Key Highlights

- Caribou Biosciences (CRBU, Financial) is focusing on its leading cancer therapies CB-010 and CB-011, necessitating a workforce reduction.

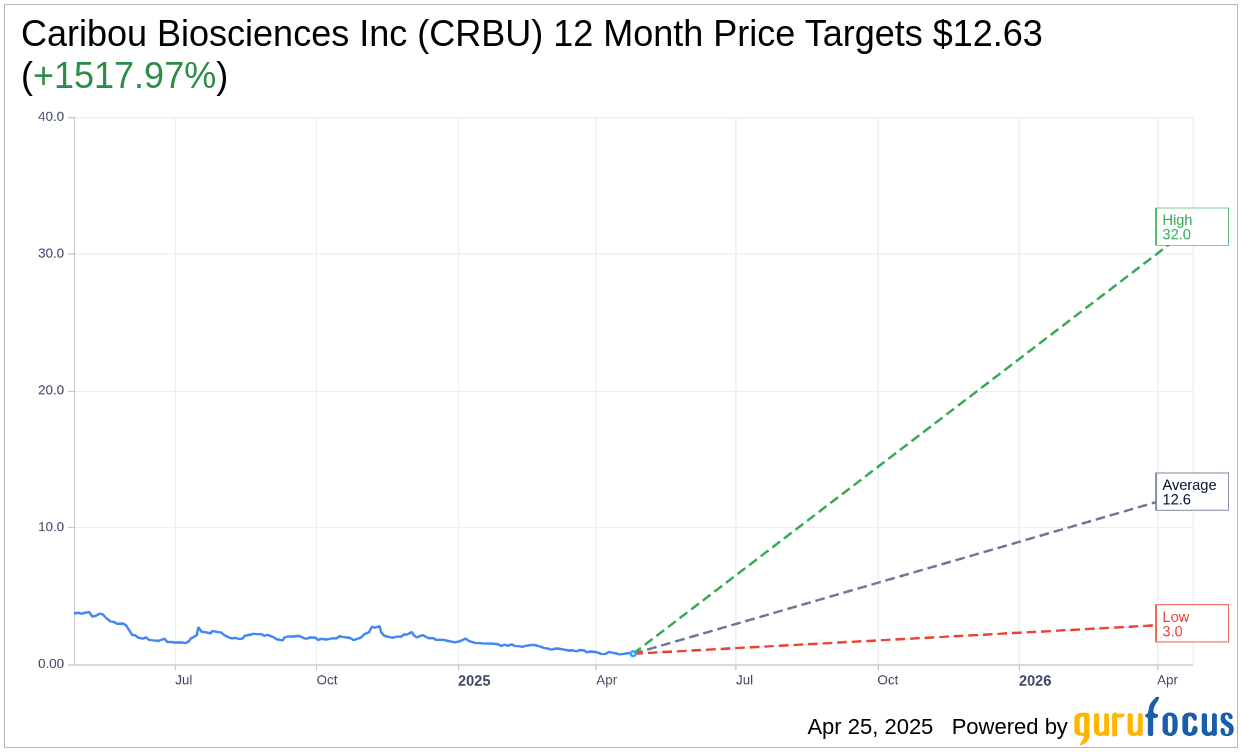

- Analysts predict a substantial upside, with the average target price set at $12.63, far above the current stock price.

- With an "Outperform" consensus, Caribou's stock valuation implies significant growth potential.

Caribou Biosciences Inc. (NASDAQ: CRBU) is embarking on a strategic pivot, honing in on its primary cancer treatment pipelines, CB-010 and CB-011. As the company realigns its focus, a notable reduction in workforce—approximately 32%—will take place. This move is part of a broader effort to extend the company’s financial sustainability through the latter half of 2027.

Wall Street Analysts' Price Projections

Current analyst sentiment towards Caribou Biosciences Inc. is bullish, with a one-year average price target of $12.63, which represents a potential upside of an impressive 1,517.97% from the current trading price of $0.78. The projected price range is quite broad, with a high estimate reaching $32.00 and a low estimate at $3.00. Investors can explore more detailed projections and analyses by visiting the Caribou Biosciences Inc (CRBU, Financial) Forecast page.

Brokerage Firms' Consensus

The average brokerage recommendation for Caribou Biosciences stands at an encouraging 1.9, reflecting an "Outperform" rating. This consensus is based on evaluations from nine financial institutions. The recommendations span a scale from 1 to 5, where 1 signifies a "Strong Buy," indicating widespread confidence in the stock's performance trajectory.

GuruFocus GF Value Assessment

According to GuruFocus's GF Value calculations, Caribou Biosciences is estimated to reach a fair value of $1.63 within a year. This implies a notable upside potential of 108.89% from its current price of $0.7803. The GF Value represents GuruFocus’ assessment of the stock's intrinsic value, which considers historical trading multiples, past business performance, and future growth prospects. For additional insights into this valuation, visit the Caribou Biosciences Inc (CRBU, Financial) Summary page.