Susquehanna analyst Joseph Stauff has initiated coverage of MSG Entertainment, represented by the ticker MSGE, with a Positive rating and set a price target of $39. MSGE operates on a pure-play venue-based model and holds a premium asset portfolio, prominently featuring Madison Square Garden in New York City. Roughly 60% of the company's revenue is derived from stable and consistent sources, according to the analyst's report.

However, MSGE's stock has experienced a downturn due to challenges in its concert segment, which comprises 40% of its revenue. The decline is attributed to challenging comparisons from previous periods and a less robust concert schedule anticipated in the near future. Despite these setbacks, the analyst maintains a positive outlook on the firm's overall business model and asset strength.

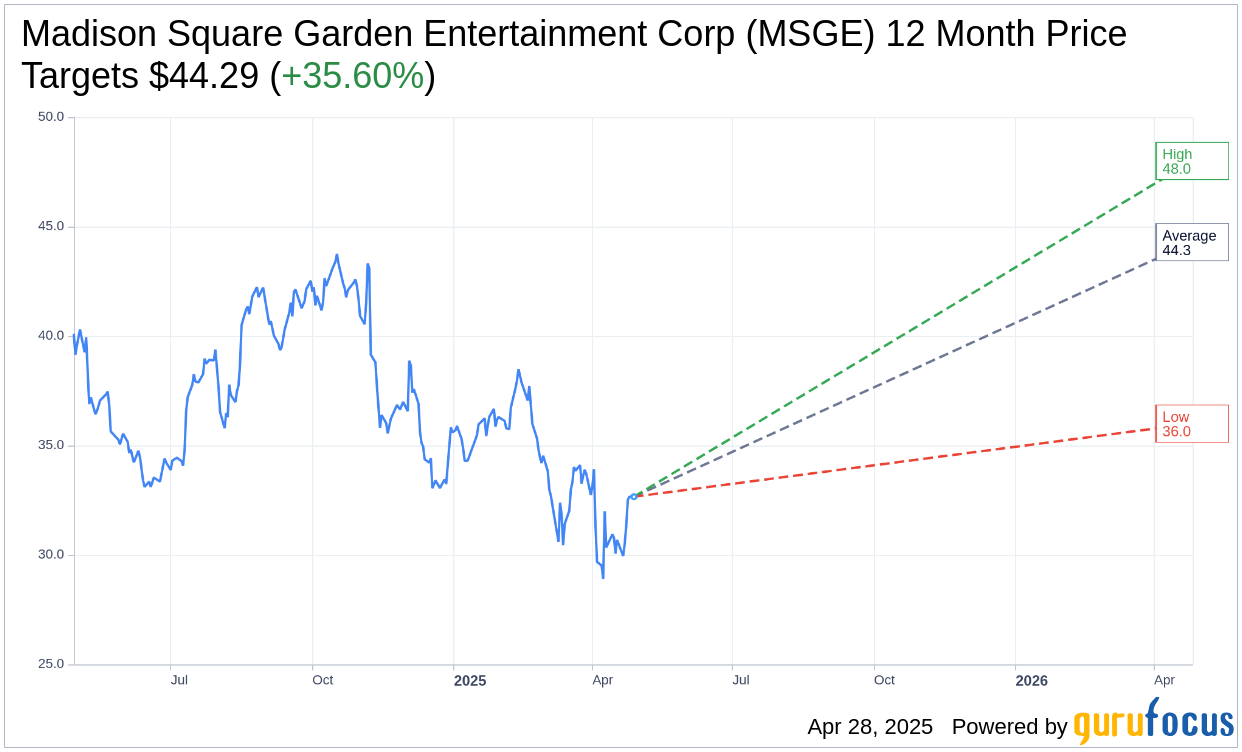

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Madison Square Garden Entertainment Corp (MSGE, Financial) is $44.29 with a high estimate of $48.00 and a low estimate of $36.00. The average target implies an upside of 35.60% from the current price of $32.66. More detailed estimate data can be found on the Madison Square Garden Entertainment Corp (MSGE) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Madison Square Garden Entertainment Corp's (MSGE, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

MSGE Key Business Developments

Release Date: February 06, 2025

- Revenue: $407.4 million, a 1% increase compared to the prior year quarter.

- Adjusted Operating Income (AOI): $164 million, a 2% increase from the previous year.

- Christmas Spectacular Revenue: Over $170 million, a new record for the production.

- Share Repurchase: $25 million or approximately 682,000 shares of Class A common stock.

- Unrestricted Cash: Approximately $55 million as of December 31.

- Debt Balance: Approximately $618 million, reflecting the pay down of the full $55 million balance under the revolving credit facility.

- SG&A Expenses: Included $3.1 million of executive management transition cash costs.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Madison Square Garden Entertainment Corp (MSGE, Financial) reported strong demand for in-person experiences, with revenues of $407 million and adjusted operating income of $164 million for the fiscal second quarter.

- The Christmas Spectacular achieved record-setting results, with 200 performances and approximately 1.1 million tickets sold, marking the strongest sell-through rate in 25 years.

- MSG Entertainment successfully resumed its stock buyback program, repurchasing $25 million of Class A common stock, demonstrating confidence in its financial position.

- The company hosted nearly 2.7 million guests at over 440 live entertainment and sporting events during the quarter, indicating robust attendance and engagement.

- Strong growth in marketing partnerships and premium hospitality, with new multi-year deals and suite renovations contributing to increased revenue.

Negative Points

- MSG Entertainment faced a decrease in the number of events year-over-year, primarily due to fewer concerts at its venues, including the absence of three Billy Joel performances.

- Revenues from entertainment offerings were essentially unchanged year-over-year, with lower per concert revenues due to a mix shift from promoted events to rentals.

- The company experienced higher selling, general, and administrative costs, partially offsetting revenue increases.

- There was a decrease in food and beverage sales at concerts, particularly at the Garden, impacting overall revenue growth.

- The company is dealing with a tough year-over-year comparison for concert bookings at the Garden, affecting the fiscal '25 outlook.