- UFP Industries (UFPI, Financial) is preparing to announce its first-quarter earnings on April 28. Analysts predict a 20.4% drop in EPS year-over-year.

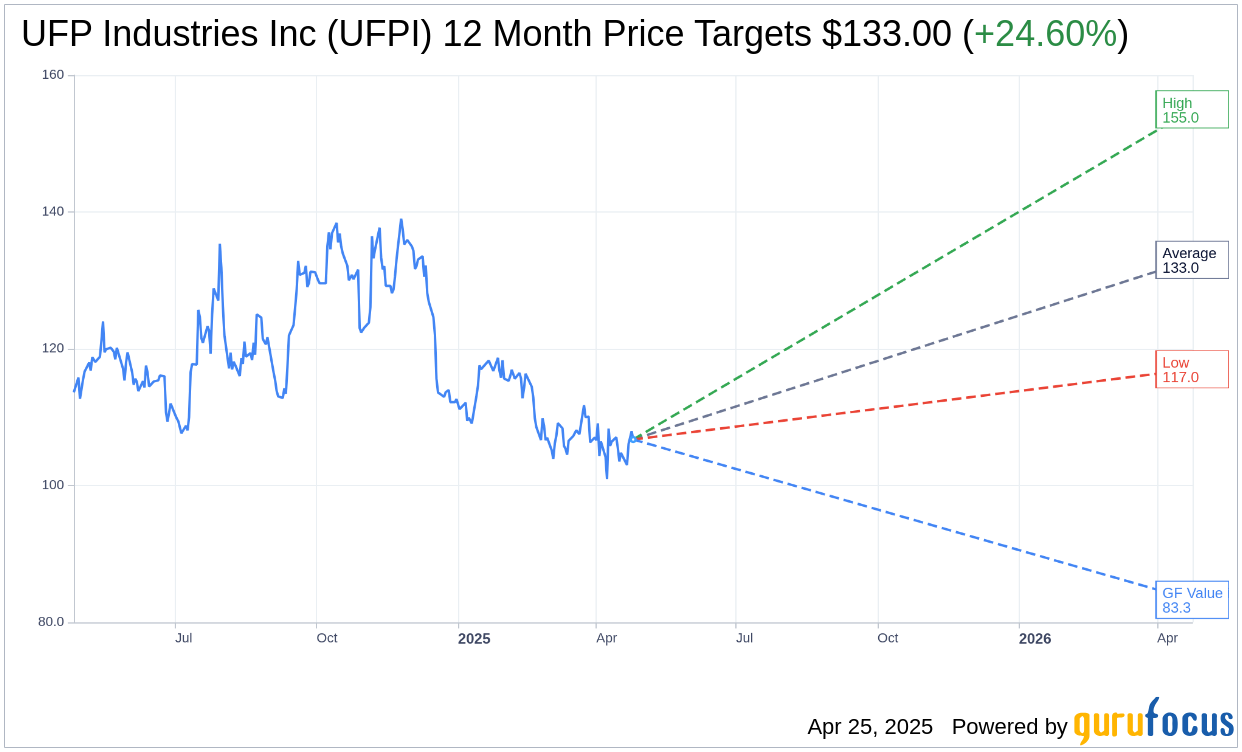

- Consensus target price among analysts suggests a potential 24.60% upside for UFPI shares.

- Despite a current "Outperform" rating, the GF Value metric indicates a possible 21.96% downside.

UFP Industries (UFPI) is gearing up to release its first-quarter earnings report on April 28, post-market close. According to analysts, there's an anticipated decline in the earnings trajectory, expecting earnings per share (EPS) to drop by 20.4% year-over-year to $1.56. Revenue is also forecasted to shrink by 2.4% to $1.6 billion, reflecting recent downward revisions.

Wall Street Analysts' Forecast

Wall Street analysts have provided one-year price targets for UFP Industries Inc (UFPI, Financial), with an average estimate of $133.00. The projections range from a high of $155.00 to a low estimate of $117.00. This average target indicates a substantial potential upside of 24.60% from the current stock price of $106.74. For more detailed projections, visit the UFP Industries Inc (UFPI) Forecast page.

The consensus from four brokerage firms rates UFP Industries Inc's (UFPI, Financial) as an "Outperform," with an average recommendation score of 2.3 on a scale where 1 signifies a Strong Buy and 5 denotes a Sell.

Evaluating the GF Value

According to GuruFocus metrics, the estimated GF Value for UFP Industries Inc (UFPI, Financial) in a year is calculated at $83.30, suggesting a potential downside of 21.96% from the current price of $106.74. The GF Value is an assessment of the fair value at which the stock should ideally trade. This is computed by analyzing historical trading multiples, past business growth, and future performance expectations. For further insights, check the UFP Industries Inc (UFPI) Summary page.