Key Takeaways:

- Micron Technology's stock fell over 7% in late trading following its announcement of a surcharge due to forthcoming US tariffs.

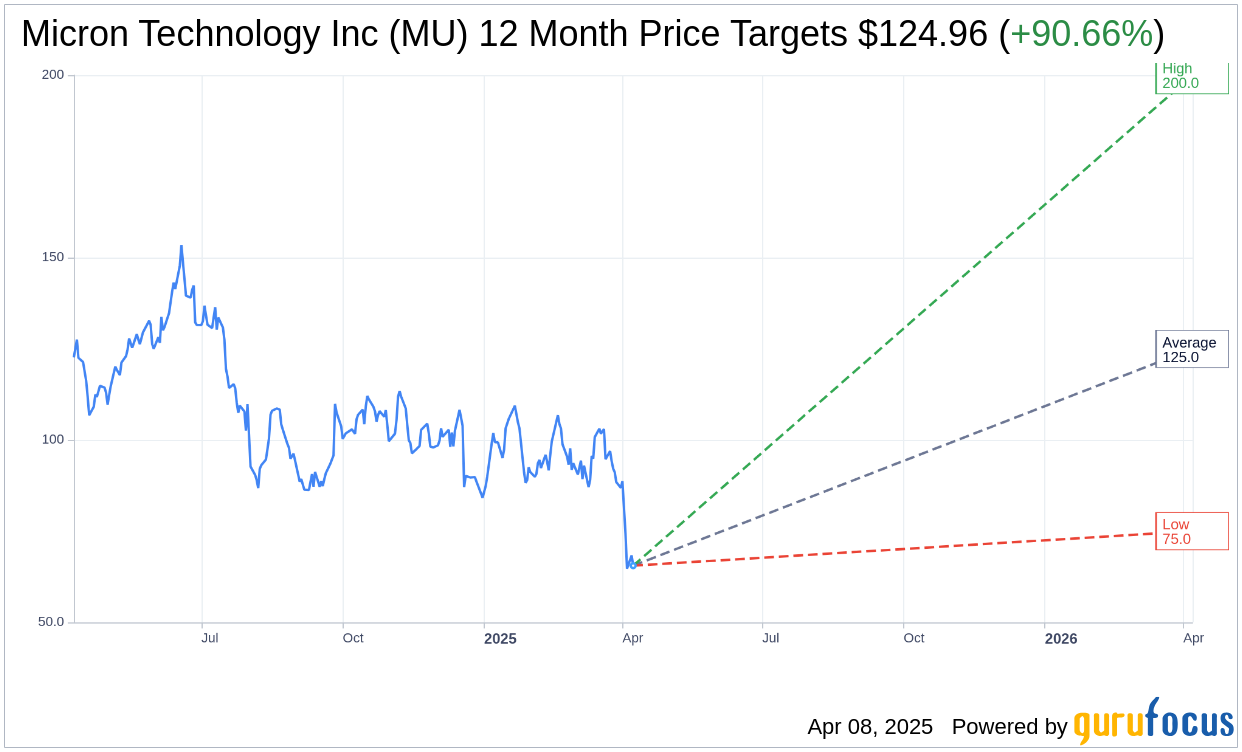

- Analysts forecast a significant potential upside for Micron Technology, with an average price target suggesting a 90.66% increase from current levels.

- GuruFocus estimates a substantial upside, projecting Micron's GF Value at $143.37, indicative of a 118.75% increase from the current stock price.

Market Reaction to Micron's Strategic Pricing Adjustment

Micron Technology (MU, Financial) recently revealed its strategic plan to implement a surcharge on certain products starting April 9. This pricing adjustment comes as a strategic response to the impending US tariffs. The announcement had an immediate impact on the stock market, causing Micron's shares to plummet by over 7% in late trading.

Analyst Price Targets and Potential Growth

In analyzing Micron Technology's trajectory, 33 analysts have provided one-year price targets. The average target set for Micron Technology Inc (MU, Financial) stands at $124.96, with projections ranging from a high of $200.00 to a low of $75.00. Notably, the average target suggests a potential upside of 90.66% from its current trading price of $65.54. For in-depth analysis and updated figures, visit the Micron Technology Inc (MU) Forecast page.

Brokerage Recommendations

Micron Technology Inc (MU, Financial) enjoys a favorable consensus among 40 brokerage firms, as evidenced by its average brokerage recommendation of 1.9, indicating an "Outperform" status. This recommendation scale, which ranges from 1 to 5, ranks Micron closer to the "Strong Buy" end of the spectrum.

Insight from GuruFocus's Proprietary Metrics

According to GuruFocus estimates, the projected GF Value of Micron Technology Inc (MU, Financial) in the next year is estimated at $143.37. This projection reflects a potential upside of 118.75% from its current price of $65.54. The GF Value serves as GuruFocus' assessment of the fair trading value for the stock, derived from historical trading multiples, past business growth, and future performance forecasts. More comprehensive data can be accessed on the Micron Technology Inc (MU) Summary page.