Market Overview

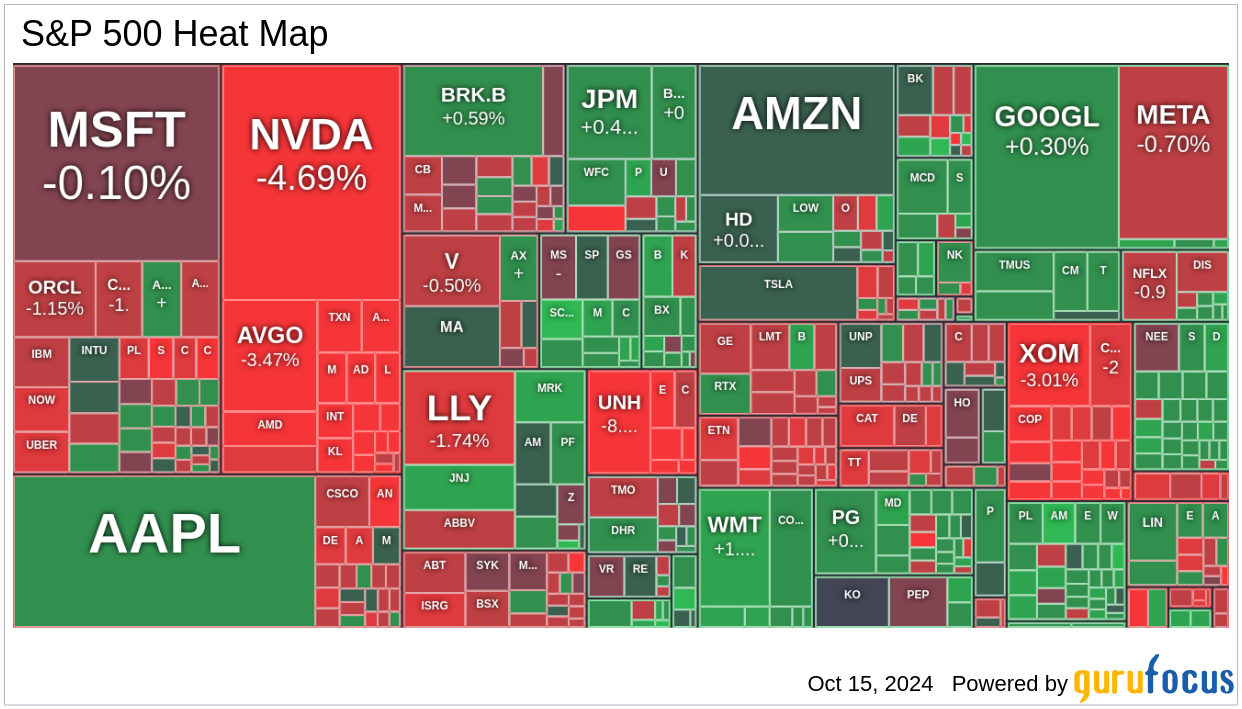

The S&P 500 (-0.8%), Nasdaq Composite (-1.0%), and Dow Jones Industrial Average (-0.8%) closed with significant losses, while the Russell 2000 managed a slight gain of 0.1%. The decline in index levels was largely due to weakness in semiconductor-related stocks. An initial drop in the semiconductor sector followed a Bloomberg report indicating that the Biden administration is considering restricting sales of advanced AI chips to certain countries, particularly in the Persian Gulf.

Semiconductor Sector Impact

The semiconductor sector experienced intensified selling after ASML (ASML, Financial) released its Q3 results, which fell short of investor expectations with below-consensus EPS, revenues, and net bookings. The company also offered weaker-than-expected FY25 revenue guidance, stating that while AI developments are strong, other market segments are slower to recover. This news significantly affected semiconductor stocks, including NVIDIA (NVDA, Financial), contributing to a 5.3% decline in the Philadelphia Semiconductor Index (SOX).

Earnings Reports

Investors also reacted to earnings reports from major companies. UnitedHealth (UNH, Financial), the largest component in the price-weighted DJIA, negatively impacted other health care stocks, with the S&P 500 health care sector declining by 1.2%. Earnings reports from financial sector companies like Goldman Sachs (GS), Bank of America (BAC), and Citigroup (C) were also released, with the financial sector settling 0.3% higher despite mixed reactions to the quarterly results.

Bond Market

- The 10-year yield decreased by three basis points to 4.04%.

- The 2-year yield increased by one basis point to 3.95%.

Year-to-Date Index Performance

- Nasdaq Composite: +22.0% YTD

- S&P 500: +21.9% YTD

- S&P Midcap 400: +13.8% YTD

- Dow Jones Industrial Average: +13.4% YTD

- Russell 2000: +11.0% YTD

Economic Data Review

Today's economic data included the October NY Fed Empire State Manufacturing index, which came in at -11.9, against a consensus of 2.0, down from a prior reading of 11.5.

Guru Stock Picks

T. Rowe Price Japan Fund has made the following transactions:

T Rowe Price Equity Income Fund has made the following transactions:

Chuck Royce has made the following transactions:

Yacktman Fund has made the following transactions:

Yacktman Focused Fund has made the following transactions:

- Reduce in XPAR:BOL by 0.4%

- Sold out in K

- Add in XKRX:012330 by 7.69%

Today's News

ASML Holding (ASML, Financial) saw its stock plummet 17% after releasing a tighter forecast for 2025, attributed to stricter export controls in the Netherlands impacting its market for EUV Lithography. The company narrowed its revenue outlook from €30-40B to €30-35B, with lower margins due to reduced economies of scale. The Dutch government’s recent actions have necessitated export authorizations, affecting ASML's business significantly.

Meta Platforms (META, Financial) has teamed up with Arista Networks (ANET, Financial) to deploy a new Ethernet-based AI cluster, utilizing Arista's 7700R4 Distributed Etherlink Switch for scaling large language models. Despite the collaboration, Arista's shares fell 5% amid concerns over Meta's latest switch announcement. Analysts from Wells Fargo believe these concerns are misplaced and maintain an Overweight rating on Arista with a $390 price target.

Google (GOOG, GOOGL) announced its cloud servers are now running on Nvidia's (NVDA, Financial) Blackwell line. This collaboration aims to build sustainable compute infrastructure, with Google joining the ranks of OpenAI and Microsoft (MSFT) in adopting Nvidia's advanced GPUs. Nvidia's CEO highlighted the high demand for Blackwell GPUs, with positive remarks from Morgan Stanley and Wells Fargo.

Enphase Energy (ENPH, Financial) shares dropped 6.6% after RBC Capital downgraded the stock to Sector Perform, citing competitive market dynamics and a slower growth pace not reflected in estimates. The high interest rate environment and TPO systems' access to higher tax credits pose challenges for Enphase's demand growth, with limited market share gains anticipated, particularly in California.

Super Micro Computer (SMCI, Financial) is launching new AI servers powered by Nvidia's latest Blackwell processors. These liquid-cooled servers are expected to enhance computational power and energy efficiency. Super Micro has started sampling these servers, with full-scale production slated for late Q4, showcasing its expertise in deploying advanced AI infrastructure.

Exxon Mobil (XOM, Financial) plans to sell part of its assets in North Dakota's Bakken shale, seeking at least $500M. The sale includes both operated and non-operated wells, with much of the land undeveloped, potentially attracting buyers. Exxon is a leading producer in the Bakken, with significant daily production from the region.

Celsius Holdings (CELH, Financial) reported a 5.6% increase in sales growth over a recent four-week period, with volume up 11.6% despite a 6% price decline. The company's market share has remained stable, though increased promotional activity by competitors has impacted its value share. Analysts note a slowdown in market share gains due to competitive pressures.

UnitedHealth (UNH, Financial) shares fell after setting a conservative 2025 earnings outlook, below Wall Street expectations. Despite in-line 2024 guidance, the company's CEO cited impacts from Medicare and Medicaid-related factors, including payment cuts and regulatory changes, as reasons for the cautious forecast.

Lam Research (LRCX, Financial) was the most shorted stock in the information technology sector in September, with a short interest of 24.65%. Super Micro Computer (SMCI, Financial) and Enphase Energy (ENPH, Financial) followed with significant short interests, reflecting investor skepticism partly due to reports from short-sellers like Hindenburg Research.

Interactive Brokers Group (IBKR) shares dipped 3.7% in after-hours trading following Q3 earnings that missed analyst estimates. The company's net interest margin compression contributed to the earnings shortfall, despite an increase in customer trading volume.

GameStop (GME) announced a new partnership to grade trading cards, becoming an authorized PSA dealer. This initiative allows customers to have their cards authenticated and graded through select GameStop locations, providing a new service offering for the retailer.

GuruFocus Stock Analysis

- Viatris Settles Lawsuit, Avoids Antitrust Charges, and Advances Effexor Study by Shanti Putri

- Goldman Sachs Raises Nvidia Price Target to $150 Amid AI Market Boom by Nauman Khan

- Akre Capital's Akre Focused Fund 3rd-Quarter Letter: A Review by James Li

- ASML Shares Plummet on Mistakenly-Released Q3 Results by Shanti Putri

- Enphase Energy Falls 8% After RBC Downgrade, Lower Growth and Competition Highlighted by Muslim Farooque