- Keros Therapeutics (KROS, Financial) sees promising growth potential with recent gains and bullish analyst targets.

- Analysts project significant upside, setting high expectations for the stock.

- Strong earnings revisions and favorable analyst ratings suggest continued performance.

Keros Therapeutics (KROS) has caught the attention of investors, recently closing at $11.59, marking an impressive 5.4% gain over the past four weeks. Analysts remain optimistic about the stock's future, with a mean price target projecting a substantial 153.7% upside to $29.40. This positive outlook is further supported by robust earnings estimate revisions and a Zacks Rank #2 (Buy), indicating potential for further gains. Let’s delve deeper into what makes Keros a standout choice for investors.

Wall Street Analysts Forecast

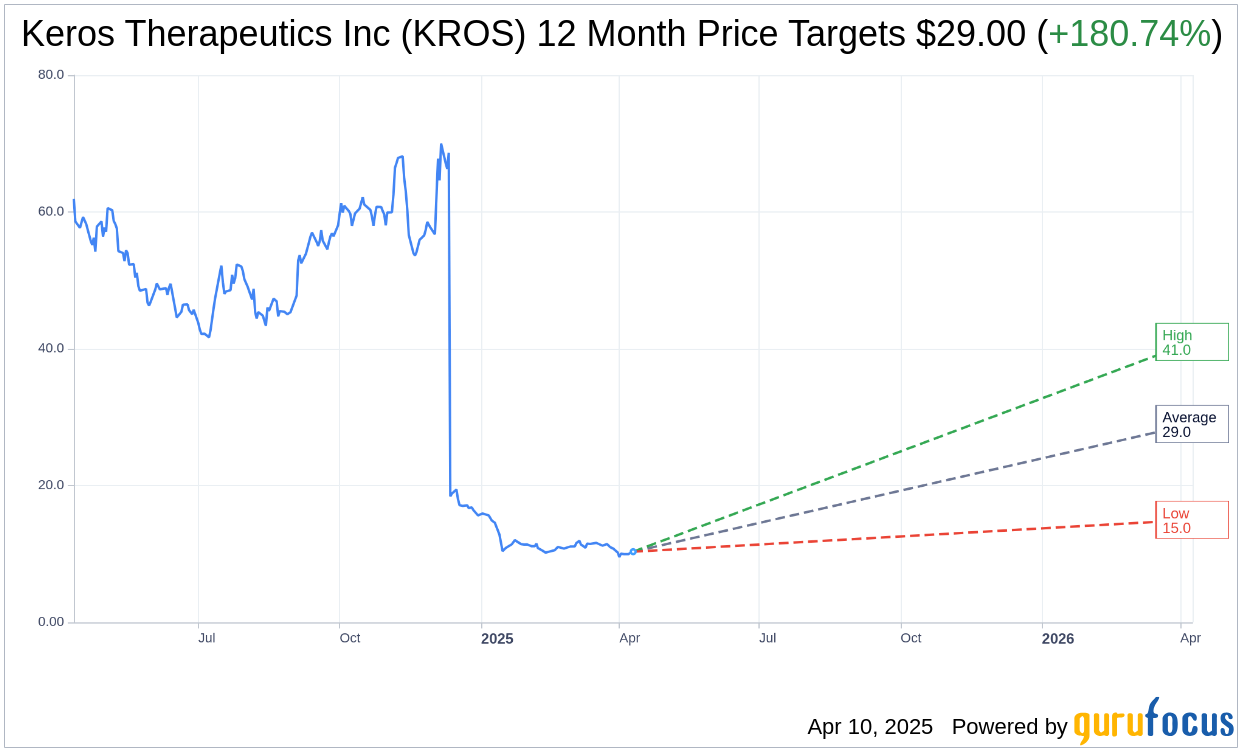

According to price predictions provided by nine analysts, Keros Therapeutics Inc (KROS, Financial) is anticipated to reach an average target price of $29.00 within a year. The estimates range from a high of $41.00 to a low of $15.00, with the average target suggesting a remarkable 180.74% upside from the current trading price of $10.33. Investors can find more comprehensive estimate data on the Keros Therapeutics Inc (KROS) Forecast page.

Analyst Ratings Endorse Outperformance

Further solidifying Keros Therapeutics' appeal, the consensus recommendation from 13 brokerage firms offers a strong endorsement of its potential. The stock holds an average brokerage recommendation of 2.1, signifying an "Outperform" status. In this rating scale, 1 stands for Strong Buy, while 5 indicates Sell. This positive consensus highlights the market's confidence in Keros Therapeutics' promising growth trajectory.

With such a compelling combination of analyst support, price target projections, and favorable revisions, Keros Therapeutics Inc (KROS, Financial) stands as a noteworthy contender for investors seeking significant growth opportunities in their portfolios.