- Intercontinental Exchange (ICE, Financial) exceeds earnings and revenue expectations in Q1.

- Analysts maintain a positive outlook with a price target suggesting potential upside.

- GuruFocus indicates a different valuation, presenting an intriguing investment debate.

Intercontinental Exchange (NYSE: ICE) has delivered an impressive performance in the first quarter, reporting a non-GAAP EPS of $1.72, outpacing analyst predictions by $0.02. The company generated revenue of $2.5 billion, marking a 9.2% increase year-over-year and topping forecasts by $30 million. This positive financial showing led to a modest 0.2% increase in shares post-market. Looking ahead, ICE’s Q2 2025 expense guidance underscores a commitment to prudent financial management.

Wall Street Analysts Forecast

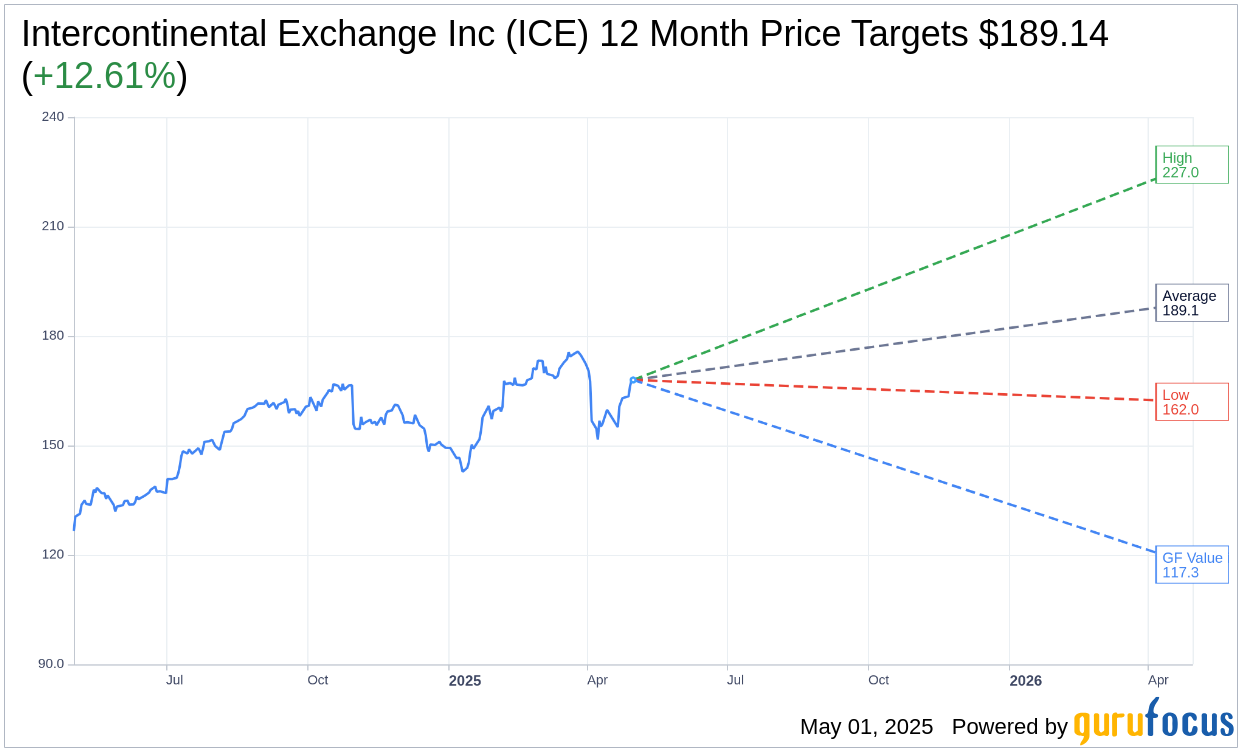

Wall Street remains bullish on Intercontinental Exchange Inc (ICE, Financial), with 14 analysts setting a one-year average price target of $189.14. This projection includes a high estimate of $227.00 and a low of $162.00, indicating an expected upside of 12.61% from the current trading price of $167.97. Investors can explore more detailed price projections on the Intercontinental Exchange Inc (ICE) Forecast page.

The consensus among 18 brokerage firms stands at an average recommendation of 1.9, classifying ICE as an "Outperform." This rating is derived from a scale of 1 to 5, where 1 suggests a Strong Buy and 5 a Sell, reflecting an overall optimistic sentiment.

GuruFocus Valuation Insights

Despite Wall Street's optimism, GuruFocus presents a contrasting evaluation with its estimated GF Value for ICE at $117.35. This valuation suggests a potential downside of 30.14% from the current price of $167.97. The GF Value is derived from historical trading multiples, past business growth, and future performance forecasts. Investors interested in deeper insights can visit the Intercontinental Exchange Inc (ICE, Financial) Summary page.

These varying perspectives between analysts and GuruFocus offer a compelling narrative about Intercontinental Exchange Inc's future financial trajectory, inviting investors to consider both optimistic growth potential and inherent risks.