In the latest trading session, U.S. equity futures took a downturn after two days of gains. The S&P 500 slipped by 0.4%, the Nasdaq 100 saw a 0.5% decrease, and the Dow Jones Industrial Average fell by 0.3%. The mood in the market was initially buoyed by exemptions for smartphones, computers, and chips from reciprocal tariffs, but caution returned as the U.S. Commerce Department initiated an investigation into how chips and chip equipment might affect national security, maintaining a level of uncertainty in the sector.

During the day's earlier trading, the tech sector registered only slight increases, while utilities and consumer staples outperformed with their defensive qualities. In commodities, WTI crude oil remained stable above $61 per barrel, and gold prices showed a minor increase to $3,229 per ounce.

On Wall Street, several companies experienced notable movements post-earnings announcements. Skillsoft (SKIL) saw an increase of 3.6%, while Capital Southwest (CSWC) rose by 2.6%. Conversely, Applied Digital (APLD) dropped by 14.3%, Ontrak (OTRK) by 5.4%, FB Financial (FBK) by 5.1%, Kestra Medical Technologies (KMTS) by 3.5%, and Pinnacle Financial Partners (PNFP) experienced a 1.5% decline.

Among the significant decreases was Allegro MicroSystems (ALGM, Financial), which fell by 13.5% following the decision by On Semiconductor (ON) to withdraw from a planned $6.9 billion acquisition. This unexpected move contributed to the volatility seen in the semiconductor sector amid ongoing regulatory scrutiny.

Wall Street Analysts Forecast

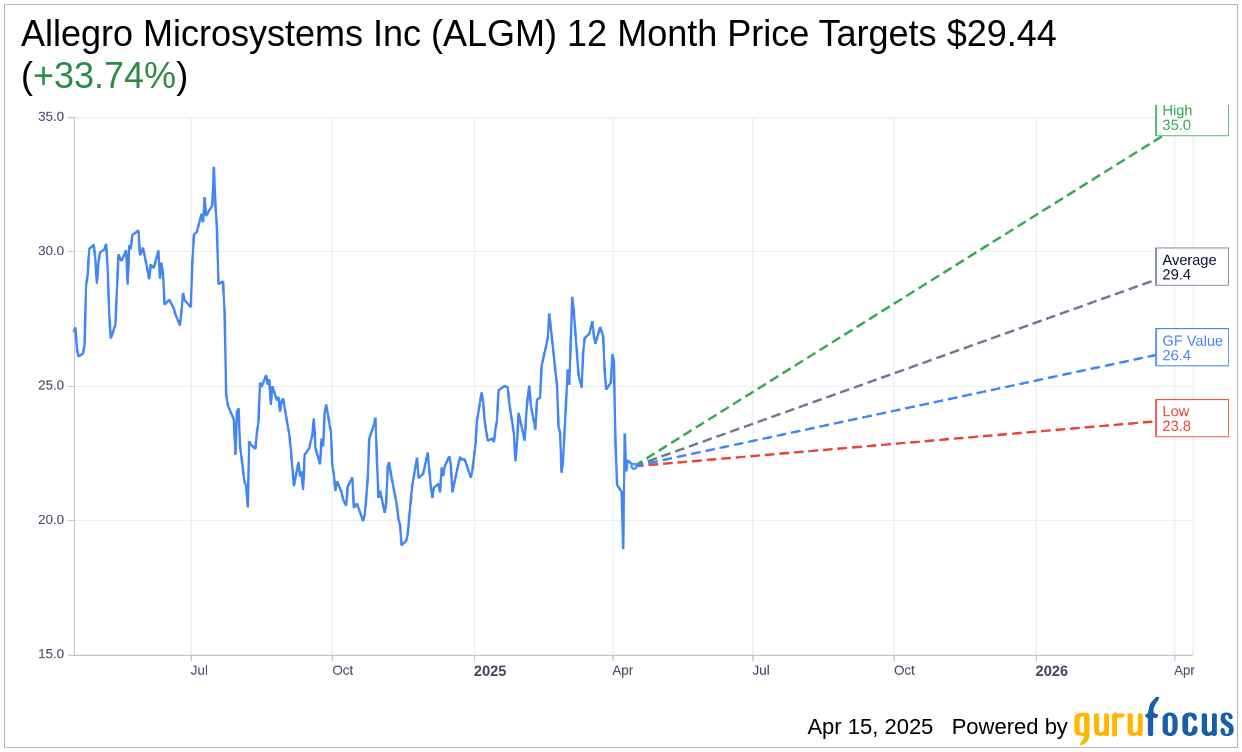

Based on the one-year price targets offered by 11 analysts, the average target price for Allegro Microsystems Inc (ALGM, Financial) is $29.44 with a high estimate of $35.00 and a low estimate of $23.80. The average target implies an upside of 33.74% from the current price of $22.01. More detailed estimate data can be found on the Allegro Microsystems Inc (ALGM) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Allegro Microsystems Inc's (ALGM, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Allegro Microsystems Inc (ALGM, Financial) in one year is $26.44, suggesting a upside of 20.13% from the current price of $22.01. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Allegro Microsystems Inc (ALGM) Summary page.