Palantir Technologies (PLTR, Financial) is gaining attention after the U.S. Army paused its Data Platform 2.0 development, a move considered favorable for Palantir's Vantage platform. Analyst Louie DiPalma from William Blair noted the Army's shift toward Vantage, which secures a significant contract for Palantir, producing around $115 million annually.

This decision may increase Palantir's revenue from $401 million to $619 million over four years, reinforcing its position in other major Department of Defense contracts. Despite this positive outlook, Palantir's shares dipped 5.2% in late trading.

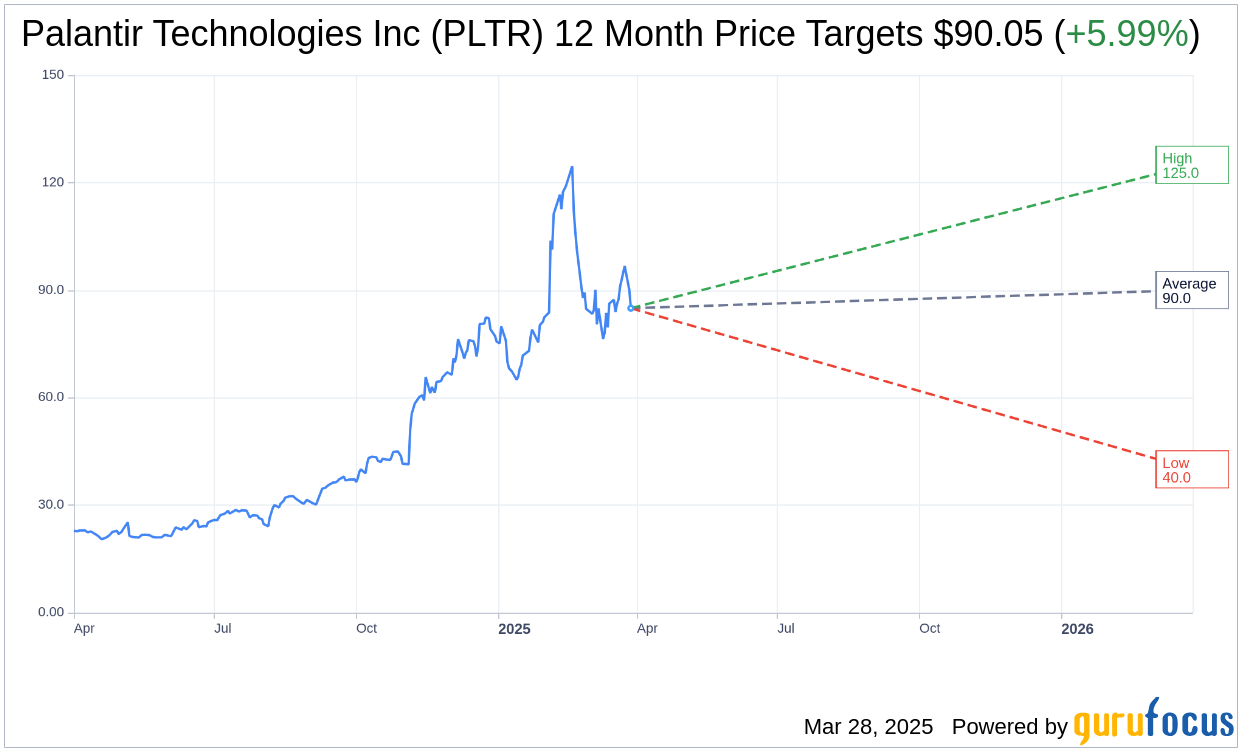

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for Palantir Technologies Inc (PLTR, Financial) is $90.05 with a high estimate of $125.00 and a low estimate of $40.00. The average target implies an upside of 5.99% from the current price of $84.96. More detailed estimate data can be found on the Palantir Technologies Inc (PLTR) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Palantir Technologies Inc's (PLTR, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Palantir Technologies Inc (PLTR, Financial) in one year is $26.18, suggesting a downside of 69.19% from the current price of $84.96. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Palantir Technologies Inc (PLTR) Summary page.