Stephens analyst Andrew Terrell has adjusted the price target for First Interstate BancSystem (FIBK, Financial), decreasing it from $34 to $32 while maintaining an Overweight rating. The company's recent quarterly performance showed operating earnings per share (EPS) at $0.50, falling short of the firm's prediction of $0.61 and the consensus estimate of $0.55. Describing the quarter as challenging, the analyst has also revised the forecast for First Interstate's fiscal year 2026 operating EPS, lowering it to $2.60 from the previous $2.90.

Wall Street Analysts Forecast

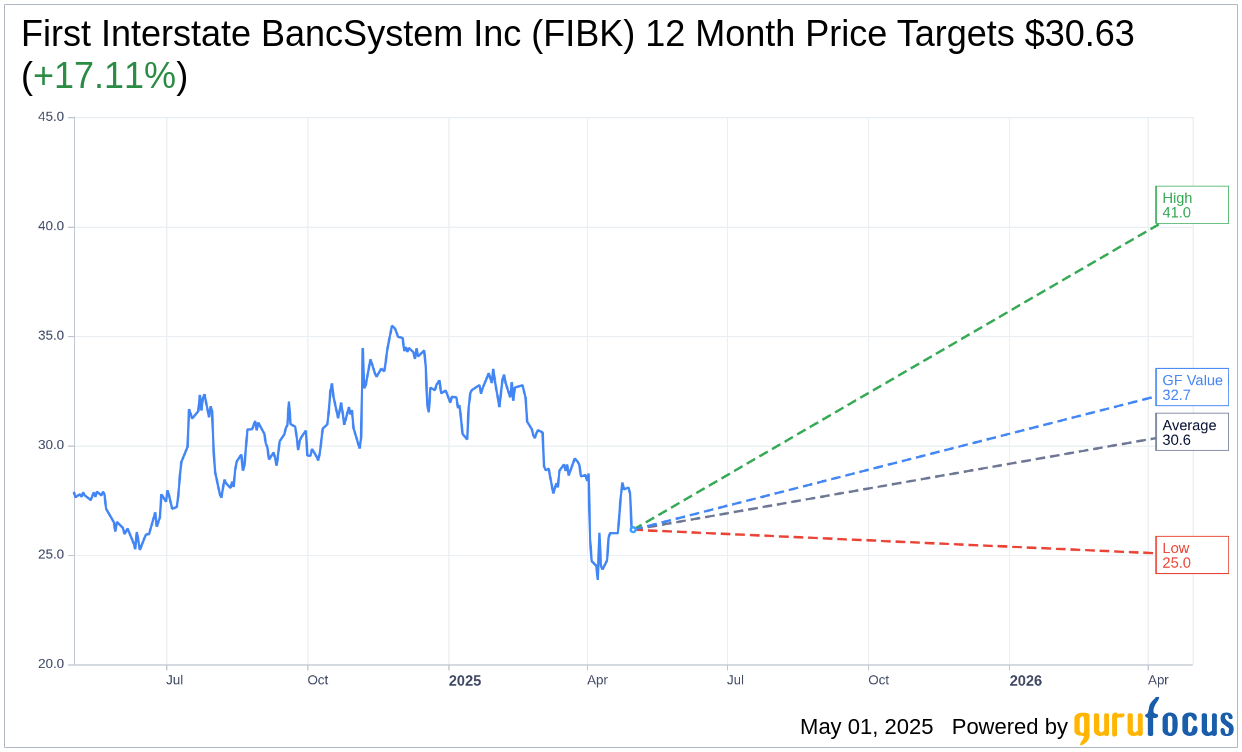

Based on the one-year price targets offered by 8 analysts, the average target price for First Interstate BancSystem Inc (FIBK, Financial) is $30.63 with a high estimate of $41.00 and a low estimate of $25.00. The average target implies an upside of 17.11% from the current price of $26.15. More detailed estimate data can be found on the First Interstate BancSystem Inc (FIBK) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, First Interstate BancSystem Inc's (FIBK, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for First Interstate BancSystem Inc (FIBK, Financial) in one year is $32.67, suggesting a upside of 24.93% from the current price of $26.15. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the First Interstate BancSystem Inc (FIBK) Summary page.

FIBK Key Business Developments

Release Date: April 30, 2025

- Net Income: $50.2 million or $0.49 per share for Q1 2025.

- Net Interest Margin: Increased 2 basis points to 3.22% in Q1 2025.

- Noninterest Income: $42 million, a decrease of $5 million from the prior quarter.

- Noninterest Expenses: $160.6 million, a reduction of $0.3 million from the prior quarter.

- Loan Balances: Declined by $467.6 million in Q1 2025.

- Deposit Balances: Declined by $282.8 million in Q1 2025.

- Borrowings: Declined by $607.5 million in Q1 2025.

- Net Charge-Offs: $9 million or 21 basis points.

- Provision Expense: $20 million in Q1 2025.

- Dividend: $0.47 per share, yielding 6.1% for Q1 2025.

- Common Equity Tier 1 Capital Ratio: Improved 37 basis points to 12.53%.

- Branch Sale: Exiting 12 locations in Arizona and Kansas, expected to close by Q4 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- First Interstate BancSystem Inc (FIBK, Financial) is refocusing on organic growth and relationship banking, moving away from large-scale M&A.

- The company has a strong and flexible balance sheet with low-cost granular deposits and strong market share in growing areas.

- Capital ratios improved this quarter, providing optionality for future capital deployment.

- Net interest margin increased in the first quarter, with expectations for further improvement throughout the year.

- The company is taking proactive steps to manage credit, including exiting certain transactional credits and conducting detailed credit reviews.

Negative Points

- Criticized loans increased by $252.8 million, primarily in commercial real estate, indicating potential credit quality issues.

- Nonperforming assets rose by $52.8 million, with significant contributions from agriculture and commercial real estate sectors.

- Loan balances declined by $467.6 million due to lower customer demand and intentional runoff of certain portfolios.

- Noninterest income decreased by $5 million from the prior quarter, driven by seasonality and lower trust fees.

- The company anticipates further shrinking of the balance sheet in the second quarter due to limited customer demand and expected loan payoffs.