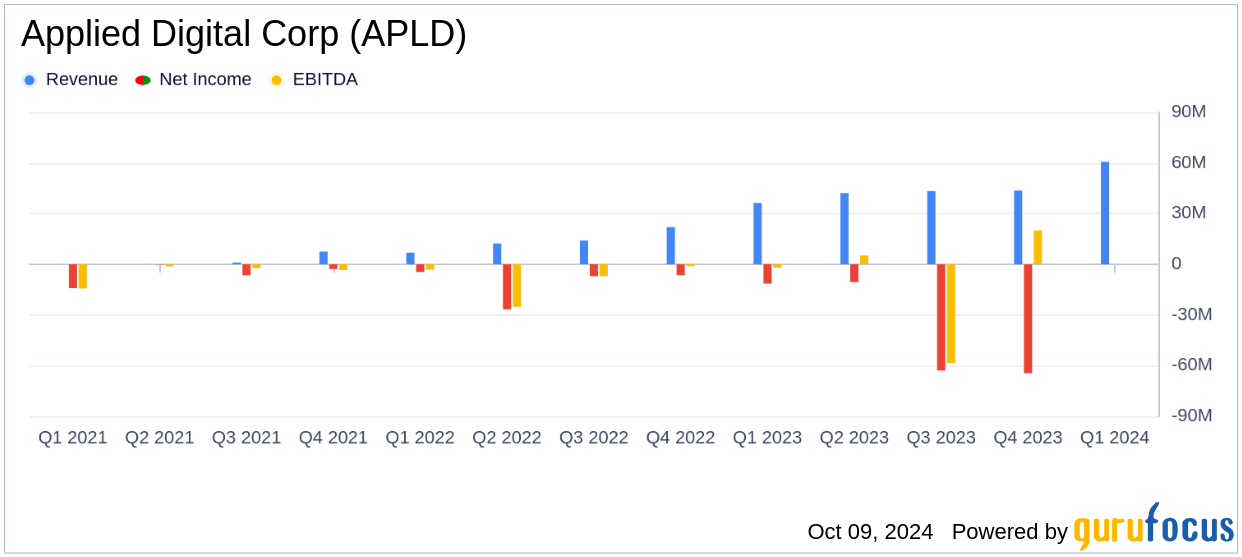

Applied Digital Corp reported revenues of $60.7 million for the fiscal first quarter of 2025, marking a 67% increase from the previous year and surpassing the analyst estimate of $54.85 million. However, the company recorded a net loss of $4.2 million, or $0.03 per share, which was better than the estimated loss of $0.29 per share. The adjusted net loss was $21.6 million, impacted by $4.4 million in expenses from facilities and equipment not yet generating revenue.

The company's performance is crucial as it reflects its ability to scale operations and manage costs effectively in a competitive industry. The challenges, particularly the expenses from non-revenue-generating facilities, highlight potential risks in operational efficiency and capital allocation.

Financial Achievements and Industry Impact

Applied Digital Corp's revenue growth is a significant achievement, driven by its Cloud Services Business, which contributed $25.9 million in revenues. This growth underscores the company's strategic focus on expanding its digital infrastructure capabilities, particularly in high-performance computing (HPC) and artificial intelligence (AI) sectors.

The company's strategic financing of $160 million from institutional investors, including NVIDIA, further solidifies its position in the accelerated compute space. This investment is pivotal for Applied Digital Corp as it aims to enhance its infrastructure and expand its market presence.

Key Financial Metrics and Analysis

From the income statement, the cost of revenues increased to $61.1 million from $25.2 million in the previous year, primarily due to higher depreciation, amortization, and personnel costs. Selling, general, and administrative expenses decreased to $14.3 million from $16.2 million, indicating improved cost management.

The balance sheet shows an increase in cash and cash equivalents to $86.6 million, up from $31.7 million at the end of fiscal 2024, alongside a rise in debt to $143.6 million from $125.4 million. This liquidity position is crucial for funding ongoing and future projects.

Wes Cummins, Chairman and CEO of Applied Digital, commented: “After the close of the quarter, our balance sheet significantly improved due to strategic investments from a group of institutional and accredited investors, NVIDIA, and Related Companies. We sincerely appreciate the vote of confidence from our investors and look forward to deploying this capital into high-return projects in the digital infrastructure sector.”

Operational Highlights and Future Prospects

Operationally, Applied Digital Corp added two clusters to its Cloud Services Business, increasing its total to six clusters, each with 1,024 GPUs. The company is also finalizing a lease agreement for a 100 MW facility designed for HPC applications, with plans to expand capacity to 400 MW.

These developments are critical as they align with the company's vision to become a leading platform for HPC data centers. The strategic focus on expanding its infrastructure and capabilities positions Applied Digital Corp to capitalize on the growing demand for digital infrastructure solutions.

Overall, while Applied Digital Corp faces challenges with net losses, its revenue growth and strategic investments indicate a positive trajectory in the digital infrastructure industry. The company's ability to manage costs and leverage strategic partnerships will be key to its future success.

Explore the complete 8-K earnings release (here) from Applied Digital Corp for further details.