Key Insights:

- Cognizant partners with NVIDIA to enhance its Neuro AI platform, aiming to boost AI adoption across sectors.

- Wall Street analysts see a potential upside of 17.86% in Cognizant's stock over the next year.

- The average brokerage recommendation for Cognizant currently stands at a "Hold" status.

Cognizant and NVIDIA: A Strategic AI Partnership

Cognizant Technology Solutions Corp. (CTSH, Financial) has announced a strategic collaboration with NVIDIA, a leader in AI technology, to enhance its Neuro AI platform. This partnership is set to propel AI integration across multiple industries by leveraging enterprise AI agents, industry-specific language models, and robust AI infrastructure. Recognized as a frontrunner in the AI transformation space, Cognizant holds the fourth position in top AI news updates that investors might have missed.

Wall Street Analysts' Price Forecast

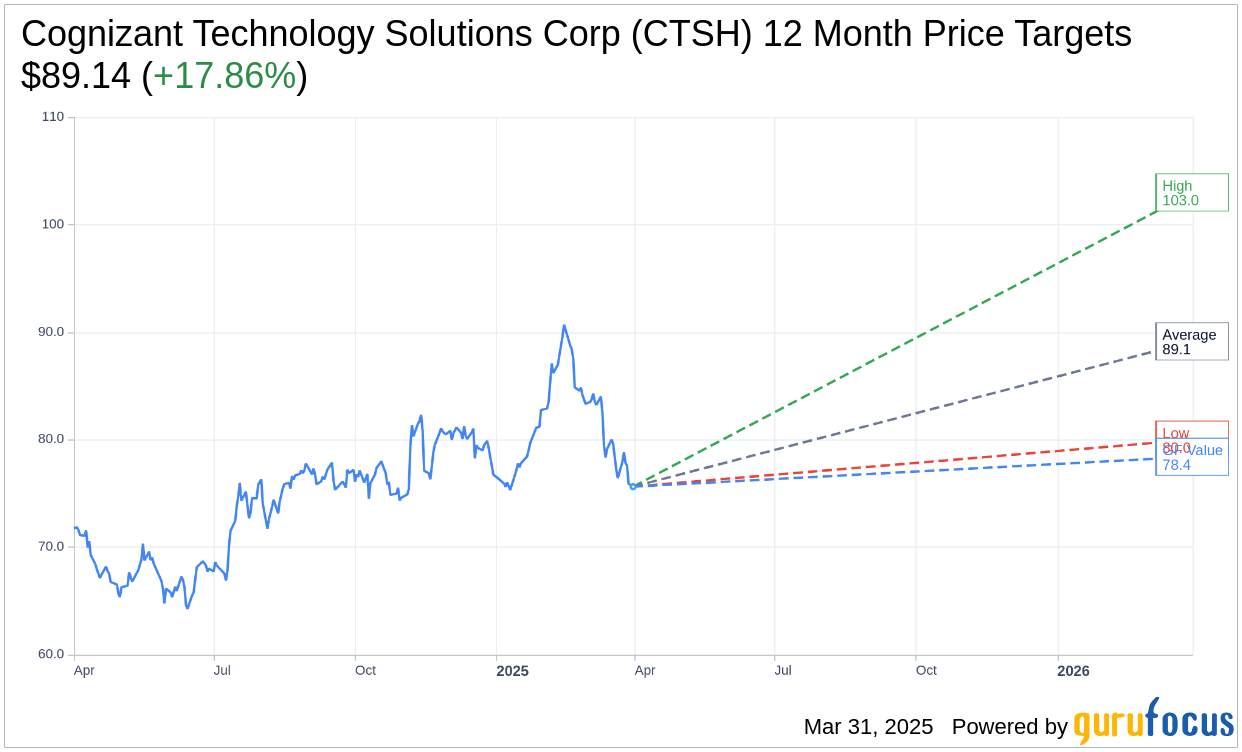

According to one-year price targets from 20 financial analysts, Cognizant Technology Solutions Corp (CTSH, Financial) is projected to reach an average target price of $89.14. This forecast features a high estimate of $103.00 and a low estimate of $80.00. The average target suggests a notable upside of 17.86% from the current trading price of $75.63. For more in-depth projections, you can visit the Cognizant Technology Solutions Corp (CTSH) Forecast page.

Brokerage Recommendations and GF Value Estimate

Based on the consensus from 27 brokerage firms, Cognizant Technology Solutions Corp's (CTSH, Financial) average recommendation is currently at 2.9, indicating a "Hold" status. This recommendation scale ranges from 1, representing a Strong Buy, to 5, symbolizing a Sell.

Furthermore, GuruFocus estimates the GF Value of Cognizant Technology Solutions Corp (CTSH, Financial) to be approximately $78.41 one year from now. This suggests a modest upside of 3.68% from the present price of $75.63. The GF Value represents GuruFocus' evaluation of the stock's fair trading value, derived from historical trading multiples, past business growth, and future business performance predictions. For more comprehensive data, refer to the Cognizant Technology Solutions Corp (CTSH) Summary page.