- Super Micro Computer, Inc. (SMCI, Financial) is capitalizing on the AI sector's growth with innovative technologies.

- Despite a dip in 2024, the stock has risen over 12% year-to-date, fueled by strategic partnerships and product advancements.

- Analysts' projections see substantial gains, reflected in optimistic price targets and solid recommendation ratings.

Super Micro Computer, Inc. (SMCI) is strategically positioning itself to harness the expansion of the AI industry, leveraging its advanced server solutions. Although the company is projected to face a 64% decline in 2024, it has still achieved a 12.08% increase year-to-date. This upward trajectory is supported by anticipated revenue growth, driven by the deployment of Nvidia's Blackwell GPUs and SMCI's cutting-edge cooling technologies.

Wall Street Analysts Forecast

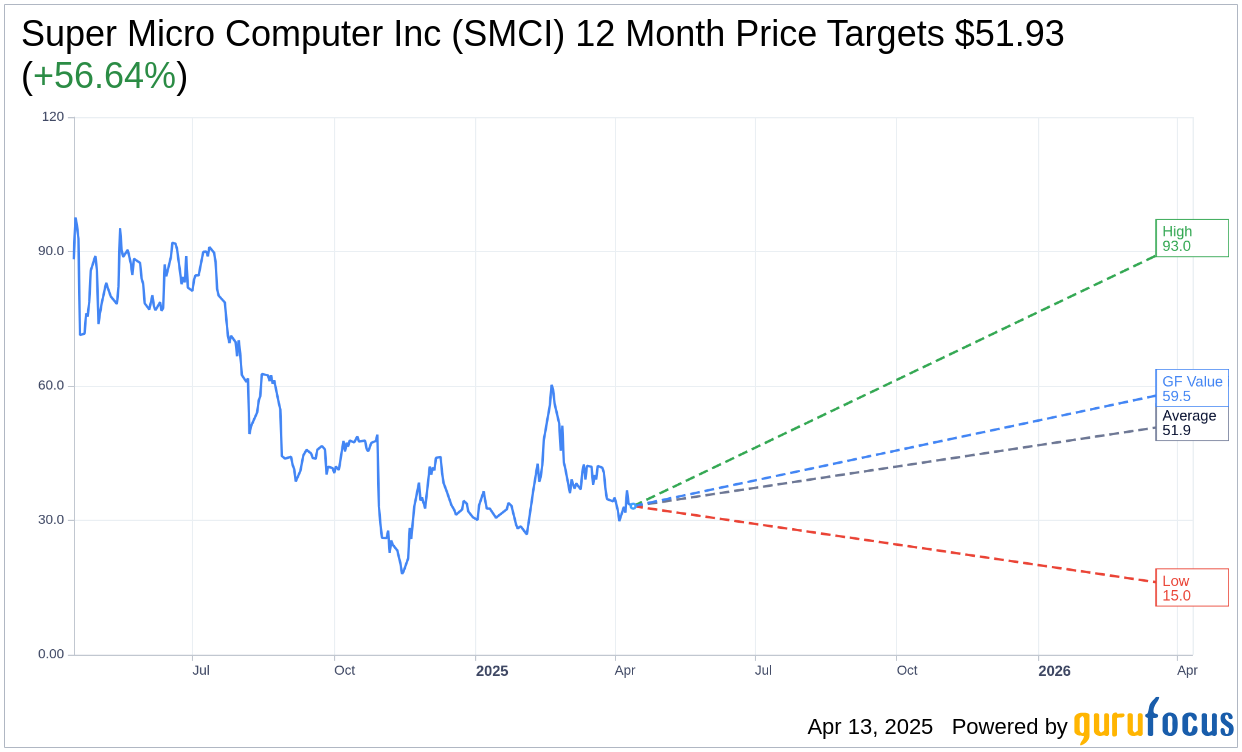

Wall Street analysts provide a positive outlook for Super Micro Computer Inc (SMCI, Financial), with 12 analysts setting an average one-year price target of $51.93. This target spans from a high of $93.00 to a low of $15.00, representing a potential upside of 56.64% from the current trading price of $33.15. For more comprehensive estimate data, visit the Super Micro Computer Inc (SMCI) Forecast page.

The consensus recommendation from 14 brokerage firms rates Super Micro Computer Inc's (SMCI, Financial) stock at 2.8, denoting a "Hold" status. This rating uses a scale from 1 to 5, where 1 indicates a Strong Buy, and 5 signifies a Sell recommendation.

According to GuruFocus estimates, the projected GF Value for Super Micro Computer Inc (SMCI, Financial) within a year stands at $59.55, offering a potential upside of 79.64% from its current price of $33.15. The GF Value metric represents GuruFocus' estimate of the stock's fair trading value, derived from historical trading multiples and past business performance, alongside future business performance projections. Further detailed information is available on the Super Micro Computer Inc (SMCI) Summary page.