On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a significant transaction by acquiring an additional 3,137,133 shares of Rigetti Computing Inc. at a trade price of $7.92 per share. This move increased BlackRock's total holdings in Rigetti Computing to 15,030,105 shares. The transaction reflects BlackRock's strategic interest in the burgeoning field of quantum computing, despite the current financial challenges faced by Rigetti Computing. This acquisition represents 5.30% of BlackRock's portfolio, indicating a substantial commitment to the potential growth of Rigetti Computing.

BlackRock, Inc. (Trades, Portfolio): A Leading Investment Management Firm

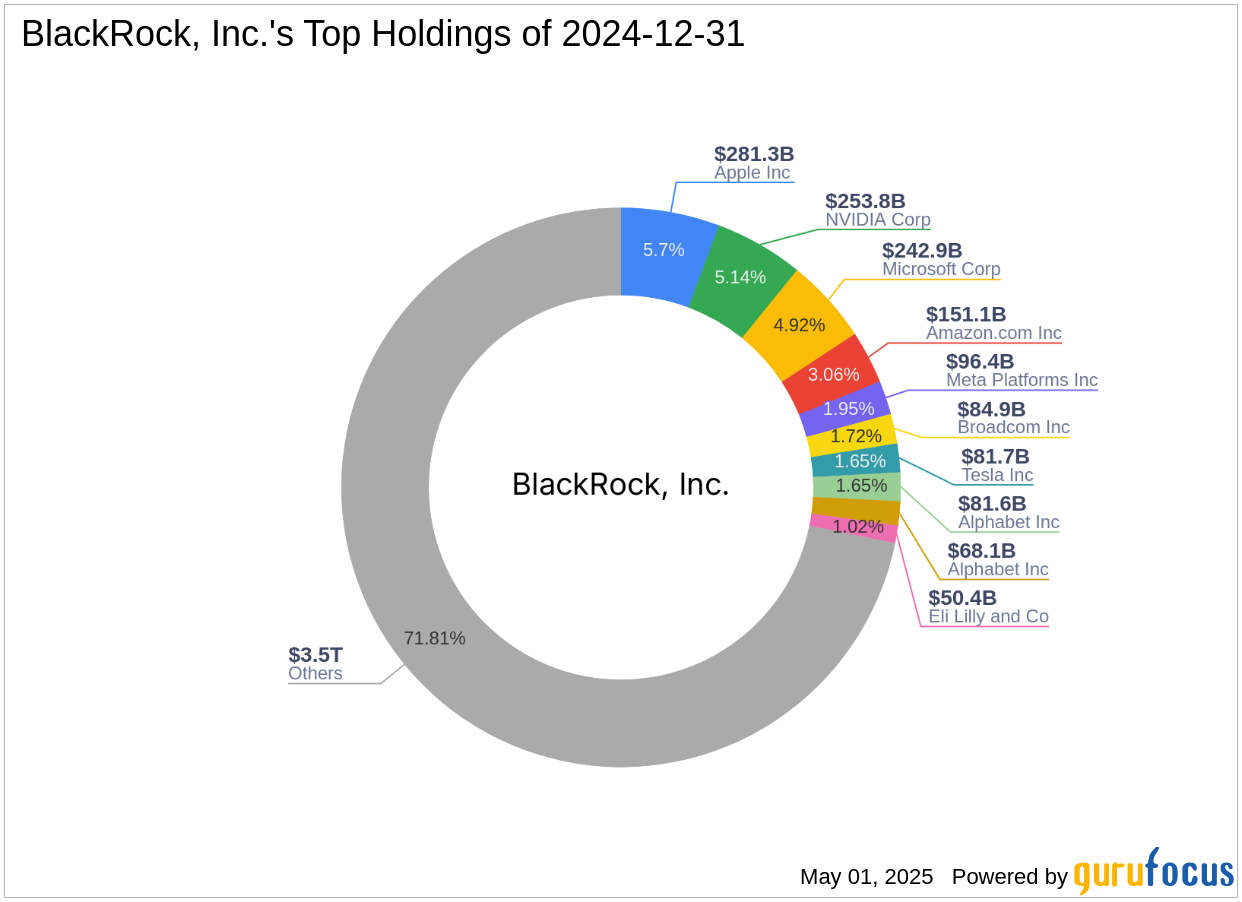

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, NY, is a prominent investment management firm known for its substantial equity holdings. With a total equity value of $4,939.25 trillion, BlackRock focuses primarily on the technology and financial services sectors. The firm's top holdings include major companies such as Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial), Meta Platforms Inc. (META, Financial), Microsoft Corp. (MSFT, Financial), and NVIDIA Corp. (NVDA, Financial). BlackRock's investment philosophy emphasizes long-term growth and value, making its recent acquisition in Rigetti Computing a noteworthy development.

Rigetti Computing Inc.: Pioneering Quantum Computing

Rigetti Computing Inc., trading under the symbol RGTI, is a USA-based company specializing in full-stack quantum computing. The company offers a quantum computing platform as a cloud service, providing ultra-low latency integration with public and private clouds. Rigetti has developed the industry's first multi-chip quantum processor, positioning itself as a leader in scalable quantum computing systems. Despite its innovative technology, Rigetti faces financial challenges, with a market capitalization of $2.55 billion and a current stock price of $8.87.

Financial Analysis of Rigetti Computing Inc.

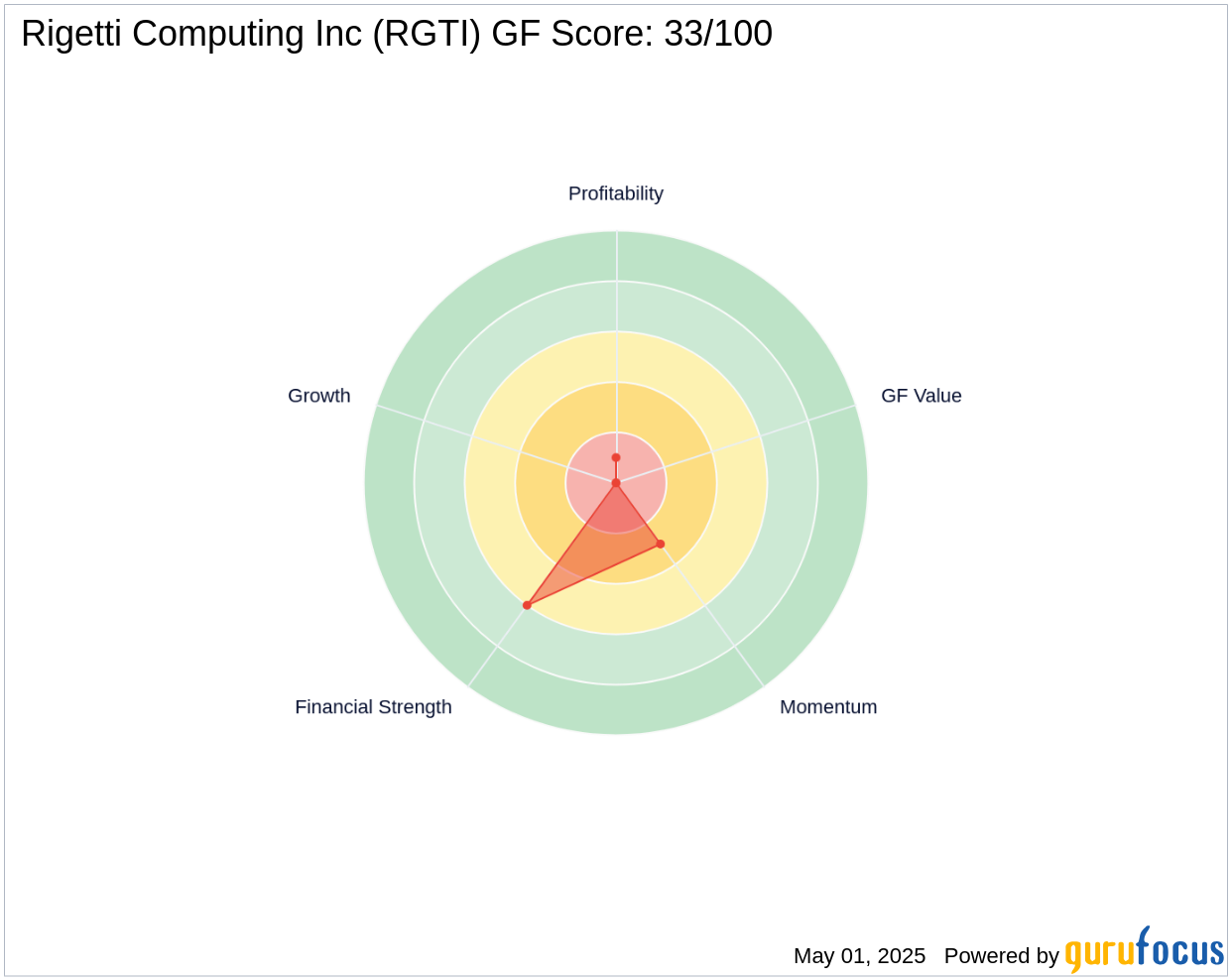

Rigetti Computing's financials reveal a company facing significant hurdles. The stock is considered significantly overvalued with a GF Value of 0.87 and a Price to GF Value ratio of 10.20. The company's GF Score is 33/100, indicating poor future performance potential. Key financial metrics include a negative ROE of -168.40% and ROA of -108.47%, with a cash to debt ratio of 21.83. These figures suggest that while Rigetti is at the forefront of quantum computing technology, it must overcome substantial financial obstacles to achieve sustainable growth.

Implications of BlackRock's Investment

The addition of shares by BlackRock, Inc. (Trades, Portfolio) suggests confidence in Rigetti Computing's potential, despite its current financial challenges. This transaction increased BlackRock's total holdings in Rigetti Computing to 15,030,105 shares, representing 5.30% of the firm's portfolio. BlackRock's investment could provide Rigetti with the necessary capital and credibility to further develop its quantum computing technology and potentially improve its financial standing.

Market Reaction and Stock Performance

Since the transaction, Rigetti Computing's stock has gained 11.99%, although it remains down 55.65% year-to-date. The stock's performance since its IPO shows a decline of 9.03%, reflecting ongoing volatility in the quantum computing sector. Despite these challenges, BlackRock's investment may signal a turning point for Rigetti, as the firm continues to innovate and expand its quantum computing capabilities.

Conclusion: A Strategic Move by BlackRock

BlackRock's acquisition of additional shares in Rigetti Computing Inc. underscores the firm's strategic interest in the quantum computing sector. While Rigetti faces financial challenges, BlackRock's investment suggests confidence in the company's potential for growth and innovation. As Rigetti continues to develop its quantum computing technology, BlackRock's support could prove instrumental in overcoming financial obstacles and achieving long-term success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.