On December 5, 2024, Lands' End Inc (LE, Financial) released its 8-K filing detailing the financial results for the third quarter of fiscal 2024. Lands' End Inc, a U.S.-based multi-channel retailer, specializes in casual clothing, accessories, footwear, and home products, with a significant portion of its revenue generated from the U.S. eCommerce segment.

Performance Overview and Challenges

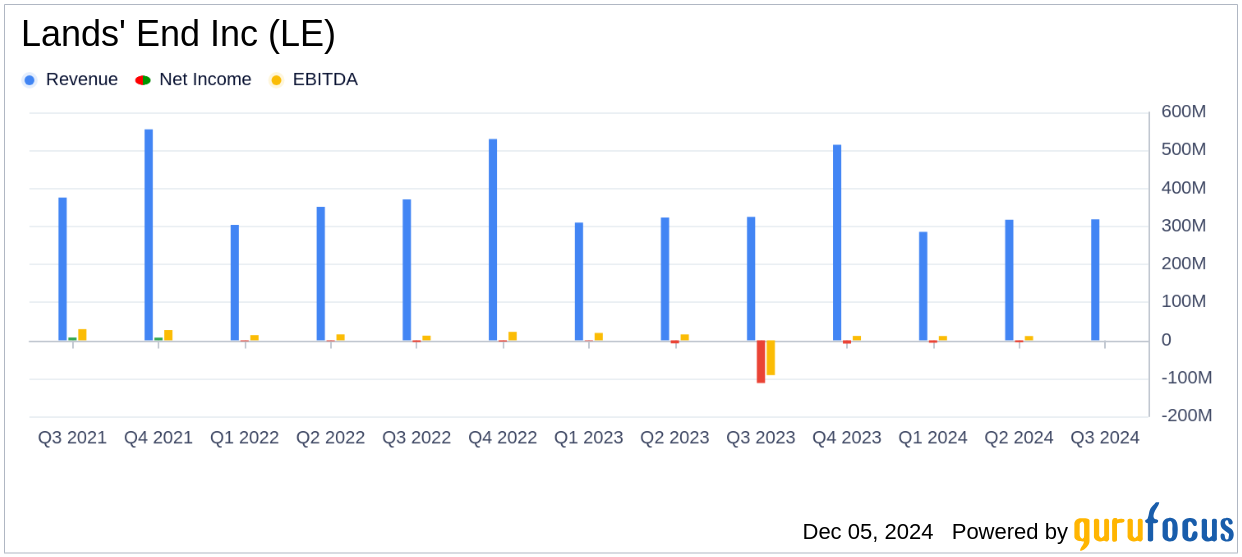

Lands' End Inc reported a net revenue of $318.6 million for Q3 2024, slightly below the $324.7 million from the same period last year. Despite this decline, the company achieved a gross margin increase of approximately 360 basis points to 50.6%, driven by reduced promotional activity and improved supply chain costs. The net loss for the quarter was $0.6 million, or $0.02 per diluted share, missing the analyst estimate of $0.02 earnings per share. However, adjusted net income was $1.8 million, or $0.06 per diluted share, indicating a positive turnaround from the adjusted net loss of $3.6 million in Q3 2023.

Financial Achievements and Industry Context

The retail-cyclical industry, characterized by fluctuating consumer demand, requires companies like Lands' End Inc to maintain robust financial health and adaptability. The company's gross profit increased by 5.6% to $161.1 million, reflecting its strategic focus on higher quality sales and innovation. This improvement is crucial for sustaining competitive advantage and supporting future growth initiatives.

Income Statement and Key Metrics

Despite a decrease in global eCommerce net revenue to $211.1 million, Lands' End Inc managed to enhance its gross profit through strategic inventory management and licensing arrangements. The U.S. eCommerce segment, although experiencing a 2.2% revenue decline, saw a low-double-digit increase when excluding the impact of transitioning kids and footwear products to licensing arrangements. The company's adjusted EBITDA rose to $20.3 million from $17.3 million in the previous year, underscoring operational efficiency improvements.

Balance Sheet and Cash Flow Insights

As of November 1, 2024, Lands' End Inc reported cash and cash equivalents of $30.4 million, down from $36.8 million a year earlier. The company achieved a 20% reduction in inventory, enhancing cash flow and operational efficiency. However, net cash used in operating activities was $12.2 million for the first 39 weeks of fiscal 2024, compared to cash provided by operating activities of $36.7 million in the same period last year, primarily due to changes in working capital.

Strategic Commentary

Andrew McLean, Chief Executive Officer, stated, “Throughout the third quarter, we sustained momentum from our deliberate efforts to drive higher quality sales, resulting in growth in both gross margin and gross profit dollars. Our sharp focus on innovation and creating solutions for life’s every journey is supporting the continued evolution of our strategy and brand.”

Analysis and Outlook

Lands' End Inc's strategic initiatives, including inventory management and licensing transitions, have positively impacted its financial performance, despite challenges in revenue growth. The company's focus on enhancing gross margins and operational efficiency positions it well for future profitability. As the company navigates the retail-cyclical landscape, maintaining this strategic focus will be essential for long-term success.

Explore the complete 8-K earnings release (here) from Lands' End Inc for further details.