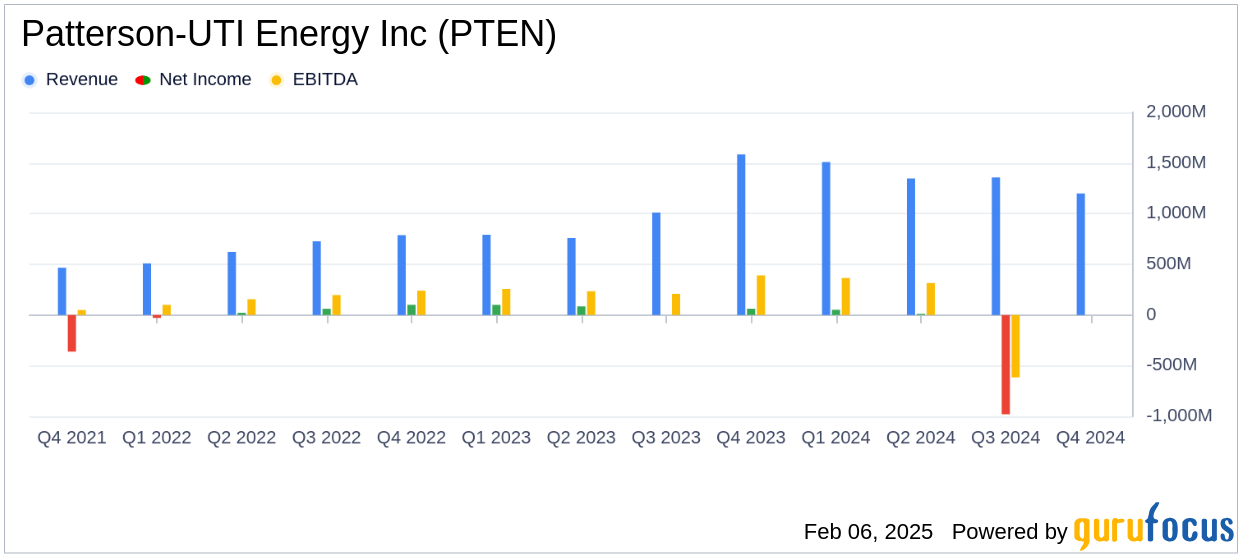

Patterson-UTI Energy Inc (PTEN, Financial) released its 8-K filing on February 6, 2025, detailing its financial results for the fourth quarter ended December 31, 2024. The company, a leading land rig drilling contractor in the United States, reported total revenue of $1.2 billion, falling short of the analyst estimate of $1.24575 billion. The net loss attributable to common stockholders was $52 million, or $0.13 per share, which was below the estimated earnings per share of -$0.08.

Company Overview and Market Position

Patterson-UTI Energy is a major player in the North American drilling and completions services market, controlling nearly 20% of the market following its 2023 merger with NexTier. The company offers a range of services, including directional drilling and tool rental services across most US onshore oil and gas basins.

Performance and Challenges

The company's performance in Q4 2024 was marked by a net loss, influenced by $3 million in merger and integration expenses. Despite these challenges, Patterson-UTI Energy's adjusted EBITDA stood at $225 million, excluding these expenses. The company's financial performance is crucial as it reflects its ability to navigate market conditions and manage operational costs effectively.

Financial Achievements and Industry Importance

For the full year 2024, Patterson-UTI Energy generated $1.2 billion in cash from operations and achieved an adjusted free cash flow of $523 million. These achievements underscore the company's ability to generate significant cash flow, which is vital for sustaining operations and funding strategic initiatives in the capital-intensive oil and gas industry.

Key Financial Metrics and Statements

From the income statement, total revenue for Q4 2024 was $1.162 billion, a decrease from $1.357 billion in the previous quarter. The balance sheet showed total assets of $5.833 billion, down from $7.420 billion at the end of 2023. Cash and cash equivalents increased to $241 million from $192 million, reflecting effective cash management.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Total Revenue | $1.162 billion | $1.357 billion | $1.584 billion |

| Net Loss | $(52) million | $(978) million | $62 million |

| Adjusted EBITDA | $225 million | $275 million | $409 million |

Management Commentary

“We are proud of our success during 2024 in leveraging our differentiated operating footprint to deliver high-end drilling and completion services and products to our customers, resulting in significant free cash flow for our investors,” said Andy Hendricks, Chief Executive Officer.

Analysis and Outlook

Patterson-UTI Energy's strategic focus on leveraging its operational footprint and integrating services has positioned it well in the competitive oil and gas market. However, the company faces challenges such as fluctuating customer demand and integration costs from its recent merger. Looking ahead, the company expects steady activity in the U.S. shale drilling market, with potential growth in natural gas-directed drilling later in 2025.

Overall, Patterson-UTI Energy's financial results highlight its resilience and strategic positioning in the industry, despite the challenges faced in the fourth quarter. The company's ability to generate cash flow and manage costs will be critical as it navigates the evolving market landscape.

Explore the complete 8-K earnings release (here) from Patterson-UTI Energy Inc for further details.