On March 27, 2025, Co-Diagnostics Inc (NASDAQ: CODX) released its 8-K filing detailing its financial performance for the fourth quarter and full year ending December 31, 2024. The molecular diagnostics company, known for its innovative platform in developing diagnostic tests, reported a revenue of $3.9 million for 2024, falling short of the analyst estimate of $4.14 million. The company also reported a net loss of $37.6 million, translating to a loss of $1.24 per share, slightly exceeding the estimated loss of $1.22 per share.

Company Overview and Strategic Developments

Co-Diagnostics Inc is a molecular diagnostics company that develops, licenses, and commercializes molecular technologies. Its low-cost system is used to diagnose various diseases, including tuberculosis, Zika, hepatitis B and C, malaria, dengue, and HIV. The company utilizes its proprietary technology to design specific tests for its Co-Dx PCR platform and to locate genetic markers for applications beyond infectious diseases.

In 2024, Co-Diagnostics made significant strides in its strategic initiatives, including inaugurating a new manufacturing facility in South Salt Lake and advancing its regulatory strategy with the FDA for its Co-Dx PCR Pro Platform. Despite withdrawing its initial 510(k) application, the company plans to submit an enhanced version, aiming to streamline operational and manufacturing processes.

Financial Performance and Challenges

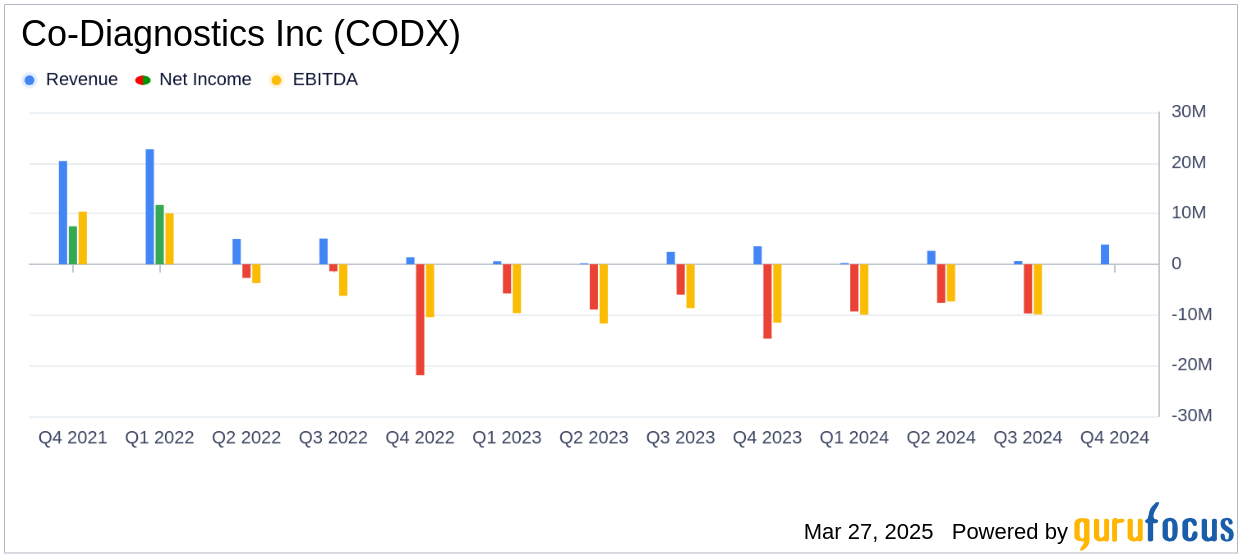

Co-Diagnostics reported a decline in revenue from $6.8 million in 2023 to $3.9 million in 2024, primarily due to reduced grant revenue. Operating expenses decreased by 5.2% to $43.0 million, reflecting lower costs associated with platform development and regulatory submissions. However, the company faced an increased net loss of $37.6 million compared to $35.3 million in the previous year.

The company's financial challenges are underscored by its operating loss of $40.1 million, slightly improved from $42.7 million in 2023. The adjusted EBITDA loss stood at $33.5 million, highlighting ongoing operational inefficiencies. These financial hurdles emphasize the importance of Co-Diagnostics' strategic focus on enhancing its product offerings and operational efficiencies.

Key Financial Metrics and Achievements

Co-Diagnostics ended 2024 with cash, cash equivalents, and marketable securities totaling $29.7 million, a decrease from $58.5 million in 2023. The company's balance sheet reflects a reduction in total assets from $95.3 million to $64.0 million, primarily due to decreased marketable investment securities and cash reserves.

Despite financial setbacks, Co-Diagnostics achieved significant milestones, including the inauguration of a new oligonucleotide synthesis facility in India and participation in key trade shows. These achievements are crucial for maintaining the company's competitive edge in the Medical Devices & Instruments industry.

Income Statement and Balance Sheet Highlights

| Metric | 2024 | 2023 |

|---|---|---|

| Total Revenue | $3.9 million | $6.8 million |

| Net Loss | $37.6 million | $35.3 million |

| Operating Expenses | $43.0 million | $45.3 million |

| Cash and Equivalents | $2.9 million | $14.9 million |

Analysis and Future Outlook

Co-Diagnostics' financial performance in 2024 reflects the challenges faced by the company in a competitive market. The decline in revenue and increased net loss highlight the need for strategic adjustments and operational efficiencies. However, the company's focus on enhancing its product offerings and regulatory strategies positions it well for future growth.

As Co-Diagnostics continues to advance its diagnostic test pipeline and streamline operations, the company remains committed to achieving its 2025 goals. The strategic initiatives undertaken in 2024 are expected to drive future growth and improve financial performance, making Co-Diagnostics a company to watch in the coming years.

Explore the complete 8-K earnings release (here) from Co-Diagnostics Inc for further details.