Quick Summary:

- Super Micro Computer (SMCI, Financial) shares plummet after Q3 results miss expectations.

- Analysts project an average price target of $50.93, suggesting potential upside.

- Current brokerage recommendation is to "Hold" at an average rating of 2.8.

Super Micro Computer (SMCI) recently witnessed a noticeable decline in its share value, prompted by the release of its preliminary third-quarter results, which fell short of market expectations. The company has attributed this downturn to postponed customer platform decisions, causing a deferral in sales to the upcoming quarter. Additionally, the company’s gross margin was adversely affected, falling by 220 basis points due to heightened inventory reserves.

Wall Street Analysts Forecast

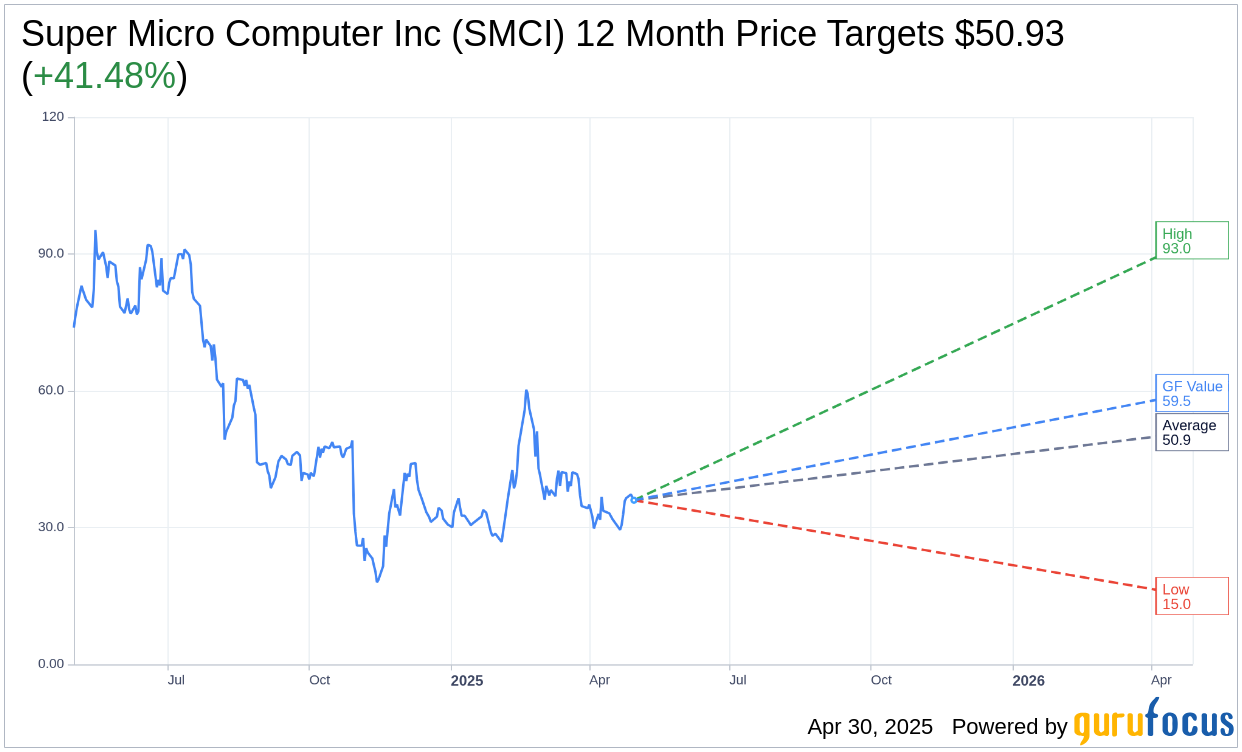

Wall Street analysts have provided one-year price targets for Super Micro Computer Inc (SMCI, Financial), with an average target price set at $50.93. This forecast comes with a high estimate of $93.00 and a low estimate of $15.00, signifying a potential upside of 41.48% from the current stock price of $36.00. For more in-depth estimate data, please visit the Super Micro Computer Inc (SMCI) Forecast page.

In regards to brokerage firm recommendations, the consensus for Super Micro Computer Inc's (SMCI, Financial) stock stands at an average recommendation score of 2.8, reflecting a "Hold" status. The recommendation scale is based on a range from 1 to 5, where 1 indicates a Strong Buy, and 5 suggests a Sell.

According to GuruFocus estimates, the projected GF Value for Super Micro Computer Inc (SMCI, Financial) is $59.52, indicating a promising upside of 65.33% from the current price of $36. The GF Value is GuruFocus' calculation of the fair value at which the stock should be traded. This is determined through analysis of past trading multiples, historical business growth, and future business performance projections. For more detailed information, refer to the Super Micro Computer Inc (SMCI) Summary page.